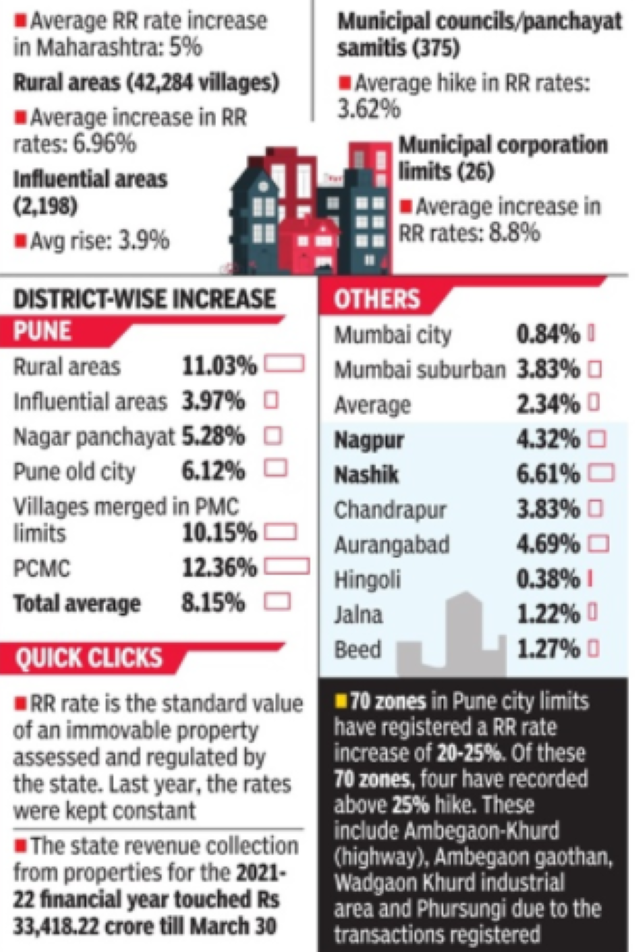

PUNE: The state government on Thursday announced new ready reckoner (RR) rates for the financial year 2022-23, with the increase for the 23 newly merged villages in the Pune civic limits pegged at 10.15%.

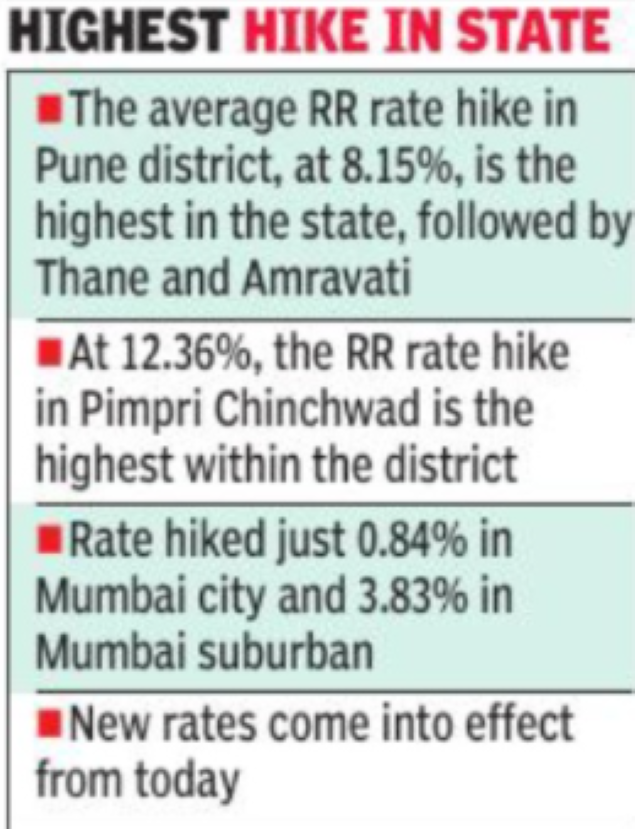

In comparison, the RR rate rise in the old parts of the city is 6.12%, which is just half of the 12.36% rise announced for areas in Pimpri Chinchwad — the highest increase in Pune district.

On an average, the RR rates will go up by 8.15% in the district, which is again the highest in the state, closely followed by Thane (7.67%) and Amravati (7.23%). The RR rate was last announced in 2020 and it was kept unchanged last year due to the Covid-19 pandemic.

Developers’ associations were taken aback by the RR rate hike, saying it comes at a time when the realty sector is struggling with an almost 40% hike in input material costs. They said the hike and the additional 1% metro cess on stamp duty will hit the sector badly. Even premiums, TDR and FSI rates will be increased now, they added.

The RR rates have gone up by 11.3% in the rural parts of the district while the influential zones registered a 3.9% rise, followed by the nagar parishad and panchayat areas (3.62%). In Mumbai city, the increase has been mere 0.84%. For the Mumbai suburban parts, the hike is 3.83% — averaging only a 2.34% increase, which is less than the state’s average increase of 5%. The new rates will come into effect from April 1.

Realtors shocked, say input material cost rising already

Developers’ bodies were taken aback by the “unexpected” increase in the RR rates on Thursday, which comes at a time when the realty sector is already struggling with almost 40% hike in input material costs.

Besides, the additional 1% metro cess on stamp duty and the increased RR rate in metros are definitely going to affect the sector in a big way. The industry is still recovering and in spite of increased traction, the selling rates haven’t increased so far. An increase in RR rates is totally uncalled for. Even the premiums, TDR, FSI rates will be increased now and that’s why it will further increase input costs and directly impact the buyer,” said president of Credai Pune Metro Anil Pharande.

All this might even lead to the temporary closure of work, he said. Credai vice-president Shantilal Kataria said the government had a record-breaking revenue collection during Covid period due to the sops like stamp duty reduction and stable ASR rates. “So, the authorities should have continued with the sops. Increase in RR rates will have a cascading effect and the common man will have to pay extra for owning dream home,” he said.

Dr Samantak Das, chief economist, and head-research and REIS, India, JLL,said the increase in RR rates has come at a time when the stamp duty waiver is over and the state has proposed a 1% metro cess. “The sharp rise in overall taxes is going to impact the homebuyer sentiments and residential sales. The impact of RR rates is expected to be higher in the case of the mid and affordable segments as the rate hikes have been higher for suburban municipal areas,” he said Homebuyers feel that they would have to doubly think about investing in properties.

Ramesh Prabhu, a consumers’ group representative, said the hike in RR rates, along with metro cess, in metros will impact property transactions and revenue. A homebuyer from Pune city, who was planning to invest in the Ambegaon area, said he would rather postpone the plan in view of the hike in RR rates. “The upfront amount will be too high and I have just got a new job, so loan amount sanctioned is too low,” he said.

The RR rate is the standard value of real estate property, regulated and assessed by the state government every year. Property buyers are expected to pay stamp duty or a registration fee not below the RR rates fixed by the state government or the actual price of the property whichever is higher. The state revenue collection from properties for the 2021-22 financial year touched Rs 33,418.22 crore till March 30.