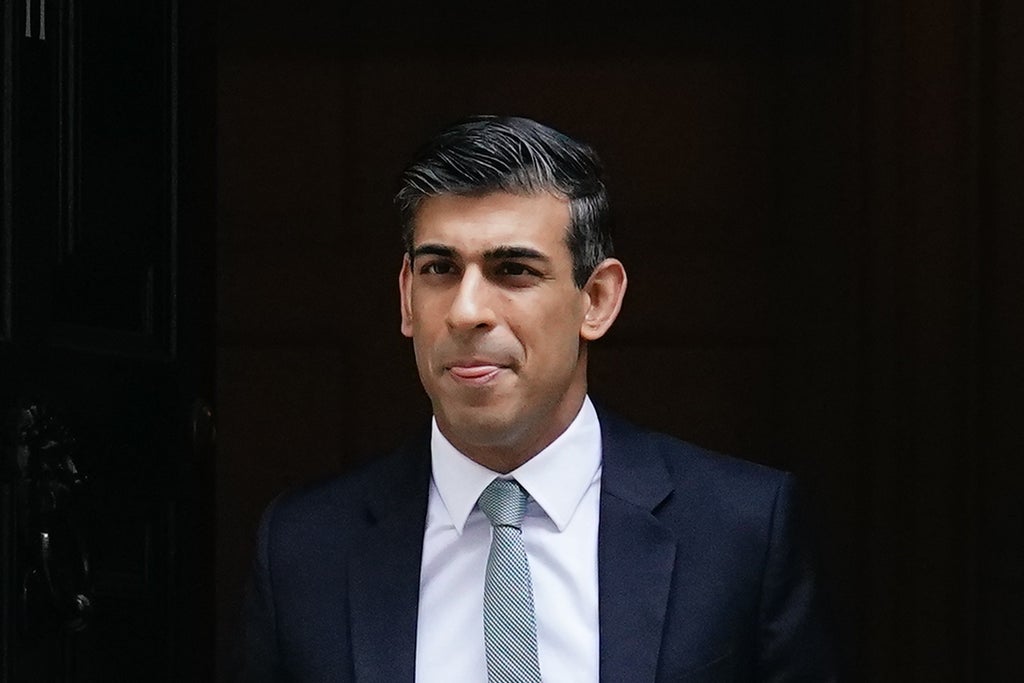

The chancellor, Rishi Sunak, is under renewed pressure to announce an emergency budget to help Britain avoid a painful recession amid spiralling living costs and plummeting consumer confidence.

The British Chambers of Commerce (BCC) wrote to Mr Sunak on Monday urging him to immediately announce measures to ease costs that businesses and households face.

In an open letter, the BCC called for a three-point plan that would slash VAT on energy bills from 20 per cent to 5 per cent, offer free Covid tests for companies and the reversing of a recent National Insurance hike.

It came as warning signs mounted about the health of Britain’s economy. Last week, the Bank of England forecast that inflation would hit 10.25 per cent when energy bills jump again in October.

The Bank predicts that massive increases to the cost of essentials will result in people cutting back on other spending, causing the economy to shrink in the final quarter of the year before flatlining in 2023.

Consumer confidence plunged to a near all-time low in April, driven by the rising cost of living. Meanwhile, retail sales slumped, according to a survey by the Confederation of British Industry.

Shevaun Haviland, director general of the BCC, said her plan was simple, straightforward and could be reversed when the economy is in better shape.

“Making these changes would have an immediate benefit for both businesses and the public.

“The costs crises facing firms and people in the street are two sides of the same coin. If we can ease the pressure on businesses then they can keep a lid on the price rises being driven by surging energy bills, staff shortages and higher taxes.

“Firms will then have the breathing space they need to raise productivity and strengthen the economy. But a change of course is needed now, if the government does not act immediately, then rising costs will put our economic recovery in a stranglehold that will have repercussions for years to come.

“The government has a variety of financial levers it can pull, and this is the time to use them. Acting today will then give businesses a chance to create the future profits needed to fill tax coffers.”

Postponing the rise in National Insurance Contribution would ease pressure on companies and put money back in consumers’ pockets, the BCC said.

Cashflows would also be helped by slashing VAT on commercial energy bills. Unlike households, businesses are not protected from rising gas and electricity costs by Ofgem’s price cap.

Under the BCC’s plan, a small business currently paying £10,000 for energy would pay £1,500 less VAT.

The business group said many firms were still struggling with high numbers of absences due to Covid symptoms or self-isolation.

The government recently scrapped free Covid testing for employers. Bringing it back would allow firms to limit the disease’s spread among employees, the BCC argued.

“With wider structural staff shortages continuing to limit productivity, this would be a key measure to keep the economic recovery on track,” the BCC wrote.

Households are expected to be hit with a devastating 40 per cent rise in energy bills this winter, sending inflation to 10.25 per cent – a level not seen since 1982.

Average gas and electricity bills are forecast to hit £2,800 when Ofgem raises its price cap to reflect a rise in wholesale energy costs, which has been exacerbated by the war in Ukraine.