Investors don’t need much more evidence than they've already got that we're in a bear market in growth stocks. And Roku (ROKU) shares have been caught up in the pressure.

The streaming-equipment major's shares are currently down about 70% from their record just a few quarters ago. Even today, the stock is down close to 7% as investors express concern about how the stock will react to tonight’s earnings report.

It’s been a brutal ride the past few months and the uncertainty is making it even harder.

From a macro perspective, what will happen to stocks like Roku if the selling pressure keeps up in the broader market?

From a micro perspective, investors must wonder whether Roku will react like Upstart Holdings (UPST) and soar on earnings or will it react like Shopify (SHOP), Fastly (FSLY) and so many others?

Regardless of how it reacts, it pays to know the levels ahead of time so that we can react (or not react) depending on the action.

Trading Roku Stock

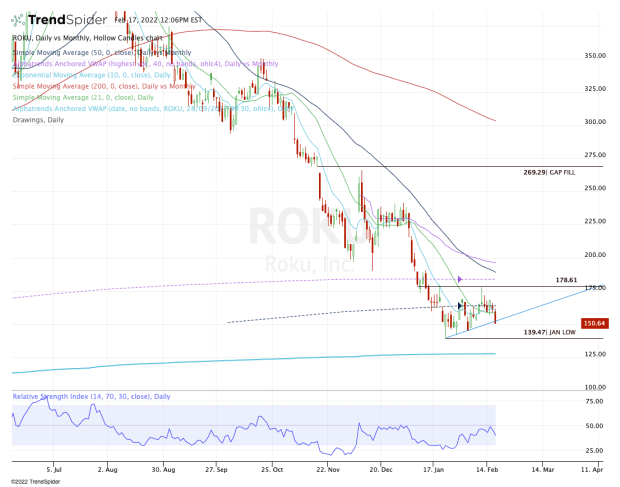

Chart courtesy of TrendSpider.com

When Meta (FB) reported earnings a few weeks ago, it crushed Snap (SNAP) to the point where the latter was down almost as much as the former. You would have thought Snap reported the bad results.

Snap fell about 24% the day it reported after the close, then exploded 59% the next day when investors realized the company was actually doing pretty well.

A little bit of that feeling is creeping in for me in regards to Roku, which is breaking below uptrend support due to the poor reactions of other growth stocks after their quarterly results.

Of course, the obvious difference is that Roku is not plunging 20% on a peer’s earnings report and hitting new lows.

From the chart above, it’s clear that the mid-$140s has been important. But I’ll be watching the $139.50 area, should Roku see a bearish reaction to the earnings. That’s last month’s low, and losing this level would give the stock a monthly-down rotation.

That very well could put the $125 to $127 area in play, where the VWAP from Roku’s first day of trading comes into play.

On the upside, bulls will want to see Roku stock clear the 10-day, 21-day and 50-month moving averages. Over $165 will put the $178 area in play, then the monthly VWAP and declining 50-day moving average.

I have a hard time believing this will be north of $200 by the end of the week, but if that’s the case we will have to reassess Roku stock.