Procter & Gamble (PG) shares are up about 4% at last check after the consumer-products giant's earnings report.

Earnings per share climbed 3% year over year and topped analysts’ expectations. Revenue also topped consensus expectations, growing 3.7%.

Management reiterated its full-year outlook for core earnings growth, while giving a slight boost to its organic-sales-growth estimates.

Don't Miss: Can Amazon Stock Break Out Ahead of Its Earnings Report?

From a technical perspective, two observations arise from today’s post-earnings rally.

First, it reemphasizes our recent observation that funds are flowing into defensive stocks. Names like PepsiCo (PEP) and Coca-Cola (KO) have been trading quite well. Walmart (WMT) has also been performing nicely for the bulls. P&G has been on that list, too.

Second, today’s rally looks as if it will be enough to trigger a larger breakout.

Trading Procter & Gamble Stock

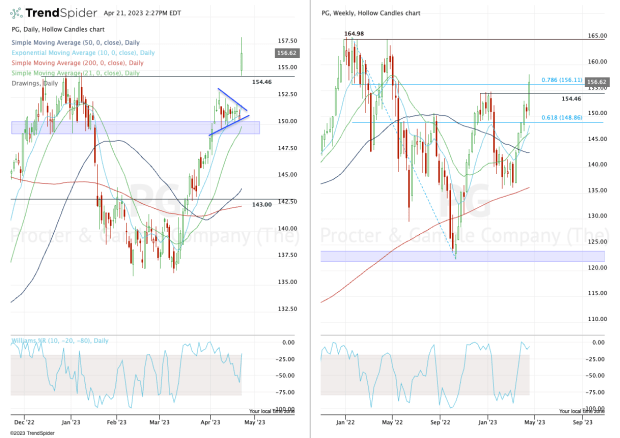

Chart courtesy of TrendSpider.com

On both the daily chart (left) and weekly chart (right), you can see how Procter & Gamble stock is breaking out over the $154 to $155 area. That zone was key resistance in December and January.

P&G shares gapping above this level, holding an intraday pullback to this zone and pushing higher is a very impressive -- and bullish -- performance.

Now that the stock is wavering around the 78.6% retracement, the bulls are looking for more.

Specifically, if P&G can stay above the $154 to $155 zone and clear the 78.6% retracement at $156.11, not much from a technical perspective stands in the way of a run back up to the $165 area.

If the stock climbs that high, it will be pushing all-time highs.

Don't Miss: Buffett's Berkshire Hathaway Is Breaking Out. Here's How to Trade It.

On the downside, a break back below the $154 to $155 breakout level could usher in a test of the 10-day moving average and the gap-fill level at $151.37.

If that’s the case, we can see how Procter & Gamble stock reacts, but it will have lost most, if not all, of its short-term bullish momentum.

From here for the bulls, it’s really as simple as seeing that the shares hold up over the $154 to $155 zone and clear $156 on the upside.

Action Alerts PLUS offers expert portfolio guidance to help you make informed investing decisions. Sign up now.

.png?w=600)