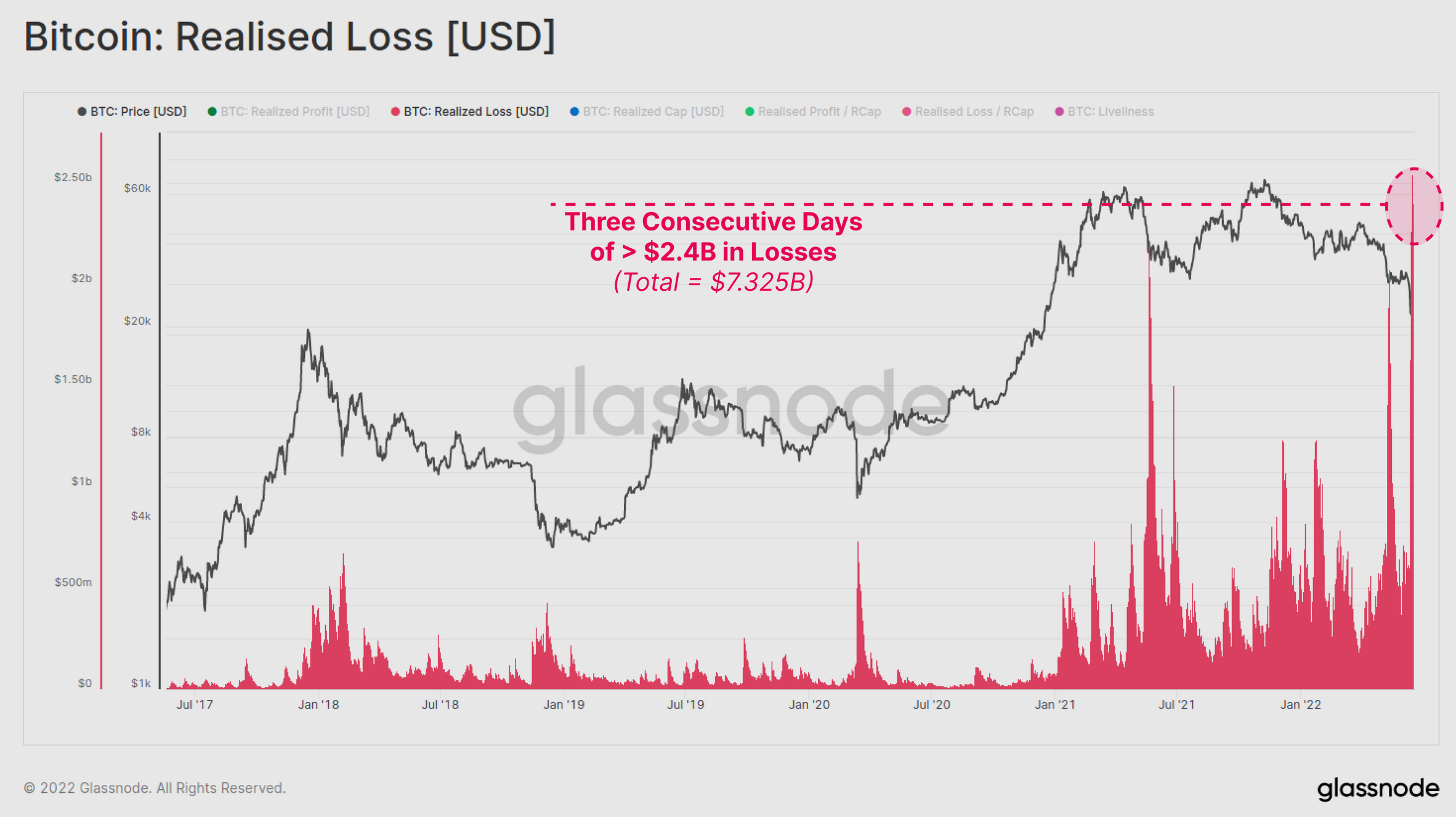

On-chain data shows that Bitcoin (CRYPTO: BTC) holders have reached historically high pain thresholds in terms of realized losses.

What Happened: According to on-chain analytics firm Glassnode, the current market conditions have resulted in realized losses hitting a new all-time high.

Over the last week, realized losses hit an all-time high of $7.325 billion and market-wide losses exceeded $2.4 billion per day.

According to Glassnode analysts, both long term and short term holders are now at a loss and holding coins below their average cost basis.

They noted that all the previous instances where these cohorts are at an unrealized loss have coincided only with late-stage bear market capitulations, providing confluence with the above profitability metrics.

“The current market has this metric [net flows] returning a -2.8% net outflow which is similar to the post-COVID crash outflows,” stated the analysts.

“As such, despite heavy downside price action, exchange balances saw a net balance depletion at a rate of 2.8% of the total this week.”

See Also: IS BITCOIN A GOOD INVESTMENT?

Price Action: According to data from Benzinga Pro, Bitcoin was trading at $21,157, gaining 5.82% over the last 24 hours. The leading digital asset is down 69% from its all-time high.