How fitting is it that PepsiCo (PEP) and Coca-Cola (KO) both reported earnings this morning?

Despite the volatility in the overall stock market — not just on Thursday, but all year — these two stocks have held up pretty well.

With today’s market-wide volatility, Coca-Cola has given up most of its gains and is down slightly on the day, while PepsiCo stock is down about 2% in the session.

Coca-Cola beat on earnings expectations, while PepsiCo also beat on estimates and boosted its dividend.

That said, PepsiCo’s charts are showing some weakness. Let’s look.

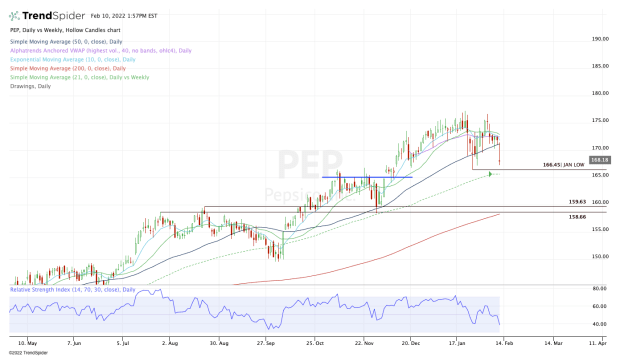

Trading PepsiCo Stock

Chart courtesy of TrendSpider.com

Shares of PepsiCo gapped below the 50-day moving average and last week’s low this morning.

However, when it rallied off the opening low, the stock was rejected by these levels. That’s never a good sign, even though it’s hard to say the stock is breaking down.

When I look at the chart, it just looks like it lacks momentum, not like it’s heading down the toilet. At least not yet and that’s likely not happening unless the overall market experiences a lot more turmoil.

From here, I am keeping a keen eye on the $165 to $166.50 area. In that zone we have the 21-week moving average, the January low and a prior support/resistance level.

Should that fail as support, PepsiCo stock could very well test down into the 200-day moving average and the $158.50 to $160 zone.

On the upside, it needs to recapture the 50-day moving average.

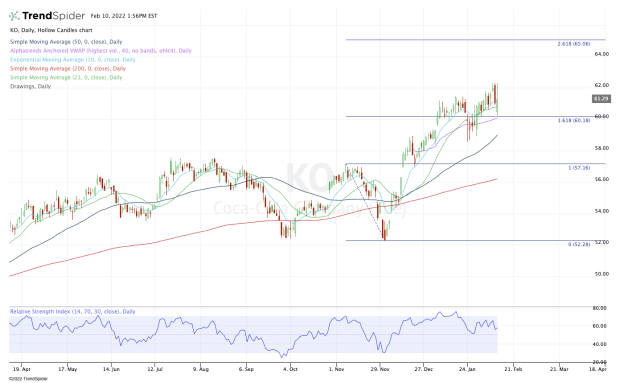

Trading Coca-Cola Stock

Chart courtesy of TrendSpider.com

For Coca-Cola stock, one could make an argument that it too is about to lose a bit of its fizzle.

Like PepsiCo, Coca-Cola also opened lower on the day. However, it has since bounced from the daily VWAP measure and reclaimed the 10-day and 21-day moving averages.

That said, it keeps getting rejected from the $62 level.

Bulls may want to wait for a clean break over $62.35. If we get it, it could set the course for an eventual move to $65, where the stock finds its 261.8% extension.

More aggressive longs may consider being long with the stock above all of its short-term moving averages. A break of $60 is a reasonable level to reassess the stock and consider stopping out for short-term traders.

On the downside, $58.50 to $59 should be support, along with the 50-day moving average.