One of investors' favorite REITs over the years has been Realty Income (O), but the stock has not been a friend of the bulls lately.

Often referred to as O stock for its symbol, it's fallen in seven of the past eight weeks. And in the one week in that stretch where it didn’t drop, it finished flat.

Currently down more than 5.5% so far this quarter, Realty Income is facing its fourth quarterly decline in the past five quarters.

Don't Miss: Apple Stock Gears Up for Major Breakout

If we hark back to March 2020 when covid-19 was surging worldwide and causing mass shutdowns, investors endlessly worried about physical retail locations and office spaces.

This caused a tremendous selloff in the REIT space, and Realty Income was swept up, seeing a peak-to-trough decline of 55%.

Despite the resurgence in the stock market and an eruption in real estate prices, Realty Income never went on to make new all-time highs.

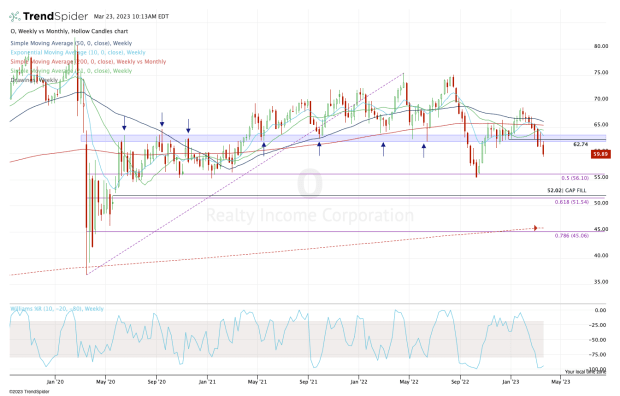

Let's look at the chart.

Is There an Opportunity in O Stock?

Chart courtesy of TrendSpider.com

Despite the relatively poor price action over the past few months and few years, Realty Income stock holds a number of positives.

First, the company pays a monthly dividend and has an annual yield of 5.1%. It has also raised its payout in 102 consecutive quarters — or more than 25 years straight. That alone makes this stock attractive for certain income-oriented investors.

Yet with the Federal Reserve continuing to raise interest rates and with investors wary of a recession, they have been selling O stock.

Don't Miss: Amazon Stock Is Teetering on a Breakout. Here's the Setup.

Should they continue to sell this name lower, I have three levels I’m watching closely.

The first is between $55 and $56. This was a big support level for several quarters after the initial covid-19 selloff. It’s also the 50% retracement from the 2022 high down to the 2020 low. Lastly, this zone contains the 2022 low.

So if we get a dip down to this area, it’s possible we get another bounce.

If the selling persists, we could have a test of the $51 to $52 area. Should we test this zone, it would be the lowest price Realty Income stock has traded at since May 2020. In this zone we have the 61.8% retracement and gap-fill level.

For long-term buyers, it would be hard to resist scooping up some shares in this zone.

Lastly, the 78.6% retracement and 200-month moving average currently sit near the $45 area, which stands out as another potential support zone.

Action Alerts PLUS offers expert portfolio guidance to help you make informed investing decisions. Sign up now.