AMC Entertainment Holdings, Inc (NYSE:AMC) and GameStop Corporation (NYSE:GME) were flying 10% and 16.5%, respectively, in after-hours trading on Tuesday but on Wednesday when the market opened most of the surge was subdued due to a 0.41% lower open for the S&P 500.

Traders and investors quickly came in and bought the dip, however, and within the first half-hour of trading, AMC was up over 7% and GameStop was soaring over 15%.

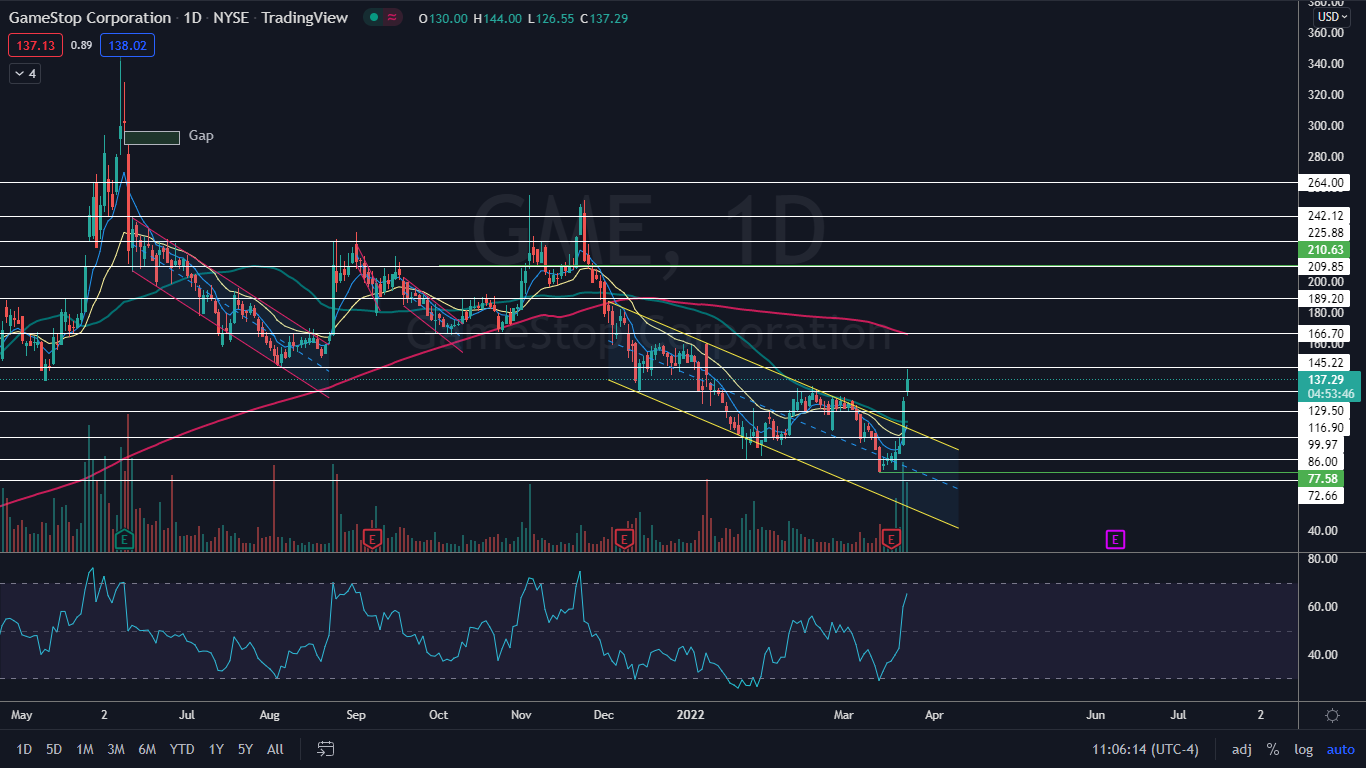

The stocks have been in a long and drawn-out decline. AMC plummeted over 82% between its June 2, 2021 all-time high of 72.62 and the March 14 low of $12.90, while GameStop plunged about 83% from the all-time high of $483 printed on Jan. 28, 2021 and its 52-week low at the $77.58.

While much of the hype around AMC and GameStop has faded with the share prices, many retail investors, who believe the stocks are manipulated and undervalued, have held onto their positions or taken the opportunity to add shares at lower prices.

Traders and investors who entered into positions or added to their share count over the past couple of weeks may have timed the bottom perfectly, because both AMC and GameStop have flashed signals that indicate the bottom is likely in.

It should be noted, however, that events affecting the general markets, negative or positive reactions to earnings prints and news headlines can quickly invalidate patterns and breakouts. As the saying goes, "the trend is your friend until it isn't" and any trader in a position should have a clear stop set in place and manage their risk versus reward.

In The News: GameStop Chairman and Chewy co-founder Ryan Cohen purchased 100,000 shares of GameStop on Tuesday at an average price of $101.76 per share, according to a regulatory filing that was printed after the market closed. Cohen’s increased stake — he now owns total of 9.1 million GameStop shares — lit up social media and the hashtags #ApesTogetherStrong and #APESNOTLEAVING started to trend more heavily.

Jim Cramer, who has taken many opportunities over the past year to insult retail traders, specifically the Apes who are holding a number of so-called meme stocks, took to Twitter shortly after the news dropped to take a jab at Cohen by suggesting he take both GameStop and Bed Bath & Beyond, Inc (NASDAQ:BBBY) private.

See Also: AMC CEO Adam Aron Highlights Movie Lineup To Keep Summer Revenues Sizzling

The AMC Chart: AMC is trading in a strong uptrend on lower timeframes, such as the four-hour chart, but hasn’t yet confirmed an uptrend on the daily chart due to lack of a higher low. Eventually a higher low on the chart will come, which could provide a solid entry for bullish traders who are not already in a position.

- If AMC closes the trading day below the $19.50 level, the stock will print a shooting star candlestick, which indicates the lower high may come on Thursday. If the stock closes the trading day near its high-of-day, however, it will print a bullish kicker candlestick, which could indicate higher prices will come again on Thursday.

- On Tuesday, AMC looks to have broken bullishly from a falling channel pattern on the daily chart that has been holding the stock down since Dec. 8, 2021. A falling channel is considered to be bearish until a stock breaks up from the upper descending trendline of the pattern, which can indicate a big reversal is in the cards.

- AMC has had higher-than-average volume over the past two days, which indicates a high level of trader and investor interest has returned to the stock. By late morning on Wednesday, over 57.8 million compared to the 10-day average of 36.09 million.

- AMC has resistance above at $20.36 and $25.79 and support below at $17.07 and $14.96.

Want direct analysis? Find me in the BZ Pro lounge! Click here for a free trial.

The GameStop Chart: GameStop is trading in a confirmed uptrend on the daily chart, with the most recent higher low created on March 18 at the $78.90 level and the most recent higher high formed on Wednesday at $144.

- Like AMC, GameStop appears to have broken up bullishly from a falling channel pattern on Tuesday, and on Wednesday bullish momentum was pushing the stock higher still.

- Also like AMC, GameStop has a massive amount of volume, with over 11.5 million shares exchanging hands by late morning compared to the 10-day average of 4.64 million.

- If GameStop closes the trading day below about the $138 level it could indicate the next higher low is on the way for Thursday or Friday, while if the stock closes the session near the high-of-day higher prices may be in the cards. Alternatively, the stock could print an inside bar pattern on Thursday, which in this case would lean bullish.

- GameStop has resistance above at $145.22 and $166.70 and support below at $129.50 and $116.90.

Photo: Alexandr Podvalny from Pexels