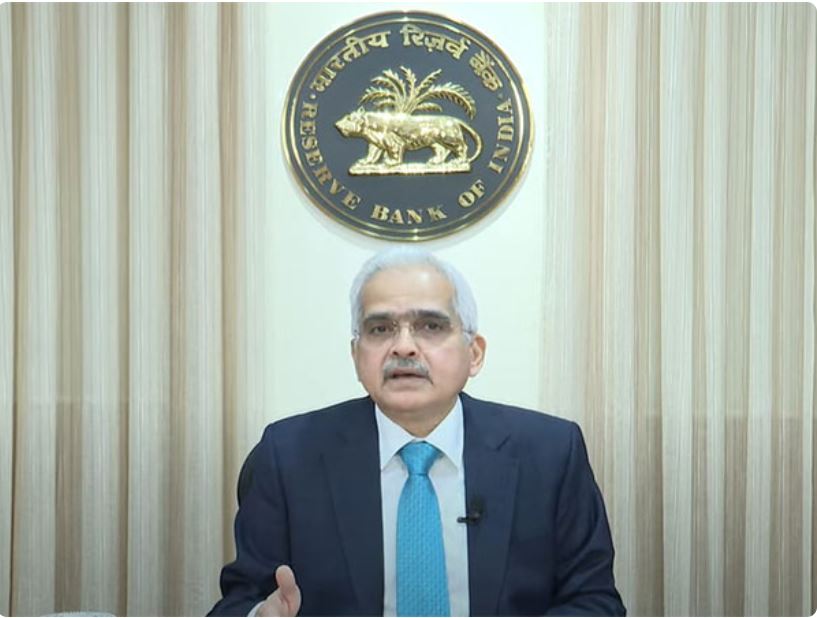

Mumbai: Reserve Bank of India (RBI) Governor Shaktikanta Das said that Monetary Policy Committee (MPC) has decided to keep the policy repo rate unchanged at 6.5 per cent as retail inflation continues to be above its target of 4 per cent.

The decision comes amidst a backdrop of economic uncertainties both domestically and globally.

The MPC, in a majority decision with four out of six members in agreement, opted to keep the Repo Rate steady.

Consequently, the standing deposit facility (SDF) rate remains at 6.25 per cent, while the marginal standing facility (MSF) rate and the bank rate remain at 6.75 per cent.

Also Read |

RBI keeps repo rate unchanged at 4 pc

Governor Das, in his post-policy press conference emphasized the importance of a balanced approach towards monetary policy.

Das reiterated the MPC's commitment to withdrawing accommodation gradually to ensure that inflation aligns with the targeted range while supporting economic growth.

"Monetary policy must continue to remain disinflationary and be resolute in its commitment to aligning inflation to the target of 4 per cent on a durable basis sustain price stability outset strong foundation," stated the RBI Governor.

The RBI revised its growth projections for the current financial year 2024-25, forecasting a GDP growth rate of 7.2 per cent.

Also Read |

RBI decides to keep repo rate unchanged at 6.5 pc

The quarterly growth projections stand at 7.3 per cent for Q1, 7.2 per cent for Q2, 7.3 per cent for Q3, and 7.2 per cent for Q4. Governor Das highlighted that the risks to the growth outlook are evenly balanced.

The decision to keep the Repo Rate unchanged signals the RBI's cautious approach towards balancing the objectives of controlling inflation and supporting economic recovery.

The announcement comes at a time when the global economy is grappling with uncertainties arising from geopolitical tensions and the lingering effects of the COVID-19 pandemic.