Discount broker Robinhood Markets Inc (NASDAQ:HOOD) has announced it will begin allowing users to earn income on the stocks they own by lending out their shares.

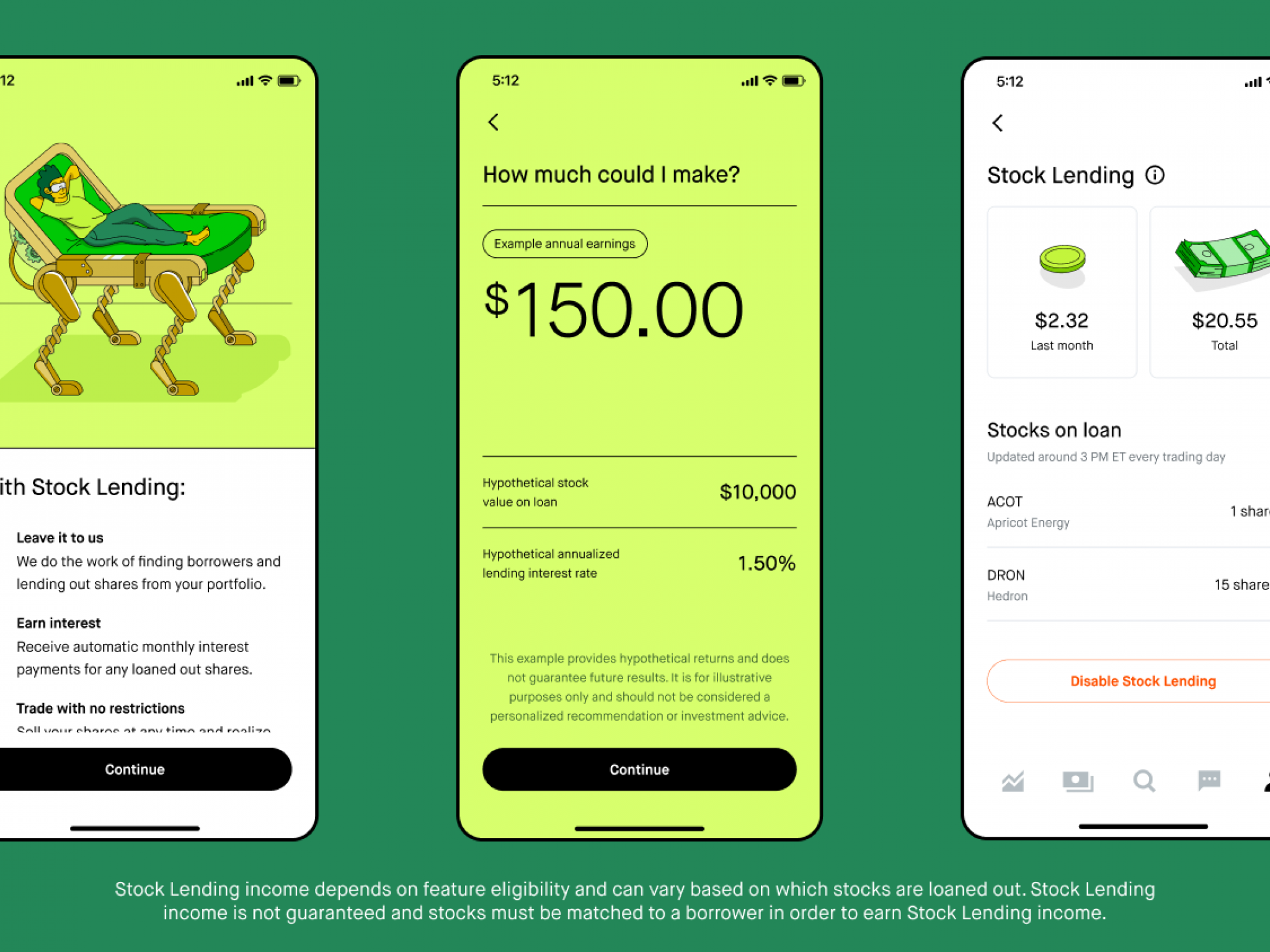

What Happened? In an effort to boost its slumping business, Robinhood has announced Stock Lending, a program through which users can earn passive recurring income from their shares of stock. All Robinhood users have to do is enable Stock Lending in their account, and they get paid when Robinhood tracks down interested borrowers.

Related Link: Which Brokers And Exchanges Are Going All-In On Crypto, And Which One is Staying On The Sidelines?

Robinhood said users can still sell shares on loan whenever they want. Stock lenders may lose the right to vote when lending shares, and Robinhood said they will receive cash payments in lieu of dividends.

"We’re excited to break down yet another barrier and democratize a product that has been historically preserved for the wealthy with high barriers to entry," said Steve Quirk, chief brokerage officer at Robinhood.

Why It's Important: Robinhood was at the epicenter of the meme stock craze in 2021 when groups of retail traders on Reddit's WallStreetBets and other social media platforms orchestrated targeted buying campaigns in GameStop Corp. (NYSE:GME), AMC Entertainment Holdings Inc (NYSE:AMC) and other heavily shorted stocks in an attempt to drive out and punish short sellers.

Robinhood subsequently dealt with a number of lawsuits when it temporarily restricted buying in GameStop and other meme stocks.

Now, Robinhood is offering its users a chance to lend their shares out to those very same short sellers many of its users were targeting just a year ago. In a blog post, Robinhood said financial institutions borrow shares of stock for "many reasons, including to cover deficits, failed deliveries, collateral, or to cover short sales."

Benzinga's Take: Robinhood recently reported a 43% drop in revenue in the first quarter as the meme stock trading frenzy of last year died down. Robinhood investors certainly can't blame the company for getting creative to try to stop the bleeding after Robinhood's stock has fallen 73.2% in just the last six months.

Photo courtesy of Robinhood.