The chancellor faces a drastic choice between a sharp increase in spending or the worst drop in living standards for nearly half a century at his spring statement this month, the Institute for Fiscal Studies (IFS), an economic think-tank has warned.

Rishi Sunak will have to decide whether to “spend and borrow billions more, or allow a hit to household incomes bigger than at any time since at least the financial crisis and quite possibly since the 1970s”, the IFS said.

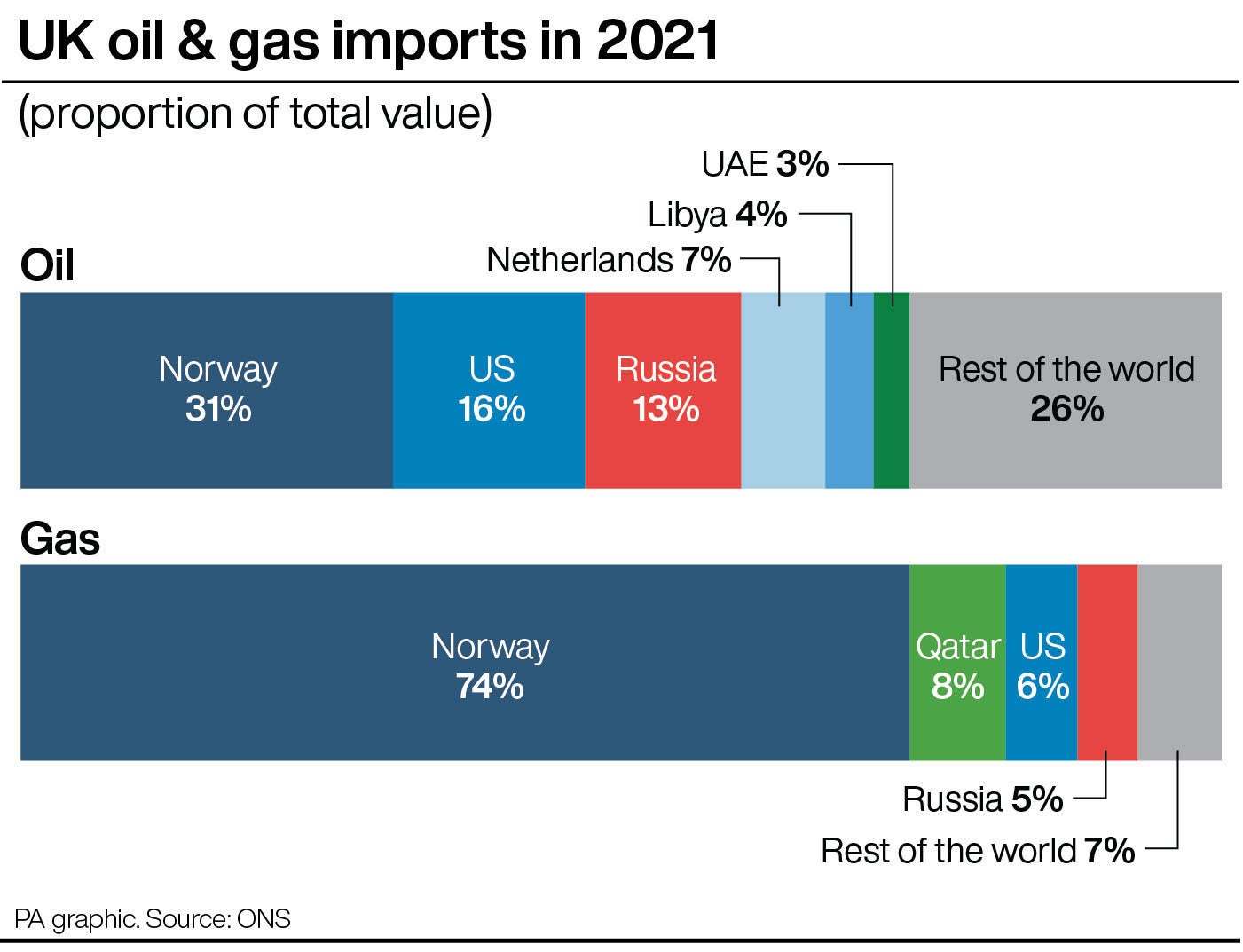

The Russian invasion of Ukraine has rocked global commodity markets, with efforts across the US, UK and EU to reduce or ban imports of crude oil and gas driving up prices for other sources.

Energy prices, already elevated before the conflict erupted, could now generate a hit to households of £43bn, according to the IFS. That compares with a package of measures to mitigate energy bills of £9bn, which was developed by the Treasury prior to the Russian invasion and resulting sanctions.

The government’s intervention “would now offset only about one-fifth of the rise in household energy bills”, the IFS said.

Before the Covid-19 pandemic and Brexit caused seismic shifts to government policy, the Treasury intended to have just one fiscal event a year, with an autumn Budget and a spring statement. However, that is now unlikely given the sheer scale of pressure on households, the IFS said.

Paul Johnson, director of the IFS, said: “At the spring statement Rishi Sunak has to make a huge judgment call. Will he do more to protect households from the effects of energy prices which have risen even further in the last two weeks?”

“If he doesn’t then many on moderate incomes will face the biggest hit to their living standards since at least the financial crisis. If he does, then there will be another big hit to the public finances,” Mr Johnson added.

In an illustration of how the Russian invasion has changed the scale of the hit to households, a person earning £27,500 a year would have been £500 worse off by 2023, prior to the attack on Ukraine, according to forecasts from Citigroup, a bank and financial services company and shared by the IFS. This has now climbed to an £800 hit. Meanwhile, someone on nearly £42,000 will be £1,300 worse off now, compared to a pre-Russian invasion estimate of £900.

The impact of higher interest rates aimed at slowing the pace of inflation, which is set to top 8 per cent in April, according to a range of economists, is also going to damage the public finances, the IFS analysis found. The shift higher in inflation since October last year is set to add around £11bn to the government’s debt interest bill in 2021-22.

Meanwhile, public sector workers were “highly likely” to face a below inflation pay rise this year, the IFS said.

Holding its place as Nato’s second-highest military spender in real terms, after the US, will also mean choosing between higher spending and borrowing or significant cuts to other departmental budgets, the IFS said. Holding this place in the spending league table would require a commitment of around 2.5 per cent of UK GDP.

Business secretary Kwasi Kwarteng told MPs that the British public were prepared to shoulder the pain of higher energy costs on Wednesday.

Fellow Tory MP, Desmond Swayne, said the government ought to be “clear” with the British people that they would have to make sacrifices while Ukrainians made “so much greater sacrifices”.

In response, Mr Kwarteng said that “people understand” the situation.

The exchange came after the government said that it would phase out imports of Russian oil and oil products by the end of the year.

“People are willing to endure hardships in solidarity with the heroic efforts that the people of Ukraine are making,” the business secretary said. “People understand this in this country, because we’re a generous and giving country.”

Shadow chancellor Rachel Reeves said the government had allowed the cost of living crisis “to spiral out of control since September”, a problem which would be made worse by an “unfair tax hike”.

"The Conservatives should halt their national insurance hike in April – and they must look again at Labour’s proposal for a one-off windfall tax on oil and gas producers to cut household energy bills by up to £600,” she said.