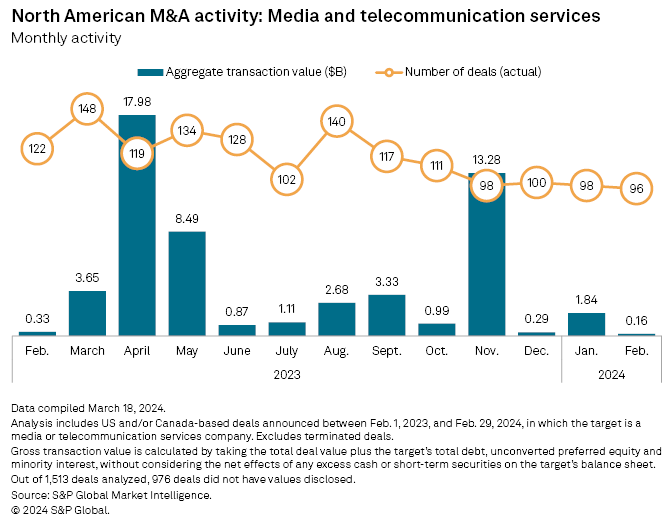

S&P Global Market Intelligence has released new data showing that dealmaking in the North America for media and telecom companies remains in the doldrums.

During February 2024 there were only 96 M&A transactions worth close to $160.0 million in aggregate transaction value, making it the sector's weakest showing in M&A activity since January 2023, when there were 142 deals with an aggregate value of $65.7 million.

It also represents a sequential drop from the $1.84 billion generated from 98 transactions in January, S&P Global Market Intelligence reported.

Key findings from the newly released analysis include:

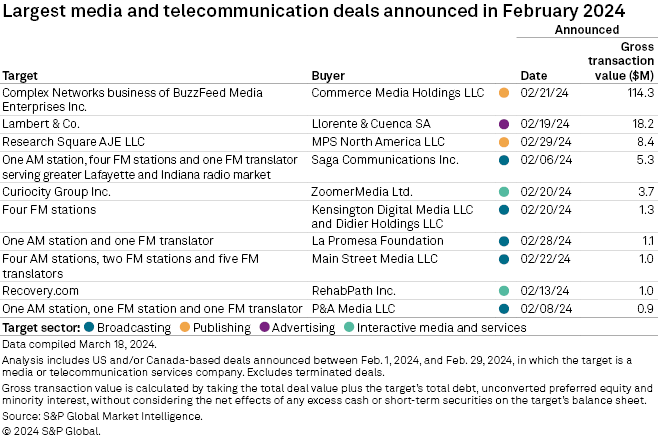

- Online media company BuzzFeed Inc., through BuzzFeed Media Enterprises Inc. completed the sale of its Complex Networks business to e-commerce company Commerce Media Holdings LLC (NTWRK) on Feb. 21 for $114.3 million, making it the biggest media and telecom deal in February.

- The second-biggest transaction was Llorente & Cuenca SA's acquisition of an initial 70% stake in Michigan-based strategic communications firm Lambert & Co. for $18.2 million. The deal price is based on Lambert's EBITDA performance in the next two years.

- Five of the month's top 10 transactions involved the purchase of radio stations, led by Saga Communications Inc.'s $5.3 million purchase of the assets of radio stations WKOA, WKHY, WASK, WXXB and WASK, and FM translator station W269DJ from Neuhoff Communications. Kalil & Co. Inc. was the exclusive broker for the deal, which remains subject to the Federal Communications Commission's approval.

The full analysis is available here: TMT M&A Deal Tracker: Media, telecom M&A plunges to 13-month low | S&P Global Market Intelligence (spglobal.com).