PARIS—As the U.S. media rights holder NBCUniversal prepares to offer the most expansive programming in Olympic history, with 7,000 hours of coverage, including 1,500 hours on linear TV, a new report from S&P says that expectations are high for the Paris Summer Olympics, the first post-pandemic Games, with both organizers and media outlets expecting revenue increases.

The report argues that Olympic broadcasting revenue growth should accelerate post-pandemic under the International Olympic Committee's current contract with NBCUniversal. Since 2004, global broadcasting revenue from the Summer Olympics has increased 108%.

The U.S. contract with NBCU drives a majority of broadcast revenue for the IOC, with over a billion dollars coming from the Americas for each Olympics since 2016. Asia and Europe historically come in second or third, with valuations improving when a country in the region hosts an event, the report from S&P Global Market Intelligence’s Kagan found.

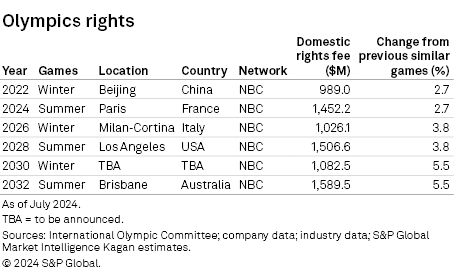

The researchers also wrote that the agreement between the IOC and NBCU averages about $1.3 billion per Olympics from 2022 through 2032, with the domestic rights fee for the 2032 Games reaching nearly $1.6 billion.

According to a recent Consumer Insights survey by Kagan, 28% of US online adults said they typically view the Summer Olympics. This is roughly on par with that of the NBA (27%) and just behind viewing for the MLB (32%).

NBCU expects ad sales for the Paris Games to set new records, driven in part by its programmatic technology, the report noted.

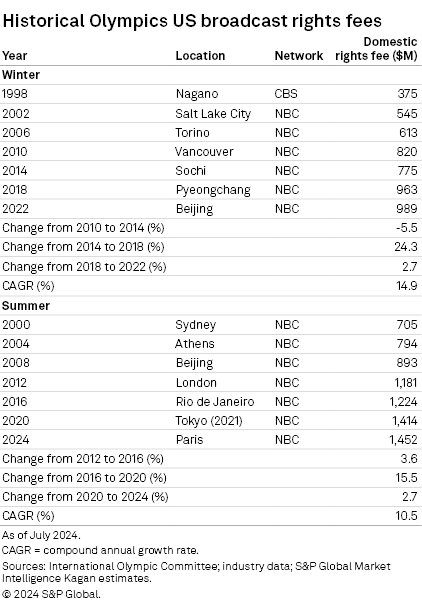

In another key finding, the report found that in the US, the domestic rights fees have steadily increased for both the Summer and Winter Games since the late 90s. The growth rate of the domestic rights fee for the Winter Games has outpaced that of the Summer Games since the 1998 Nagano Olympics in Japan.

The compound annual growth rate for the Winter Games over that period is 14.9% versus 10.5% for the Summer Games. Looking at the most recent Olympics, the US rights fees for each season increased 2.7% under the IOC's current agreement with NBCUniversal, which runs through 2032, S&P Global Market Intelligence’s Kagan found.