Financial giants have made a conspicuous bullish move on Robinhood Markets. Our analysis of options history for Robinhood Markets (NASDAQ:HOOD) revealed 8 unusual trades.

Delving into the details, we found 62% of traders were bullish, while 0% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $75,050, and 6 were calls, valued at $233,435.

Projected Price Targets

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $23.0 to $45.0 for Robinhood Markets over the last 3 months.

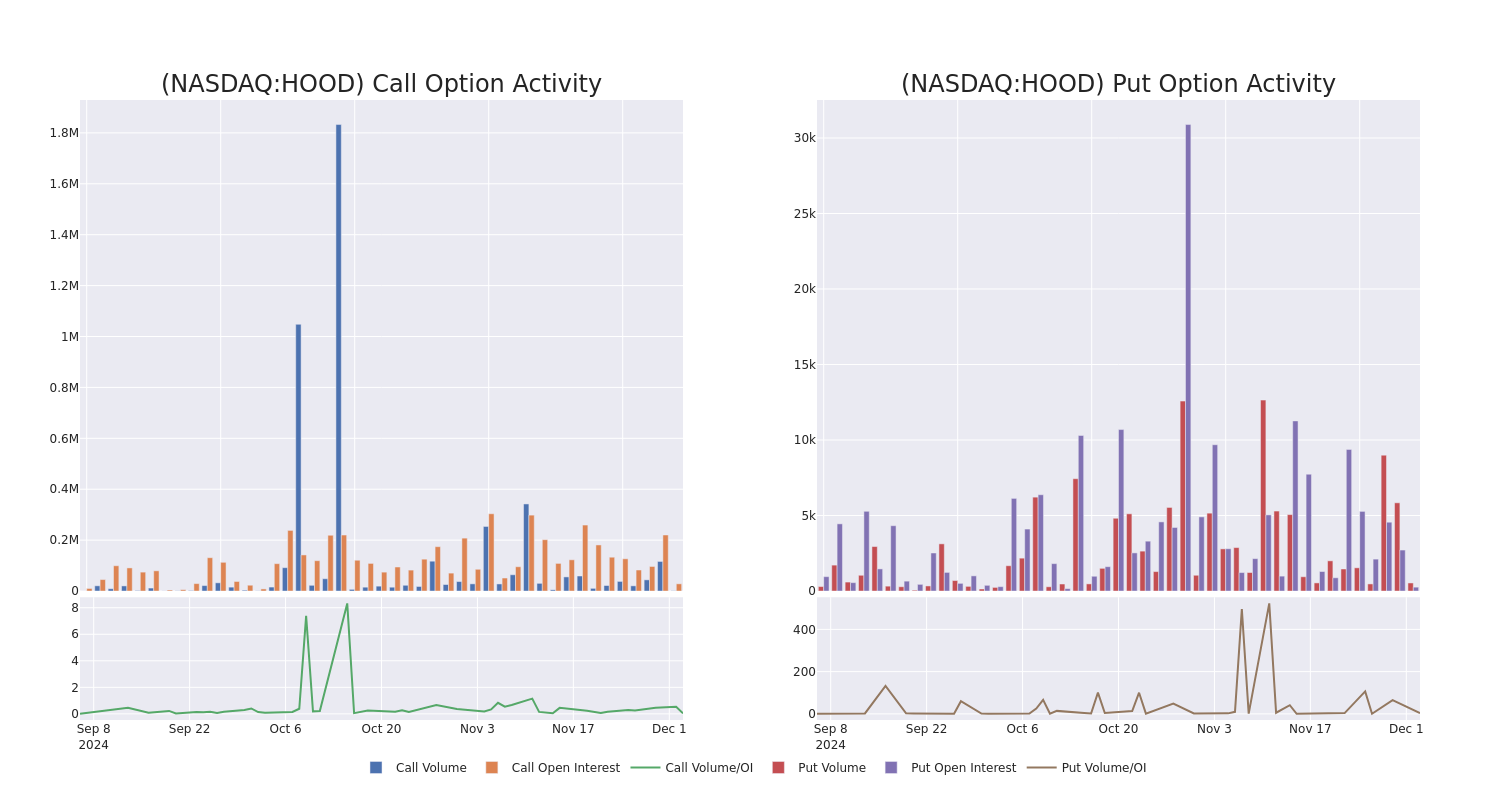

Insights into Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Robinhood Markets's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Robinhood Markets's whale trades within a strike price range from $23.0 to $45.0 in the last 30 days.

Robinhood Markets Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| HOOD | CALL | TRADE | NEUTRAL | 12/06/24 | $14.9 | $14.75 | $14.82 | $23.00 | $59.2K | 82 | 40 |

| HOOD | PUT | TRADE | BULLISH | 01/16/26 | $14.6 | $14.1 | $14.3 | $45.00 | $50.0K | 47 | 35 |

| HOOD | CALL | TRADE | NEUTRAL | 12/13/24 | $7.4 | $6.0 | $6.7 | $30.50 | $44.2K | 128 | 0 |

| HOOD | CALL | SWEEP | NEUTRAL | 12/13/24 | $1.19 | $1.16 | $1.17 | $40.00 | $35.6K | 8.6K | 597 |

| HOOD | CALL | TRADE | BULLISH | 12/20/24 | $13.05 | $12.65 | $12.95 | $24.00 | $34.9K | 4.7K | 27 |

About Robinhood Markets

Robinhood Markets Inc is creating a modern financial services platform. It designs its own products and services and delivers them through a single, app-based cloud platform supported by proprietary technology. Its vertically integrated platform has enabled the introduction of new products and services such as cryptocurrency trading, dividend reinvestment, fractional shares, recurring investments, and IPO Access. It earns transaction-based revenues from routing user orders for options, equities, and cryptocurrencies to market makers when a routed order is executed.

After a thorough review of the options trading surrounding Robinhood Markets, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of Robinhood Markets

- With a trading volume of 1,980,406, the price of HOOD is down by -0.12%, reaching $37.58.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 70 days from now.

Expert Opinions on Robinhood Markets

In the last month, 5 experts released ratings on this stock with an average target price of $37.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access. * An analyst from Deutsche Bank has decided to maintain their Buy rating on Robinhood Markets, which currently sits at a price target of $32. * An analyst from Piper Sandler has decided to maintain their Overweight rating on Robinhood Markets, which currently sits at a price target of $42. * An analyst from Deutsche Bank has decided to maintain their Buy rating on Robinhood Markets, which currently sits at a price target of $35. * Maintaining their stance, an analyst from JMP Securities continues to hold a Market Outperform rating for Robinhood Markets, targeting a price of $40. * Maintaining their stance, an analyst from Piper Sandler continues to hold a Overweight rating for Robinhood Markets, targeting a price of $36.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Robinhood Markets, Benzinga Pro gives you real-time options trades alerts.