Robinhood Markets Inc (NASDAQ:HOOD) has launched a new stock market index that reflects its customers' top 100 stock holdings.

What Happened? On Friday, Robinhood announced the Robinhood Investor Index, a market index that reflects only the most high-conviction stock holdings of its user base.

The index is weighted by the percentage of each user's portfolio that is allocated to the stock, regardless of the size of their portfolio. In a blog post, Robinhood said it wants the index to represent the investments all its users are passionate about rather than just the stocks its largest investors own.

Related Link: Analyst Says Robinhood Stock 'Not Worth $1,' Calls It A 'Bad Bet For Investors With Alarming Risk'

Robinhood said the index is 75% weighted to large cap stocks, but it will be updated once a month to accurately reflect what its customers are buying.

The Retail Trader Landscape: Robinhood traders gained a reputation for aggressive and at times reckless speculation during the meme stock trading frenzy in 2021. Unprecedented trading volume in AMC Entertainment Holdings Inc (NYSE:AMC), GameStop Corp. (NYSE:GME) and other stocks forced Robinhood to temporarily halt buying of these stocks in early 2021.

Related Link: Why Meme Stocks AMC Entertainment And GameStop Are Still 'In Danger Of Declining To $0'

Robinhood has about 22.9 million users as of June 2022. The company has prioritized the democratization of investing. Its user base is relatively young and inexperienced with the market.

The average age of Robinhood's users is 31, and about half its users are first-time investors, according a Robinhood spokesperson told Next Advisor.

Top Robinhood Holdings: Despite Robinhood users' youth and inexperience, the initial top 10 holdings in the Robinhood Investor Index include several high-quality blue chip names with a couple of high-risk meme stocks sprinkled in as well:

- Tesla Inc (NASDAQ:TSLA)

- Apple Inc (NASDAQ:AAPL)

- Amazon.com, Inc. (NASDAQ:AMZN)

- Ford Motor Company (NYSE:F)

- AMC Entertainment

- Microsoft Corporation (NASDAQ:MSFT)

- Nio Inc - ADR (NYSE:NIO)

- Walt Disney Co (NYSE:DIS)

- AMC Entertainment Hldg Pref Equity Units (NYSE:APE)

- GameStop

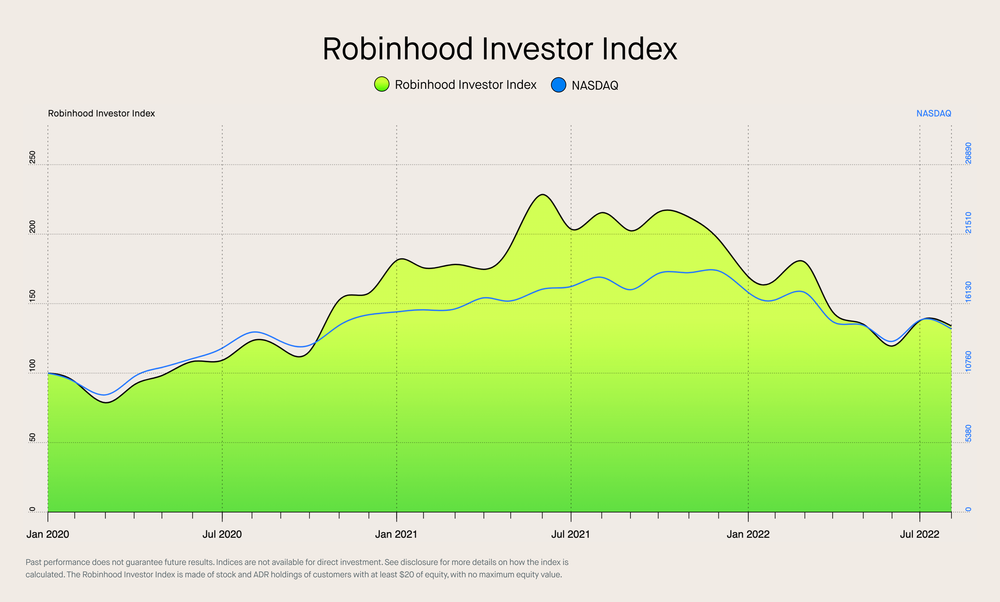

Benzinga's Take: The chart above that Robinhood included in its Friday blog post compares the historical performance of the Robinhood Investor Index to the performance of the Nasdaq Composite Index since the beginning of 2020, and it may demonstrate what investors can expect from the Robinhood Investor Index in the future.

The Robinhood index outperformed the Nasdaq during the market boom in 2021, underperformed during the market weakness in 2022 and has now generated overall returns almost exactly in-line with the Nasdaq since the beginning of 2020.

Illustration courtesy of Robinhood.