Republican Rep. Glenn Grothman, from Wisconsin's 6th District, plans to introduce a bill that would bar future presidents from cancelling student loan debt, something the Biden administration has sought to do over the past two years. Grothman's bill would affect the over 700,000 student loan borrowers who reside in his state.

The Protecting Taxpayers from Student Loan Bailouts Act would bar the secretary of education from issuing regulations that cost taxpayers more than $100 million annually, a spokeswoman for Congressman Grothman confirmed. If such a bill were passed by Congress, it would essentially prevent any mass-cancellations of loans from a president in the future.

"Congress could block the Education Department from issuing new regulations or executive actions related to the student loan program that increase costs to taxpayers," Preston Cooper, a senior fellow at the American Enterprise Institute, told The New York Sun. "Had it been in effect during the last four years, such a law would have killed all of President Biden's attempts at loan cancellation in the cradle."

"The Biden administration may be finished, but it's wrong to assume that its agenda on student loan cancellation is dead forever. Congress can Democrat-proof the student loan program forever with one simple legislative change," he continued.

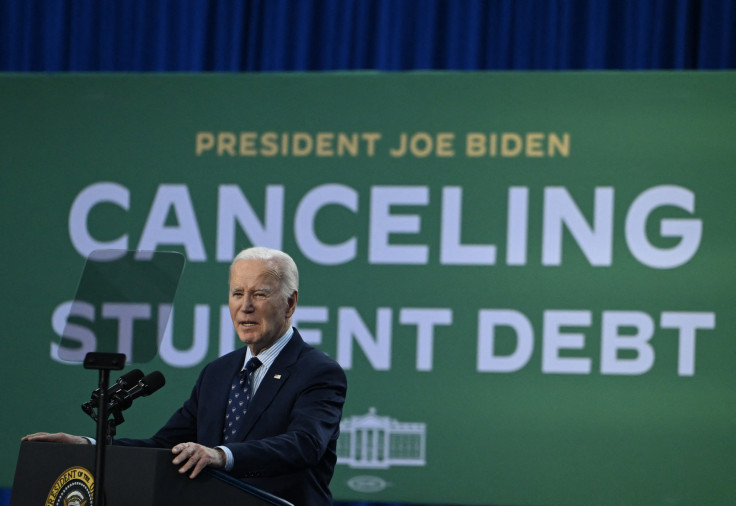

The Biden administration has continuously tried to cancel student loans for borrowers across the country, though their efforts have been largely blocked by the Supreme Court and Republican lawmakers.

The series of Republican-led lawsuits led the Biden administration to withdraw its plans to forgive student loan debt for millions of borrowers. The U.S. Department of Education posted notices in the Federal Register in December that it was pulling its wide-scale loan forgiveness plans. The department cited "operational challenges," and experts say political difficulties likely also played a role, CNBC reports.

Grothman's proposed legislation deals with federal spending and regulations, so it could be included in the Republican legislative package now being debated among House members and Senators, according to The New York Sun.

There are over 43.2 million student loan borrowers in the U.S., totaling $1.73 trillion in student loan debt. In Wisconsin, the state that Congressman Grothman represents, around 727,400 people are student loan borrowers, having an average of $31,894 in loans, according to The College Investor.

Throughout the Biden administration, total student loan debt held by Americans has increased by about $400 billion. As college gets more expensive and students take on more debt, experts advise seeing all the roads available.

"College keeps getting progressively more expensive, and so does borrowing money to attend. Federal student loan interest rates are rising to a 12-year high for the upcoming academic year, so it's important to plan carefully when borrowing," said Cassandra Happe, a Wallethub analyst.

"In addition to attending college in a less expensive state and pursuing other avenues of funding like financial aid and grants, students should also carefully calculate how much they can afford to borrow before taking out a loan," she continued.

© 2024 Latin Times. All rights reserved. Do not reproduce without permission.