In previous commentaries I have overly simplified the definition of a recession to the common belief that 2 quarters of GDP contraction spells recession. If it were that easy...then case closed as Q1 and Q2 were both negative.

Yet with most things with investing...it is never really that easy. And not everyone adheres to this definition.

Or perhaps we could use this old economist joke that tries to define recession as well:

What’s the difference between a recession and a depression?

A recession is when your neighbor loses his job...a depression is when you lose your job.

Yes, this joke may explain why most economists are not on the standup comedy circuit ;-)

At the end of the day, the official arbiter of what defines a recession is the National Bureau of Economic Research who normally weighs in months after the fact. Meaning they have not dubbed this a recession yet...and likely won’t when you appreciate the following definition on FAQ section of their site:

“The NBER's traditional definition of a recession is that it is a significant decline in economic activity that is spread across the economy and that lasts more than a few months. The committee's view is that while each of the three criteria—depth, diffusion, and duration—needs to be met individually to some degree, extreme conditions revealed by one criterion may partially offset weaker indications from another. For example, in the case of the February 2020 peak in economic activity, we concluded that the drop in activity had been so great and so widely diffused throughout the economy that the downturn should be classified as a recession even if it proved to be quite brief. The committee subsequently determined that the trough occurred two months after the peak, in April 2020.”

For as much as they tried to make that accessible to the layman it still leaves something to be desired. The main thing they need to see is PAIN. And the main measure of pain is job loss which is a main indicator that remains positive as we saw in today’s surprisingly robust Government Employment report.

On the other hand, I stand behind what I said in my Reitmeister Total Return commentary earlier this week in the section below:

Employment is Still Strong: This is everyone’s favorite point to bring up. However, most people are not economists...because if they were they would know that employment is a lagging indicator. Often still looking good as things are going straight down the toilet.

That is where we stand now. But the more inflation stays in place...the more damage is being created...the more likely that job loss is what comes next and that leads to:

Lower income > lower spending > lower corporate profits > lower share prices.

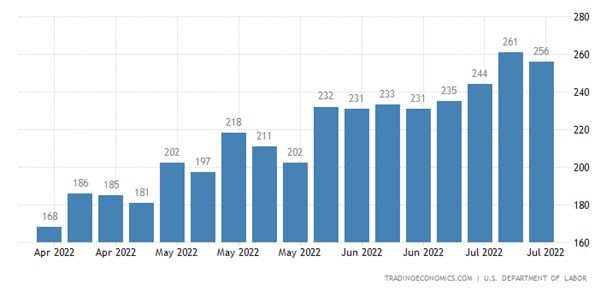

Note that weekly Jobless Claims is the most telling indicator of where monthly job gains and unemployment rate will be in the future and that is getting worse week by week as you will see in the chart below.

So I believe this is the next shoe to drop to put a sword in this faux bull rally leading back to return of the bear.

If job gains were so strong today, then it would seem to negate the recessionary premise. If true...then why did stocks head lower on Friday?

Whereas we may not CURRENTLY be in recession, then unfortunately the Fed will feel all the more emboldened to aggressively raise rates which increases the odds of economic damage down the road.

Meaning the odds of a recession in the future still looms large especially when you appreciate this cornucopia of hawkish comments made by Fed members and assembled by SeekingAlpha.com:

St. Louis' James Bullard: "I think that inflation has come in hotter than what I would have expected during the second quarter. Now that that has happened, I think we're going to have to go a little bit higher than what I said before."

San Francisco's Mary Daly: "[The Fed is] nowhere near almost done. We have made a good start and I feel really pleased with where we've gotten to at this point, [but] people are still struggling with the higher prices. My modal outlook, or the outlook I think is most likely, is really that we raise interest rates and then we hold them there for a while at whatever level we think is appropriate."

Chicago's Charles Evans: "If we don't see improvement before too long, we might have to rethink the path a little bit higher. We want to see if the real side effects are going to start coming back in line... or if we have a lot more ahead of us."

Cleveland's Loretta Mester: "We have more work to do because we have not seen that turn in inflation. It's got to be a sustained, several months of evidence that inflation has first peaked - we haven't even seen that yet - and that it's moving down."

Point being we are not technically in recession. BUT certainly still have a strong chance it could be on the way in the months ahead. Especially true with a Fed dead set on crushing inflation...which yes will likely dampen the economy including job loss.

And yes, dear friend, the Fed’s track record on creating recessions is higher than the odds of creating a soft landing. That is why it is hard to truly get behind the thesis that the new bull market is at hand.

Could there be more upside to recent stock price action?

Yes. That’s because stock prices swing from fear to greed. And at each extreme prices go too far. So very common to overshoot before prices come back to a more rational standpoint.

However, as I look out to the end of the year and into 2023 I still believe we have not seen the lows of this bear market. Just remember that the Covid bear market lasting just a few weeks is the extreme oddity. Much more common to be a 12-18 month endeavor with see-sawing price action before final capitulation bottom is found.

Very little about the June 2022 lows feels like that to me. However, am open to the possibility that this time is different and that a new bull market has begun. Crazier things have happened. But again, the odds are against that outcome with more pain on the way.

What To Do Next?

Right now there are 5 positions in my hand picked portfolio that will not only protect you from the bear market, but also lead to ample gains as stocks head lower.

This strategy perfectly fits the mission of my Reitmeister Total Return service. That being to provide positive returns…even in the face of a roaring bear market.

Yes, it’s easy to make money when the bull market is in full swing. Anyone can do that.

Unfortunately most investors do not know how to generate gains as the market heads lower.

So let me show you the way with 5 trades perfectly suited for today’s bear market conditions.

And then down the road we will take our profits on these positions and start bottom fishing for the best stocks to rally as the bull market makes it rightful return.

Come discover what my 40 years of investing experience can do you for you.

Plus get immediate access to my full portfolio of 5 timely trades that are primed to excel in this difficult market environment.

SPY shares closed at $413.47 on Friday, down $-0.70 (-0.17%). Year-to-date, SPY has declined -12.30%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks.

Recession or Not Recession…That Is the Question StockNews.com