Russia has earned $98bn from fossil fuel exports during the first 100 days of its war in Ukraine, with the European Union being the top importer, according to new research.

The report published on Monday by the independent, Finland-based Centre for Research on Energy and Clean Air (CREA) came as Russian forces continued making slow but steady progress in their campaign to fully capture eastern Ukraine’s Donbas region.

The United States and the EU have sent weapons and cash to help Ukraine fend off the Russian advance, alongside punishing Moscow with unprecedented economic sanctions.

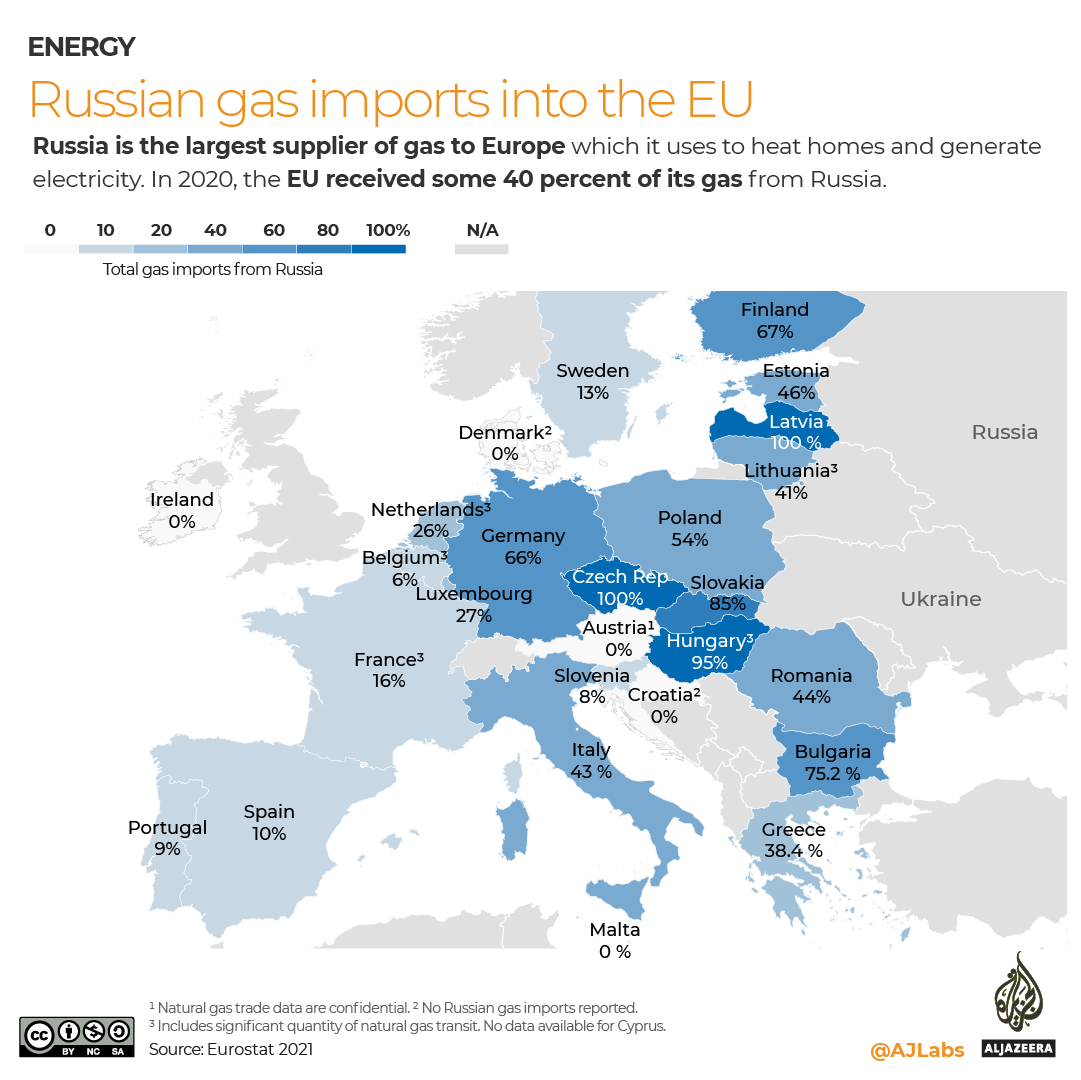

But Kyiv has called on Western countries to sever all trade with Moscow in the hopes of cutting off its financial lifeline in the wake of the February 24 invasion. Pre-war, Russia supplied 40 percent of the EU’s gas and 27 percent of its imported oil.

Earlier this month, the bloc agreed to halt most Russian oil imports, and while it aims to reduce gas shipments by two-thirds this year. An embargo is not on the cards at present.

According to CREA’s report, the EU took 61 percent of Russia’s fossil fuel exports during the war’s first 100 days, worth about $60bn.

Overall, the top importers were China at $13.2bn, Germany at $12.7bn, Italy at $8.2bn, the Netherlands at $8.4bn, Turkey at $7bn, Poland at $4.6bn, France at 4.5bn and India at $3.6bn.

Russia’s fossil fuel revenues come first from the sale of crude oil ($48.2bn), followed by pipeline gas ($25.1bn), oil products ($13.6bn), liquefied natural gas, or LNG, ($5.3bn) and coal ($4.8bn).

Even as Russia’s exports plummeted in May, with countries and companies shunning its supplies over the war, the global rise in fossil fuel prices continued to fill the Kremlin’s coffers, with export revenues reaching record highs.

Russia’s average export prices were about 60 percent higher than last year, according to CREA.

Some countries have increased their purchases from Russia, including China, India, the United Arab Emirates and France, the report added.

“India became a significant importer of Russian crude oil, buying 18% of the country’s exports,” CREA said, adding that a “significant share of the crude is re-exported as refined oil products”, including to the US and European countries.

“As the EU is considering stricter sanctions against Russia, France has increased its imports to become the largest buyer of LNG in the world,” said CREA analyst Lauri Myllyvirta.

Since most of these are spot purchases rather than long-term contracts, France is consciously deciding to use Russian energy in the wake of the invasion, Myllyvirta added.

He called for an embargo on Russian fossil fuels to “align actions with words”.