In the first half of 2021, amidst a flurry of enthusiasm for meme stocks that briefly inflated Robinhood Markets Inc.'s (HOOD) revenues to considerable peaks, traders were drawn to the online brokerage platform. Crypto became one of Robinhood’s most lucrative verticals.

Concurrently, the company has been exploring growth strategies in Europe as it confronts strenuous scrutiny and increased regulatory pressure stateside.

However, Robinhood reported a downturn in trading volumes and a decrease in monthly active users in its most recent quarter. Although revenues for the third quarter grew by 29% reaching $467 million, it failed to meet analysts’ prediction of $480 million. This shortfall was impacted by a 13% reduction in third-quarter transaction revenues related to stock trading relative to the same timeframe in 2020, paired with a 55% drop in cryptocurrency trading on a year-over-year basis.

The company also experienced a 16% decrease in monthly active users, falling to 10.3 million in the last reported quarter compared to the same period in the previous year.

As Robinhood grapples with the U.S. Securities and Exchange Commission's tightening grip on crypto firms and an increase in regulatory pressures, the stock exhibits strong potential for significant instability. Therefore, it is prudent advice that risk-averse investors keep their distance in the short term. A detailed analysis of some of the firm's key performance indicators could offer further insight into its financial status and potential future trajectory.

Robinhood (HOOD): Volatile Revenue and Significant Losses

The trend and fluctuations of trailing-12-month Net Income over the given period show a gradual improvement, though still negative. Its net losses have been easing over the period from December 31, 2021, where it peaked at -$3.69 billion, towards a reduced loss of -$737 million by September 2023. Key points to note include:

- Initially, HOOD reported a Net Income loss of -$3.69 billion on December 31, 2021.

- Within the subsequent quarters of 2022 the company’s Net Income loss showed a significant reduction, dropping to -$1.03 billion by December 2022.

- However, in the first quarter of 2023 there was slightly increased loss reported, at -$1.15 billion.

- From this point towards September 2023, the losses gradually decreased quarter-over-quarter with Net Income losses reported at -$827 million in June 2023 and -$737 million by September 2023.

By looking into the numbers, we can see a significant contraction of 80% in the Net Losses from December 2021 to September 2023.

The trailing-12-month revenue trend for HOOD shows a series of ebbs and flows over the examined period:

- As of December 31, 2021, their Revenue was $1.82 billion.

- By March 31, 2022, their Revenue saw a dip to $1.59 billion, marking a decreasing trend.

- This downward spiral continued onto June 30, 2022, with Revenue amounting to $1.34 billion.

- There was a negligible increase in Revenue by September 30, 2022, bringing it to approximately $1.34 billion.

- The end of 2022 marked an increment in Revenue to $1.36 billion on December 31, 2022.

The beginning of the new year saw improvements in the revenue numbers:

- The first quarter ended with an increased Revenue of $1.5 billion on March 31, 2023.

- A continued upward revenue trajectory was observed with a mid-year Revenue of $1.67 billion by June 30, 2023.

- The last recorded value shows a Revenue apex at $1.77 billion on September 30, 2023.

This series of data portrays a fall and rise trend of the company's Revenue. From the initial recorded value ($1.82 billion) to the last ($1.77 billion), HOOD's Revenue had a temporary slump but recovered later showing a decrease in the growth rate of approximately -2.7%. Notably, the Revenue has been oscillating around $1.3 billion to $1.4 billion for a significant portion of the year 2022 before showing steady improvement in 2023. The most recent statistics indicate a healthier standing for the company showcasing promising progress.

The Gross Margin for HOOD has demonstrated a declining trend with a notable series of fluctuations. Below are the key points:

- On December 31, 2021, the gross margin was reported as 91.6%

- The Gross Margin decreased slightly to 91.1% by March 31, 2022

- By June 30, 2022, it fell further to 90.0%

- A slight increase was observed as the value rose to 90.8% on September 30, 2022

- However, the closing of the year 2022 saw a significant drop as the Gross Margin stood at 86.8% on December 31, 2022

- An upward shift started in 2023 with the margin rising to 87.7% on March 31, 2023

- Continuing this trend, it further increased to 88.4% on June 30, 2023

- As of the latest data, on September 30, 2023, the Gross Margin is reported as 88.8%

The calculated growth rate from the first to the last value indicates a decline of approximately 3%. The data clearly exhibits that the latter half of the years have shown volatility in terms of Gross Margin. The year 2022 witnessed a significant drop, but since the beginning of 2023, a gradual increase has been observed. However, compared to the start of the series, the overall margin percentage is still lower as of the latest data available.

The Current Ratio of HOOD has demonstrated both fluctuating trends and a general decrease during the period from March 2021 to September 2023. Here's a concise breakdown:

- Starting at 1.61 (March 2021), it initially fell to 1.46 in June 2021.

- This was followed by a slight increase to 1.60 in September 2021, however, the value lowered again to 1.56 by December 2021 and slightly increased to 1.59 in March 2022.

- A notable decline was seen by June 2022, when it dipped to 1.38 and further dipped slightly to 1.38 in September 2022.

- This fluctuating trend persisted with a slight increase to 1.41 in December 2022, followed by several months of a declining trend falling to 1.31 by September 2023.

Overall, comparing the first value (1.61 in March 2021) with the last available data point (1.31 in September 2023), there is a negative growth rate of approximately -18.63%. It's essential to note that the significance placed on more recent data implies that the overall downward trend and the current ratio value of 1.31 as of September 2023 should be given specific attention in any analyses or future predictions for the company’s ability to cover its short-term liabilities.

Analyzing HOOD's Share Price Volatility: A Six-Month Trend Review

The data shows the share price of HOOD from July 2023 to January 2024.

- For the period from July 14, 2023 to July 21, 2023, the share price increased from $11.89 to $12.78 showing a growth. However, the shares started a minor decline to value at $12.64 on July 28.

- In August 2023, the shares continued to depreciate from a price of $12.18 at the beginning of the month to $10.42 by the end of the month.

- In the course of September 2023, the company's shares showed a slight fluctuation in the initial weeks. However, the trend remained descent over the month, starting with $10.94 and ending at $9.67 at the end of the month.

- October saw a slow but steady decrease in the share price of HOOD, starting at $9.69 and terminated at $9.16 by the end of the month.

- In November, the downward trend persisted, and the shares fell from $9.26 to $8.14 at the end of the month.

- December demonstrated an impressive recovery and a clear upward trend for HOOD shares which spiked from $8.80 at the commencement of the month to $13.05 at the end.

- However, by January 4, 2024, the shares took a sharp turn downwards to land at $12.08.

Over the six-month period from July 2023 to December 2023, the shares have shown an overall downward trend with minor fluctuations. Nevertheless, a clear accelerating growth is observed in the final month of 2023, only to take a quick descent at the beginning of the following year. This indicates a trend of erratic spikes followed by fall, making the growth rate volatile over this period. Here is a chart of HOOD's price over the past 180 days.

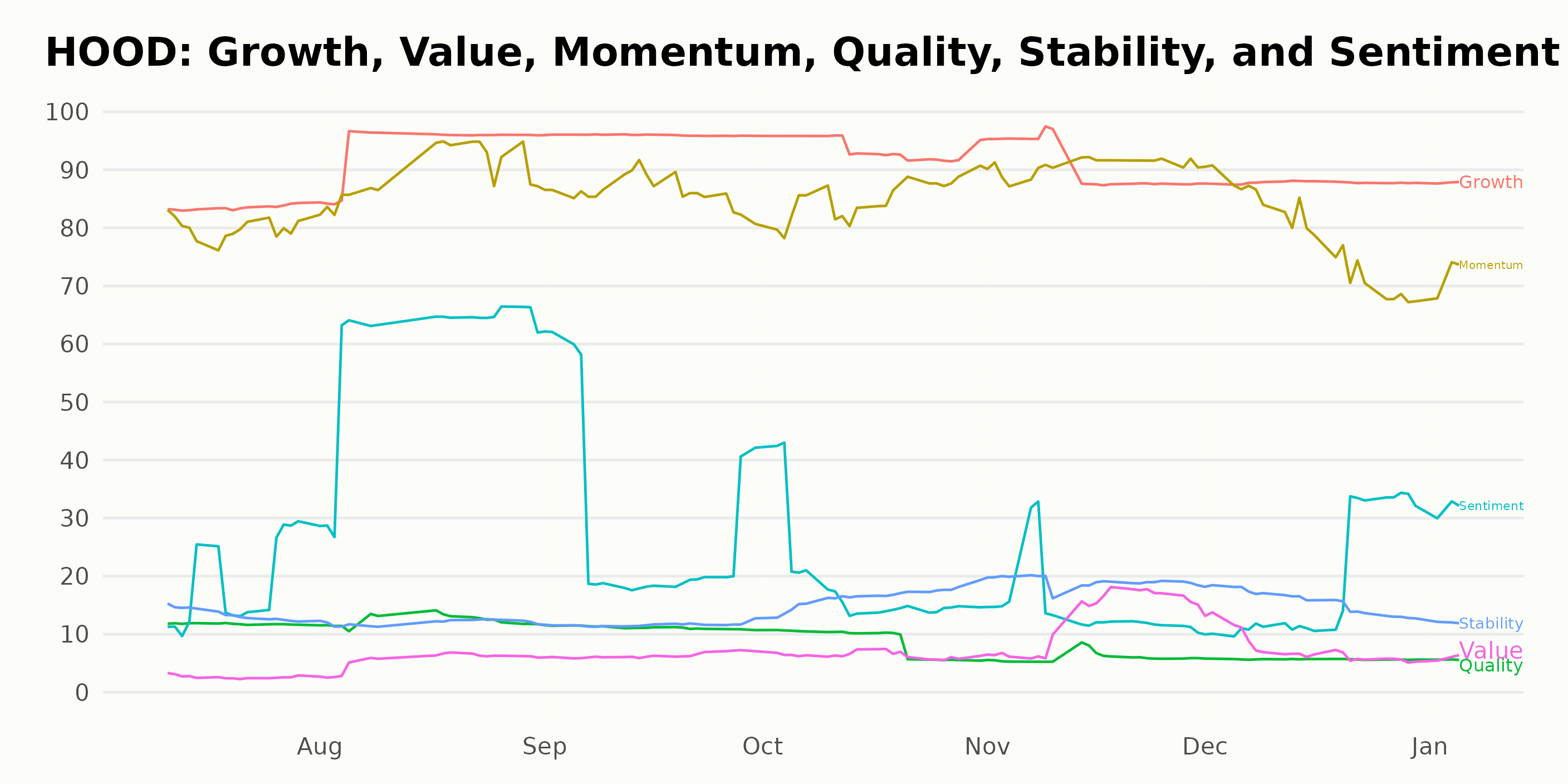

Analyzing HOOD's POWR Ratings: Growth, Momentum, and Sentiment (July 2023 - January 2024)

HOOD has an overall D rating, translating to a Sell in our POWR Ratings system. It is ranked #126 out of the 133 stocks in the Software - Application category.

According to POWR Ratings, HOOD has shown significant performance in three dimensions: Growth, Momentum, and Sentiment. The following text focuses on the ratings of these dimensions over a six-month period between July 2023 and January 2024.

Growth: The Growth dimension consistently remained high for (HOOD). It started at 83 in July 2023 and increased to its peak value of 96 in September 2023. Although slight fall was noted afterwards, it sustained a strong rating above 85 for the rest of the period.

Momentum: Similarly, Momentum also maintained a high rating over this period, starting at 80 in July 2023 and increasing to a peak of 91 in November 2023. Despite fluctuating slightly downwards to 72 by January 2024, the overall momentum remained strong.

Sentiment: Sentiment showed a somewhat erratic pattern over the reviewed months, starting at a low of 18 in July 2023 before jumping to its highest point of 58 in August 2023. Thereafter it fluctuated significantly, falling to 14 in November 2023, and eventually stabilizing around 32 by January 2024.

These POWR ratings clearly indicate that among the various dimensions for HOOD, Growth and Momentum retained consistently high ratings throughout the period with clear upward trends, while Sentiment had a more varied track record but showed a strong performance mid-period.

How does Robinhood Markets Inc.'s (HOOD) Stack Up Against its Peers?

Other stocks in the Software - Application sector that may be worth considering are Commvault Systems Inc. (CVLT), TeamViewer SE (TMVWY), and Rimini Street Inc. (RMNI) -- they have better POWR Ratings.

What To Do Next?

Get your hands on this special report with 3 low priced companies with tremendous upside potential even in today’s volatile markets:

3 Stocks to DOUBLE This Year >

HOOD shares were trading at $11.93 per share on Friday afternoon, down $0.05 (-0.42%). Year-to-date, HOOD has declined -6.36%, versus a -1.61% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics.

Robinhood Markets (HOOD) 2024 Predictions Check: Buy or Hold? StockNews.com