The chancellor has insisted Donald Trump's administration is keen to do a trade deal with the UK, suggesting the UK could achieve a carve out from the US president's sweeping global tariffs.

Rachel Reeves has headed to Washington for a major economic summit before she holds crucial trade talks with her US counterpart amid economic uncertainty.

At a Q&A during Semafor’s World Economic Summit, Ms Reeves said: “What we hear from the US administration is that they are keen to do a deal with the UK, reflecting the closeness of that relationship.”

She also suggested that she would look to go beyond a deal on tariffs, including a “technology partnership” and “building on the close relationship we have on security and national defence”.

The chancellor said: “This isn’t just about damage limitation, it’s also about what the next step is.”

The chancellor will have her first face-to-face meeting with US Treasury secretary Scott Bessent in an attempt to strike a trade deal with the Trump administration.

Her trip comes after the IMF slashed the UK’s economic growth forecast, warning that the fallout from Mr Trump’s trade war will hit Britain harder than the rest of Europe.

Key Points

- Reeves insists Trump is 'keen to do a deal with the UK'

- Why is Rachel Reeves in the US, and what is on the agenda?

- Economists warn Reeves may need to raise taxes in Autumn budget

- Reeves under pressure to secure Trump trade deal amid tax hike fears

- UK borrowing overshoots forecasts by £14.6bn

US 'respect' UK will not reduce agricultural standards

18:43 , Athena StavrouThe US administration “respect and understand” that the UK will not reduce agricultural standards as part of a trade deal, the Chancellor has said.

Rachel Reeves told BBC News: “We’ve been really clear since the beginning of our discussions with our US counterparts that we’re not going to be reducing agricultural standards in the UK, and the US administration respect and understand that.

“We have high standards to support British farming and support British consumers, and we’re not going to be relaxing those standards.”

US 'keen to do a deal' - Reeves reiterates

18:42 , Athena StavrouThe Chancellor has insisted the US is “keen to do a deal with the UK” ahead of talks with her American counterpart in Washington.

US vice-president JD Vance suggested earlier in April that there was a “good chance” of a UK-US deal, but US officials have suggested there is little scope for any country securing tariffs of less than 10%, saying Mr Trump regards that figure as a “baseline”.

Asked whether reducing US tariffs below 10% was a realistic aim, Ms Reeves told ITV News: “Let’s see where we get to. Those discussions are ongoing. They’re going well.”

But she declined to put a timetable on when an agreement might be reached, saying: “We’re not going to rush into a deal.”

Analysis | Rachel Reeves is besieged on all sides and needs a dramatic intervention to save UK economy

17:59 , Athena StavrouWhen Rachel Reeves turns up at the International Monetary Fund (IMF) today she already knows that she needs a near miracle to turn things around, our political editor David Maddox writes.

For a woman whose mantra during and after the election was “growth! growth! growth!” the news could not be worse for the chancellor, he says.

Read the full analysis below:

Reeves is besieged on all sides and needs a dramatic intervention to save the economy

Bank of England governor to speak in Washington

17:51 , Athena StavrouBank of England Governor Andrew Bailey is due to speak in Washington DC shortly.

Mr Bailey will be in conversation with Tim Adams at the Institute of International Finance at 6:15pm.

He will be followed by deputy BoE governor Sarah Breeden appearing on IMF and World Bank panel meetings.

What could a UK-US trade deal look like?

17:29 , David MaddoxSir Keir Starmer’s government has made no pretence over the fact that it is not looking for a traditional comprehensive trade deal.

Instead, it is pushing for an agreement based around the growth of “future” industries, such as biotech, new pharmaceuticals and artificial intelligence.

The proposal is that the UK and US research base, coupled with the money markets in New York and London, would create a powerhouse for the latest industrial revolution, which could shape the future of the world.

The US largely embraces this idea, but there are caveats, and the negotiations have been complicated by President Trump’s tariffs.

While a final deal would see close integration for those future growth industries, it now would also mean deals on more traditional areas to remove tariffs altogether.

The biggest issue – as is often the case – will be how far it affects agricultural products. Mr Trump’s team would like the UK to allow chlorinated chicken or beef with added hormones. But the UK does not want to go this far.

In the end, the quick deal will be closer to the UK vision on future growth technologies, but the ongoing question is how much Sir Keir will have to compromise in other areas.

What does the UK trade with the US?

16:58 , Jabed AhmedThe US continues to be Britain’s largest single-country trading partner, followed by Germany, the Netherlands, Ireland and France. As a bloc, trade with the EU is significantly higher.

The UK has nearly no trade imbalance with the US when it comes to goods, exporting £59.3bn and importing £57.2bn in 2024.

This has likely contributed to the fact that Britain has not been in Mr Trump’s firing range when it comes to extra tariffs – and why a trade deal is on the cards.

Currently, the UK is facing a 10 per cent tariff on all goods exported to the US.

British automotive and steel exports are taking a stronger blow, with a separate 25 per cent levy on sales to the US market.

Cars are Britain’s single largest export to the US, valued at £8.3bn in the year up to November 2024.

The US is also the top buyer of domestic cars, from Aston Martin to Mini; though British brand Jaguar Land Rover (JLR) is the most at risk from tariffs, with the US being its top sales market.

This has been a point of tension between Sir Keir and Mr Trump, as negotiations to exempt the UK from these industry-specific tariffs have so far fallen short.

Reeves says ‘that ship has sailed’ on Brexit but pledges closer ties with EU to tackle tariff impact

16:18 , Millie Cooke, Political CorrespondentRachel Reeves has said the “ship has sailed” when it comes to Brexit, but promised to “deepen and strengthen” the UK’s ties with the EU in order to support businesses in the face of sweeping global tariffs.

Speaking about the UK’s relationship with the EU in the context of Donald Trump’s global tariffs, the chancellor said: “It will be nine years ago, this June that the British people voted to leave. And you know that ship has sailed - we're outside the Customs Union, the single market.

“But we want to deepen and strengthen our trade relationships, also our defence and security relationships with our European colleagues.

“And that's why we've got a summit between our countries on May 19 to really remove some of those barriers that are making it difficult for businesses.”

UK offers financial stability, Reeves says

16:17 , Jabed AhmedRachel Reeves has said the UK is open for business and open for trade amid economic uncertainty.

Speaking at a Q&A in Washington, she said: “The message I’m coming to Washington this week is... Britain is open for business, open for trade, open for investment, and we are changing the way our economy works to really attract the brightest and the best and fast-growing businesses.”

“What the UK is able to offer is political, financial, economic stability in a world that is very volatile at the moment,” the chancellor added.

Rachel Reeves is sticking firmly to the script

16:14 , David MaddoxThe chancellor is coming under intense questioning for her Q&A at the World Economy Summit in Washington DC but she is not showing much to her American audience.

Ms Reeves seems to be keener on avoiding any confrontation with the US administration and instead is continuing to focus on the balanced trade between the two countries.

There is no sense of urgency for the trade talks despite the sword of Damocles hanging over the UK economy as a result of potential tariffs from Trump.

There is the usual sales pitch for investing and doing business in the UK to her US audience but not much in terms of how she may try to turn a stagnating economy around beyond her already published plans to loosen up the planning system.

Meanwhile, Ms Reeves refuses to answer the question of what unnecessary trade barriers she wants to remove between the UK and US.

This is not going to get her into further trouble but at the same time it is not going to help herself out either.

Reeves insists Trump is 'keen to do a deal with the UK'

16:11 , Jabed AhmedThe chancellor has insisted that Donald Trump's administration is keen to do a trade deal with the UK, suggesting the UK could achieve a carve out from the US president's sweeping global tariffs.

Appearing at Semafor’s World Economic Summit in Washington, Rachel Reeves said: “What we hear from the US administration is that they are keen to do a deal with the UK, reflecting the closeness of that relationship.”

She also suggested that she would look to go beyond a deal on tariffs, including a “technology partnership” and “building on the close relationship we have on security and national defence”.

The chancellor said: “This isn’t just about damage limitation, it’s also about what the next step is.”

Adding that she would like to see a reduction in tariffs and non-tariff barriers on both sides of the Atlantic, Ms Reeves said: “I think that can be a bilateral process between our two countries to remove those remaining trade barriers that do exist, and if we work on that basis there is a deal to be done that will benefit industry both in the UK and the US and jobs in our countries as well.”

Watch live: Rachel Reeves gives major speech on UK economy at International Monetary Fund in Washington DC

16:06 , Jabed Ahmed

Watch live: Reeves gives major speech on UK economy in Washington DC

Rachel Reeves gives major speech on UK economy at IMF in Washington as pressure mounts

16:05 , Jabed AhmedRachel Reeves has begun a speech on the sidelines of the the International Monetary Fund’s (IMF) spring meetings.

We will bring you the latest lines.

EU says it prefers negotiated solution on trade with US

15:57 , Jabed AhmedThe European Union's first preference is to reach a negotiated solution with the United States over trade, but if discussions with the US do not lead to a solution, the EU will respond with countermeasures, the European Union Commissioner for the Economy has said.

Speaking at an IMF and World Bank meeting, Valdis Dombrovskis said that the EU had already offered to buy more US LNG and to reduce tariffs on certain goods, and added that the EU would welcome more clarity from the US about its expectations.

He added the EU is not giving up on its trade relationship with the United States but will also seal new partnerships across the world to strengthen its economic security at home

Comment | ‘Security’ is a sound enough slogan – but can Labour deliver it?

15:29 , Jabed AhmedRead the full Voices article from Andrew Grice:

‘Security’ is a sound enough slogan – but can Labour deliver it?

US Treasury's Bessent calls on IMF and World Bank to refocus on core missions

15:17 , Jabed AhmedUS Treasury Secretary Scott Bessent has called on the International Monetary Fund and World Bank to refocus on their core missions of macroeconomic stability and development, arguing that they have strayed too far into vanity projects such as climate change that have reduced their effectiveness.

Me Bessent, in remarks outlining his vision for US engagement with the IMF and World Bank on the sidelines of the institutions' spring meetings, said that they serve critical roles in the international financial system.

"And the Trump administration is eager to work with them - so long as they can stay true to their missions," Mr Bessent said.

"The IMF and World Bank have enduring value. But mission creep has knocked these institutions off course. We must enact key reforms to ensure the Bretton Woods institutions are serving their stakeholders - not the other way around," he said, calling on U.S. allies to join the effort. "America First does not mean America alone."

Why is Rachel Reeves in the US, and what is on the agenda?

14:58 , Jabed AhmedRachel Reeves will spend three days in Washington for the International Monetary Fund’s (IMF) spring meetings, which bring together finance ministers and business leaders from across the G7 and G20.

While she champions Britain as a destination for investment, Ms Reeves will also hold her first face-to-face meeting with American counterpart Scott Bessant for talks on an economic deal between the US and UK.

Securing such a deal with the US acquired a new sense of urgency earlier this month when Mr Trump announced the sweeping tariffs on imports from the rest of the world.

As well as seeking to make progress on a US deal, Ms Reeves is also expected to discuss improving trading relations with other nations – something she has previously said the government is keen to do.

IMF says tariff pressures to push global public debt past pandemic levels

14:50 , Jabed AhmedEconomic pressures from steep new US tariffs will push global public debt above pandemic-era levels to nearly 100 per cent of global GDP by the end of the decade as slower growth and trade strain government budgets, the International Monetary Fund has said.

The IMF's latest Fiscal Monitor projected that global public debt will grow 2.8 percentage points to 95.1 per cent of global GDP in 2025. It said the upward trend was likely to continue, reaching 99.6 per cent of global GDP by 2030.

Global public debt peaked in 2020 at 98.9 per cent of GDP as governments borrowed heavily for COVID-19 relief and output shrank. Debt fell 10 percentage points within two years.

"Major tariff announcements by the United States, countermeasures by other countries, and exceptionally high levels of policy uncertainty, are contributing to worsening prospects and heightened risks," the IMF said in the report.

It added that this leaves governments with more difficult trade-offs as their budgets are stretched by higher defense spending needs, demands for more social support and rising debt service costs that could grow with more inflationary pressures.

How the UK's growth forecast compares to countries across the world

14:30 , Jabed AhmedGlobal growth is projected to fall from 3.3% in 2024 to 2.8% in 2025, before edging up to 3% in 2026.

This is lower than the IMF’s previous forecasts, published in January, by 0.5 percentage points for 2025 and 0.3 percentage points for 2026.

The outlook for nearly all countries has been downgraded, reflecting the direct effect of new trade measures and the knock-on impact on uncertainty, which has surged to “unprecedented” levels, and deteriorating sentiment among consumers and businesses.

Growth will nonetheless be stronger in the UK than Germany – which is predicted to flatline this year – France, and Italy.

Are MPs being denied a meaningful vote on a Trump deal?

13:59 , David MaddoxKeir Starmer was pressed in PMQs today on whether MPs would get a vote on a trade deal with Donald Trump.

Given the consequences of such a deal on issues like food standards, privacy issues, data and jobs the question by Lib Dem leader Sir Ed Davey should have been a direct “yes!”

But Sir Keir was in a non-committal mood as he often is with his response to Sir Ed.

Keir Starmer has failed to commit to a vote in Parliament on any Trump trade deal, after being asked by Liberal Democrat Leader Ed Davey at PMQs today.

Starmer simply said the government is making progress and there would be a “process if a deal is reached.”

Sir Ed responded: “It is really worrying that Keir Starmer wouldn't commit to a vote in Parliament on a Trump trade deal. If the government really thinks this will be a good deal for Britain, what are they so afraid of?

“British farmers, online safety rules for children and tax cuts for tech barons are all apparently being used as bargaining chips in these negotiations. It would be an affront to democracy if MPs are bypassed and the government rams through a deal with Trump without proper scrutiny.”

Comment | It’ll take a miracle for the economy to grow under Rachel Reeves

13:41 , Jabed AhmedRead the full voices article from Sean O’Grady here:

It’ll take a miracle for the economy to grow under Rachel Reeves

'Pip should not cause an increase in poverty' says former shadow minister

13:25 , Rebecca WhittakerA Labour former shadow minister said the Government’s proposed changes to personal independence payments (Pip) should not cause an increase in poverty.

Andy McDonald, who held an employment rights brief in opposition, asked the Prime Minister if MPs will see new Office for Budget Responsibility (OBR) analysis on the changes.

He said: “After 14 years of Conservative government too many of my Middlesbrough and Thornaby East constituents are on low incomes or in real poverty. I very much welcome the employment support proposals in the welfare Green Paper, but the Government has to be clear about the real opportunities it’s offering more than three million families who it says will lose out financially as a result of this package.

“So before asking MPs to vote, can he confirm that we will see fresh OBR analysis, evidence on who will be affected by the Pip changes, and the Government’s own assessment of the employment impact of its measures, and will he confirm that this policy will not result in increased experience of poverty?”

Sir Keir Starmer said the Government had introduced £1 billion of tailored employment support and more money for those with lifelong disabilities who are unable to work. He said working halves people’s risk of poverty.

Sir Keir said: “We are reforming a broken system, the system we inherited, and I think most people accept that it needs reform because it traps people in unemployment and inactivity, and we need to reform it for that reason. The principles will be that we will provide support where support is needed.”

Analysis | Rachel Reeves is besieged on all sides and needs a dramatic intervention to save UK economy

12:47 , Jabed AhmedWhen Rachel Reeves turns up at the International Monetary Fund (IMF) today she already knows that she needs a near miracle to turn things around, our political editor David Maddox writes.

For a woman whose mantra during and after the election was “growth! growth! growth!” the news could not be worse for the chancellor, he says.

Read the full analysis below:

Reeves is besieged on all sides and needs a dramatic intervention to save the economy

Analysis | Labour MPs beginning to speak out on welfare cuts

12:43 , David Maddox, Political EditorScarborough and Whitby MP Alison Hume’s attack on her party’s government over welfare cuts is a bad sign for Keir Starmer.

It shows that Labour MPs are becoming more comfortable with attacking the party leadership over harsh measures to try and balance the books on the economy.

Ms Hume wanted to make sure that people with learning disabilities will not lose out from cuts to disability payments. The truth is they almost certainly will.

It is an early sign that the current economic policy is causing political problems for Sir Keir and his beleaguered chancellor Rachel Reeves who may soon be looking for more welfare cuts.

Starmer challenged over wanting China as a business partner

12:34 , David Maddox, Political EditorOne of the problems facing Sir Keir Starmer and his government is how to treat China.

Is it a hostile state or a country Britain can do business with? Or both?

Tory MP Dr Neil Shastri-Hurst was pretty clear that China is a hostile state as well as a human rights abuser.

His challenge to Starmer in PMQs over “treating China as a business partner” reflects an increasing unease over the way Labour is trying to appease Beijing.

Sir Keir fairly points out that the delicate balance his government is trying to achieve is the same as the previous Tory government.

However, this is going to be an increasingly difficult economic issue going forward.

UK stocks rise after Trump backtracks on remarks over Fed

12:32 , Jabed AhmedUK shares climbed on Wednesday, led by the gains in chemical companies and metal mining firms, while markets also found relief in U.S. President Donald Trump's reversal of his threats to fire Federal Reserve Chair Jerome Powell.

As of 10.45am the blue-chip FTSE 100 index (FTSE) was up 1.3 per cent, and the midcap index (FTMC) gained 1.2 per cent.

The chemicals index (FTNMX552010) led the gains with Croda International jumping 10.7 per cent after the company reported 8 per cent growth in first quarter group sales. Croda also topped the FTSE 100 index.

BP climbed 5 per cent after activist investor Elliott increased its stake in the oil major to just over 5 per cent. An index of UK's energy companies (FTNMX601010) rose 3.6 per cent after oil prices climbed more than 1 per cent on a fresh round of US sanctions on Iran and a drop in U.S. crude stocks.

Industrial metal miners (FTNMX551020) were also up 4.5 per cent in the day as copper prices in London hit a near three-week high.

Babcock rose 2 per cent after the engineering firm said it expects fiscal 2025 operating profit to jump 17 per cent.

AJ Bell: ‘The sums have changed’ as borrowing hits new highs

12:19 , Jabed AhmedDanni Hewson, head of financial analysis at AJ Bell, said the government’s fiscal picture has worsened significantly since last month’s Spring Statement.

“Markets have wobbled, trade tensions have risen, and global growth forecasts have been cut,” she said. “Looking back, the government borrowed far more than the OBR expected in March.”

March borrowing was the third highest for that month since records began, with rising inflation, public sector pay, and benefit costs driving spending. Debt interest payments hit £4.3 billion — the highest March figure on record.

Although tax revenues rose by £2.5 billion year-on-year, it wasn’t enough to close the gap.

With the Chancellor in Washington seeking a tariff deal, Ms Hewson said the headroom created in March now “seems rather insubstantial” ahead of the autumn.

Jennie the guide dog unimpressed with Starmer on economy

12:16 , David Maddox, Political EditorPMQs opened off with Lib Dem MP Steve Darling going for the big issue of the economy even though the Tories are more interested in fighting the culture wars on the trans issue.

But Mr Darling made the point which many businesses around the country are complaining about the national insurance hike by Rachel Reeves.

The tax rise is literally killing jobs and holding back the economy but Sir Keir was not keen to take up Darling’s invitation to visit a local zoo to see the effects of the NIC hike.

Sir Keir attempted to avoid addressing the issue by saying happy birthday to Mr Darling’s guide dog Jennie. Unfortunately, for him Jennie looked distinctly unimpressed by his good wishes or defence of economic policy.

While Sir Keir obfuscated his chancellor will have less room to do that in Washington today at the IMF.

Live: Starmer faces PMQs as Reeves heads to Washington for crucial Trump trade talks

11:57 , Jabed AhmedEconomists warn Reeves may need to raise taxes in Autumn budget

11:48 , Jabed AhmedRuth Gregory, deputy chief UK economist at Capital Economics, said the latest government borrowing figures "even before the influence from the tariff chaos is felt" raised the chances of "more tax hikes".

"Reeves may not be too far away from having to raise money again in the Autumn Budget, by cutting spending and/or raising taxes, to meet her fiscal rules," she added.

Elliott Jordan-Doak, senior economist for Pantheon Macroeconomics, agreed that “fracturing global trade and geopolitical uncertainties are going to make the Chancellor’s life even more difficult”.

Mr Trump’s sweeping tariffs on US imports are expected to impact UK economic growth, “which will further weigh on the public finances”, he warned.

“The public finances were already in a difficult position heading into the trade war, and we think both taxes and borrowing will need to be raised in the October budget,” he added.

‘Fiscal challenge’ deepens as borrowing surpasses forecasts, says think tank

11:42 , Jabed AhmedThe Resolution Foundation has warned of growing pressure on the UK’s public finances following today’s release of government borrowing data.

James Smith, research director at the Foundation, said the figures “lay bare the public sector finances challenge facing the Government” and come amid rising global economic uncertainty.

“The UK is already borrowing far more than the OBR forecast just last month, before the new financial year has even begun,” Mr Smith said.

He added that the outlook for growth, interest rates and inflation is shifting, with global instability likely to weigh further on the UK’s fiscal position: “Britain’s borrowing prospects could look very different by the time of the Autumn Budget.”

Sterling shrugs off weaker UK business activity

11:17 , Jabed AhmedSterling recovered from early losses against the dollar on Wednesday, brushing off data showing UK business activity weakened by the most in more than two years due to global trade tensions.

The pound was flat on the dollar at $1.3337, and was also little changed against the euro at 85.71 pence to the common currency.

Early in the day, Sterling dropped as much as 0.7 per cent against the dollar, which strengthened after US president Donald Trump backed away from threats to fire Federal Reserve Chair Jerome Powell and expressed optimism over a trade deal with China.

But market sentiment towards US assets remains fragile and the knee-jerk response was shortlived.

Reeves meeting her own fiscal rules 'by a hair's breadth', IFS says

10:57 , Jabed AhmedThe Institute for Fiscal Studies (IFS) has raised concerns over the UK’s public finances.

Nick Ridpath, a research economist at the IFS, said government borrowing for the last financial year came in above expectations — exceeding even the forecasts made in the Spring Statement last month.

He said: “This serves to highlight the uncertainty surrounding these – or indeed any – fiscal forecasts. The Chancellor’s fiscal rules, which apply to forecast borrowing in 2029–30, are only being met by a hair’s breadth. Today’s data highlight the clear risk that is being taken with that strategy.”

Borrowing to fall to £117.7bn by March 2026, economists predict

10:24 , Holly EvansThe OBR forecasts UK Government borrowing will fall to £117.7 billion for the year to March 2026, according to projections published last month.

Philip Shaw, an economist for Investec Economics, said measures including hiking employer national insurance contributions are likely to “boost tax inflows” in the year ahead.

“It remains to be seen whether this forecast will be achieved, especially given the size of the overshoot in 2024-25 and that uncertainty over tariffs poses a major downside risk to the global economy this year,” he said.

Economist says private sector activity reflects higher staffing costs and global trade concern

09:54 , Holly EvansChris Williamson, chief business economist at S&P Global Market Intelligence said a survey indicating falling private sector activity in the UK “reflects the impact of headwinds from both home and abroad”.

He said: “The biggest concern lies in a slump in exports amid weakened global demand and rising global trade worries, but higher staffing costs have also piled pressure on companies – linked to the national insurance and minimum wage changes that came into effect at the start of the month.

“Just as export orders are falling at the sharpest rate since May 2020, during the pandemic lockdowns, firms’ costs spiked higher to a degree not seen for over two years.

“The collapse in confidence and drop in output during April raise red flags as to the near-term economic outlook and add pressure on the Bank of England to reduce interest rates again at its May meeting.”

Breaking: UK company activity weakens by most in more than 2 years as US trade war rages, PMI shows

09:47 , Jabed AhmedActivity across the UK’s private sector has plunged to a more than two-year low as Donald Trump’s trade tariffs hammered exporters, according to new data.

The S&P Global flash UK composite purchasing managers’ index (PMI) reported a reading of 48.2 in April, a 29-month low and down from 51.5 in March.

The flash figures are based on preliminary data. Any score above 50.0 indicates that activity is growing while any score below means it is contracting.

The latest reading was weaker than expected, with a consensus of analysts having predicted a reading of 50.5 for the month.

How the UK's growth forecast compares to countries across the world

09:46 , Jabed AhmedGlobal growth is projected to fall from 3.3% in 2024 to 2.8% in 2025, before edging up to 3% in 2026.

This is lower than the IMF’s previous forecasts, published in January, by 0.5 percentage points for 2025 and 0.3 percentage points for 2026.

The outlook for nearly all countries has been downgraded, reflecting the direct effect of new trade measures and the knock-on impact on uncertainty, which has surged to “unprecedented” levels, and deteriorating sentiment among consumers and businesses.

Growth will nonetheless be stronger in the UK than Germany – which is predicted to flatline this year – France, and Italy.

Recap | The IMF downgrades UK's economic forecast ahead of Reeves' Washington visit

09:32 , Jabed AhmedOn Tuesday, The International Monetary Fund (IMF) lowered its growth outlook for the UK by 0.5 percentage points this year, and cut the US’s growth projections by 0.9 percentage points.

The UK’s downgrade partly reflected tariffs, but also weaker consumption amid higher inflation which bills and energy price hikes have driven.

Reacting to the revised IMF figures, chancellor Rachel Reeves said: “The world has changed and we are in a new era of global trade.

“I am in no doubt that the imposition of tariffs will have a profound impact on the global economy and the economy at home.”

But she said that the Government should not be “knocked off course or to take rash action” and vowed to “always act to defend British interests”.

Analysis | Gloomy economic forecast piles pressure on Reeves to secure trade deal with Trump

09:19 , Jabed AhmedOur Whitehall Editor Kate Devlin reports:

Gloomy economic forecast piles pressure on Reeves to get US trade deal

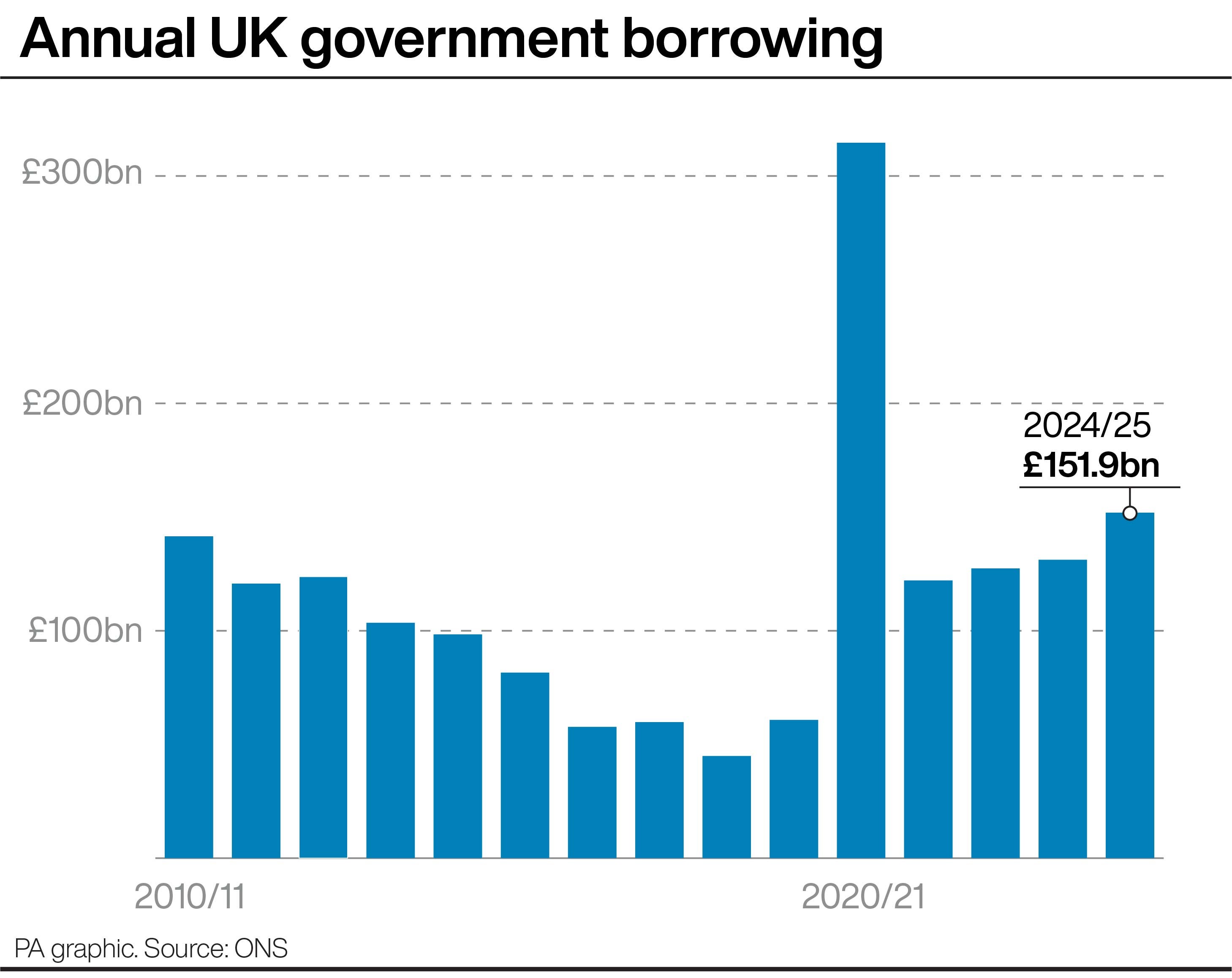

Charted | UK government borrowing over the years

09:02 , Jabed Ahmed

Shadow chancellor says British people are paying the price of Reeves borrowing

08:40 , Holly EvansShadow chancellor and Conservative MP Mel Stride said the latest ONS figures “lay bare the price the British people are paying for Rachel Reeves’ choices”.

“By fiddling the fiscal rules, increasing borrowing by £30 billion a year and piling up debt – these figures are alarming but not surprising,” he said.

The self-imposed fiscal rules limit the Government’s ability to borrow to fund day-to-day spending.

This morning’s figures lay bare the price the British people are paying for Rachel Reeves' choices.

— Mel Stride (@MelJStride) April 23, 2025

By fiddling the fiscal rules, increasing borrowing by £30 billion a year and piling up debt - these figures are alarming but not surprising.

These eyewatering sums are being… https://t.co/iERemwtZW5

Reeves says we are 'in a new era of global trade' ahead of Washington visit

08:34 , Holly EvansThe International Monetary Fund (IMF) on Tuesday lowered its growth outlook for the UK by 0.5 percentage points this year, and cut the US’s growth projections by 0.9 percentage points.

The UK’s downgrade partly reflected tariffs, but also weaker consumption amid higher inflation which has been driven by bills and energy price hikes.

Chancellor Rachel Reeves, who is spending three days in the US capital Washington DC for the IMF’s spring meetings, said: “The world has changed and we are in a new era of global trade.

“I am in no doubt that the imposition of tariffs will have a profound impact on the global economy and the economy at home.”

But she said that the Government should not be “knocked off course or to take rash action” and vowed to “always act to defend British interests”.

The Independent View | Rachel Reeves goes to Washington – and will need nerves of steel

08:24 , Holly EvansRachel Reeves will visit Washington DC in the next few days. Formally, the chancellor is attending the International Monetary Fund’s spring meeting of finance ministers. Informally, she will also be meeting representatives of Donald Trump’s administration to discuss the US-UK trade deal that sometimes appears, like a mirage, in the near future.

Any negotiation with the Trump administration is a fraught affair, because however normal the discussions seem at the level of officials or ministers, they are liable to be upended by the whims of the president and vice-president.

In the past few days alone Mr Trump and JD Vance have said contradictory things about how much the president loves the United Kingdom and is hopeful of a deal, while Mr Trump has suggested that the 10 per cent minimum tariff is permanent, and Mr Vance has signalled that any deal would depend on the UK lifting some largely imagined restrictions on free speech.

Read the full editorial below:

Rachel Reeves goes to Washington – and will need nerves of steel

Borrowing figure third-highest since records began in 1947

08:14 , Holly EvansThe UK Government borrowed more than expected for the latest financial year, with the ONS saying it was the third-highest level of borrowing in any financial year since records began in 1947.

It is only third behind the Covid pandemic in the year to 2021, and the 2010 financial year following the global crisis.

The borrowing figure refers to the difference between what the Government spends on the public sector and what it receives in income from tax and other receipts.

Grant Fitzner, the ONS’s chief economist, said: “Our initial estimates suggest public sector borrowing rose almost £21 billion in the financial year just ended as, despite a substantial boost in income, expenditure rose by more, largely due to inflation-related costs, including higher pay and benefit increases.

“At the end of the financial year, debt remained close to the annual value of the output of the economy, at levels last seen in the early 1960s.”

It’s official – Donald Trump is bad for the world economy

08:03 , Holly EvansThough covered by a thin veneer of nuanced “econospeak”, the message of the International Monetary Fund (IMF) could not be clearer: Donald Trump is bad for the world economy and will make America poorer, not wealthier – now, tomorrow and far into the future.

The assessment of the IMF’s economists – who are listened to intently by investors, even if not President Trump – is damning. The downgrade in the growth forecasts for the United States this year alone amounts to almost 1 per cent of GDP – a loss of some $200bn, of which about half is a direct result of the tariffs announced on and after the ironically named “Liberation Day” on 2 April.

Mr Trump was at least wise to postpone his foolish initiative by one day.

Read the full analysis here:

Analysis: Grim backdrop for Reeves heightens importance of US visit

07:47 , Archie MitchellRachel Reeves has been handed a fresh blow arriving in Washington, with government borrowing figures coming in higher than expected last year.

The chancellor is grappling with stubbornly high inflation, stagnant economic growth and now a debt pile growing more quickly than anticipated. It is a grim backdrop for her US trip.

The triple threats heighten the importance of Ms Reeves’ first face to face talks with her American counterpart Scott Bessent, with negotiations ongoing behind the scenes over a UK-US trade deal.

The pair will meet on Wednesday and Friday in the US capital, with Ms Reeves hoping to secure a carve-out for Britain from Donald Trump’s damaging tariffs.

With her autumn Budget looming, the stakes could not be higher. Her time as chancellor has so far been defined by one so-called “difficult decision” after another.

The fiscal wiggle room she left herself in March is all but certain to have been blown apart by Mr Trump’s trade war. She urgently needs a US deal to boost confidence and get the economy roaring if she is to have any hope of avoiding further politically painful tax hikes or spending cuts later this year.

Treasury says they are 'laser-focused' on economic stability

07:30 , Holly EvansChief Secretary to the Treasury, Darren Jones, said: “Economic stability is crucial within a changing world.

“We will never play fast and loose with the public finances, that’s why our fiscal rules are non-negotiable and why we are going through every penny of taxpayer money spent, line by line, for the first time in 17 years to tear out waste.

“We are laser-focused on making sure taxpayer money is delivering our Plan for Change missions to put more money in people’s pockets, rebuild the NHS and strengthen our borders.”

How likely is a deal with the US?

07:28 , Athena StavrouVice-president JD Vance last week raised hopes that a deal is close, saying the US is “working very hard” to secure a “great” agreement with the UK.

But, ahead of Rachel Reeves’ trip, her hopes of securing an exemption slimmed, with Donald Trump’s senior economic adviser Kevin Hassett suggesting the 10 per cent is a “baseline” which would require an “extraordinary deal” for the president to go below.

Mr Trump himself has said he is in “no rush” to negotiate exceptions to the tariff regime due to the revenues he claimed the charges were generating.

UK officials are now pinning their hopes on securing an exemption from the more severe levies on metals and cars.

UK borrowing overshoots forecasts by £14.6bn

07:20 , Holly EvansUK Government borrowing rose to £151.9 billion in the year to the end of March, overshooting official forecasts by £14.6 billion, according to official figures.

The Office for National Statistics (ONS) said public sector net borrowing was higher than the £137.3 billion forecast by the Office for Budget Responsibility.

The yearly figure was also £20.7 billion more than the same period a year earlier.

It comes as borrowing rose to £16.4 billion last month, the third-highest March borrowing since monthly records began, the new figures show.

It’ll take a miracle for the economy to grow under Rachel Reeves

07:08 , Holly EvansWell, Rachel Reeves, whatever happened to growth? The latest economic outlook from the International Monetary Fund (IMF) suggests it remains elusive, to say the least.

Not so very long ago, growth was presented almost as a panacea for Britain’s central economic problem – an economy with low investment and consequently disappointing productivity that stubbornly refused to expand in line with the needs and expectations of the nation. Stagnant wages, declining public services, derelict high streets… a pervasive sense of malaise summed up in the dread phrase “Britain is broken”.

Solve the growth conundrum, it seemed, and Labour could confidently look forward to the “decade of renewal” – and power – promised so often by Keir Starmer.

Read the full analysis from Sean O’Grady here:

It’ll take a miracle for the economy to grow under Rachel Reeves

UK economic growth forecast slashed ahead of crucial talks

06:55 , Athena StavrouRachel Reeves’ trip comes after the International Monetary Fund (IMF) slashed the UK’s economic growth forecast, with a warning that the fallout from Donald Trump’s trade war will hit Britain harder than the rest of Europe.

The global economic organisation predicts growth will stall by 0.5 per cent in 2025, with a further downgrade of 0.1 per cent in 2026. It means the UK economy will grow by just 1.1 per cent next year, and 1.4 per cent the year after.

Rising government borrowing costs as a result of Trump’s tariffs as well as higher inflation and sky-high energy costs in the wake of Russia’s invasion of Ukraine are all to blame, the IMF said.

Chancellor pledges to 'defend Britain’s interests' ahead of Washington meeting

06:28 , Athena StavrouRachel Reeves has pledged to “defend Britain’s interests” as she prepares to meet fellow finance ministers in Washington and push for a US trade deal.

Ahead of her visit, Ms Reeves said: “The world has changed and we are in a new era of global trade. I am in no doubt that the imposition of tariffs will have a profound impact on the global economy and the economy at home.

“This changing world is unsettling for families who are worried about the cost of living and businesses concerned about what tariffs will means for them. But our task as a Government is not to be knocked off course or to take rash action which risks undermining people’s security.

“Instead, we must rise to meet the moment and I will always act to defend British interests as part of our plan for change.

“We need a world economy that provides stability and fairness for businesses wanting to invest, and trade, more trade and global partnerships between nations with shared interests, and security for working people who want to get on with their lives.”

Chancellor under pressure to secure Trump trade deal amid tax hike fears

06:01 , Athena StavrouRachel Reeves is preparing for crucial talks with her US counterpart as she pushes to secure a trade deal amid economic uncertainty.

The chancellor will have her first face-to-face meeting Scott Bessant as she spends three days in Washington DC for the International Monetary Fund (IMF)’s spring meetings.

Her trip comes after the IMF slashed the UK’s economic growth forecast, with a warning that the fallout from Donald Trump’s trade war will hit Britain harder than the rest of Europe.

The downgrade threatens to wipe out the fiscal headroom she had clawed back with benefits cuts in her spring statement - meaning she will likely have to make further cuts or hike taxes when she delivers her second Budget this autumn.