Economists have poured scorn on western efforts to hit Russia’s economy in response to its bloody invasion of Ukraine.

A slew of measures have been announced by the US and UK against Russian banks and companies, limiting their access to financial markets. The EU is still debating what measures it will impose, but political statements thus far suggest these will stop short of cutting its dependency on Russia’s cash-generating energy sector.

The Russian economy will still face a significant long-term hit from financial measures, but it will not necessarily be enough to trigger a recession or slash at the country’s asset prices in the near future, economists told The Independent.

Russia’s role as a commodities powerhouse amid high demand for natural gas and oil means that the pain of financial sanctions is partly offset by strong energy prices.

“Greta Thunberg might be more effective than any western sanctions,” said Charlie Robertson, chief economist at Renaissance Capital. European governments have made little progress in weaning themselves off Russian energy imports in recent years, he said.

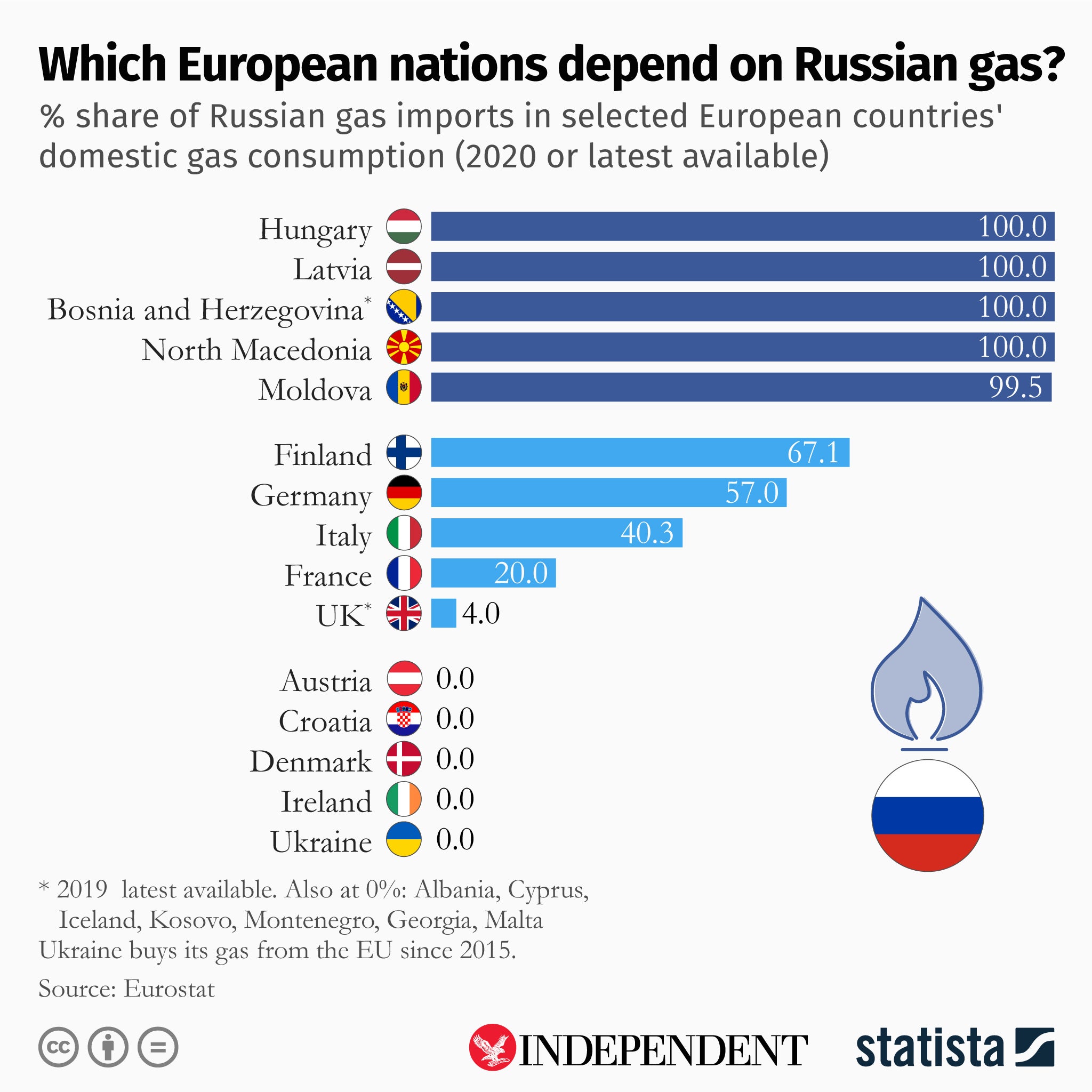

Russia still accounts for about a third of Europe’s natural gas imports. This is despite warnings from a range of economists about the political risks associated with this energy need in the wake of the annexation of Crimea, part of Ukrainian territory, in 2014. Environmental campaigners such as Ms Thunberg have done more to push politicians away from fossil fuels than Russian threats to democracy so far, the economist added.

Early indications are that the suite of measures so far announced could knock as much as 2 per cent off Russian GDP this year. However, that would still leave it in growth territory, with a 1 per cent increase in its economic output, according to Mr Robertson.

“What can Europe do now about its energy dependency? If they’d done what we’d said in 2014, Russia wouldn’t have the strength it has today. If Germany had reconsidered its approach to nuclear power, for instance,” Mr Robertson said. “Russia’s making billions. Every time people in Europe turn on their heating, Russia’s making money.”

Energy imports are not the only area in which western powers have fallen short in their economic defence of Ukraine and Europe, economists suggested.

“This is supposed to be the biggest threat to European security since the Second World War,” said Timothy Ash, an economist covering emerging markets at BlueBay Asset Management.

In the face of such a serious danger, Germany’s and Italy’s opposition to blocking Russia’s use of the interbank payment system, Swift, was “pretty disgraceful”, he added. Even if some economic sanctions will have longer-term consequences for Russia’s political leadership, he said.

The failure to block Russia from Swift has been condemned by Ukrainian politicians.

Governments face a balancing act between domestic economic hurt and punishing Russian aggression. While Russia has created an alternative to the Swift messaging system, some western banks would be unlikely to want to use it. But it cuts both ways in terms of its economic significance, particularly for high volumes of transactions related to energy – something that Germany and Italy would be more exposed to than some other western countries.

Disrupting transactions related to the energy market could in and of itself drive up oil and gas prices, which some reports suggest is a sensitive issue in the US too, where consumers are very dependent on petrol-fuelled cars.

“This isn’t shut off, this is restricted access,” said Tomas Hirst, credit strategist at CreditSights. “As far as we can see the measures that have been announced show incremental tightening that falls well short of the rhetoric on how aggressive this round of sanctions was going to be.”

With Russia benefitting from such high energy prices for its exports its companies and government will not struggle for funds or a source of US dollars and sterling. Only at a time of lower oil prices would the steps taken by the US and the UK make for more significant economic harm.

For now, allowing Russian gas and oil to flow into Europe will prevent sanctions biting more deeply into the Kremlin’s ability to build the economy.

However, that may not prove a sustainable position for western governments, economists said.

“As more and more Ukrainian civilians die, the pressure on the west is going to increase. It’s not going to stop the invasion. It’s not going to change Putin’s behaviour, but it is going to be about the reaction to public opinion,” said Mr Robertson of Renaissance Capital.

Thirty years of independence in Ukraine will make it a difficult country for Russia to dominate in the long term, even if it manages to achieve some manner of military victory, said Mr Ash.

The nature of that oppression may demand further action from Ukraine’s neighbours and allies, he said. “As always in these conflicts, the military conflict is easier. It’s the peace that’s difficult.”