After a huge fourth quarter, during which it exceeded revenue growth expectations, narrowed its losses, and surpassed 80 million active users, Roku found its way to the same old jam: another after-hours trading blood bath on the Nasdaq.

It seems investors were once again spooked on the streaming company following its reserved projections for the ongoing first quarter of 2024: "We remain mindful of near-term challenges in the macro environment and an uneven ad market recovery," Roku wrote in its quarterly letter to shareholders.

"While we will face difficult YoY growth rate comparisons in streaming services distribution and a challenging M&E environment for the rest of the year, we expect to maintain our Q4 2023 YoY Platform growth rates in Q1," the company added.

Speaking to Next TV via email, equity analyst Michael Nathanson put it another way: "Because the stock has doubled since last quarter on vapor, these results were broadly in line," he told us.

Roku shares reached a 19-month high back in November, after the company reported a similarly strong third quarter.

But this week has been not so good for Roku. It's stock also dropped Monday when it was reported that Walmart is in discussions to possibly by smart TV company Vizio for around $2 billion.

Roku's Q4 performance was strong across virtually all metrics.

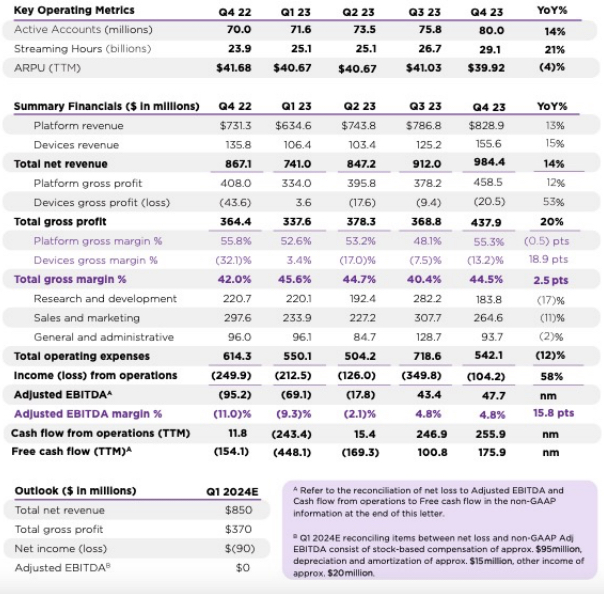

Quarterly revenue increased by 14% to $984.4 million, while losses closed to $78.3 million vs. $237.2 million a year prior. Both outcomes exceeded equity analysts' forecast.

Meanwhile, Roku added 4.8 million active users from October 1 through Dec. 31, surpassing the 80 million user milestone. (As one of the Penske showbiz trades noted, that's more users than all of the U.S. pay TV companies have put together.)

With 10 million more users engaging on the Roku platform on Dec. 31 vs. the laste day of 2022, total usage hours spiked by 21% to 29.1 billion.

The forward-looking metrics, however, were not something Roku's beyond-skittish investors wanted to hear.

Roku is forecasting first-quarter revenue of $850 million and losses of around $90 million.

After rising 3.57% during the trading day to reach $94.50 a share, Roku declined nearly 14% after hours, to around $81.47.

Despite its currently dominant position in the North American connected TV market, equity analysts believe Roku will eventually be surpassed by "better capitalized" competitors including Amazon, Google ... and now, perhaps, Walmart.