Rush Street Interactive (NYSE:RSI) will release its quarterly earnings report on Wednesday, 2024-10-30. Here's a brief overview for investors ahead of the announcement.

Analysts anticipate Rush Street Interactive to report an earnings per share (EPS) of $-0.01.

Anticipation surrounds Rush Street Interactive's announcement, with investors hoping to hear about both surpassing estimates and receiving positive guidance for the next quarter.

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.

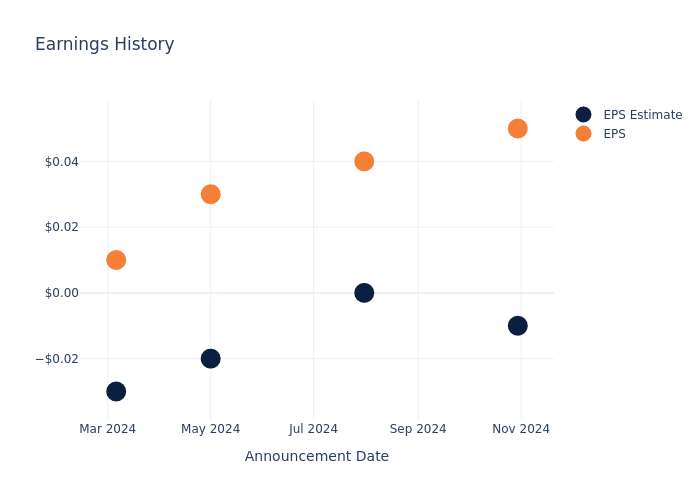

Historical Earnings Performance

The company's EPS beat by $0.04 in the last quarter, leading to a 7.59% increase in the share price on the following day.

Here's a look at Rush Street Interactive's past performance and the resulting price change:

| Quarter | Q3 2024 | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|---|

| EPS Estimate | -0.01 | 0 | -0.02 | -0.03 | -0.06 |

| EPS Actual | 0.05 | 0.04 | 0.03 | 0.01 | -0.03 |

| Price Change % | 1.0% | 8.0% | 18.0% | 16.0% | 6.0% |

Stock Performance

Shares of Rush Street Interactive were trading at $14.51 as of November 26. Over the last 52-week period, shares are up 244.66%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analyst Observations about Rush Street Interactive

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on Rush Street Interactive.

Rush Street Interactive has received a total of 3 ratings from analysts, with the consensus rating as Buy. With an average one-year price target of $16.0, the consensus suggests a potential 10.27% upside.

Comparing Ratings with Peers

In this analysis, we delve into the analyst ratings and average 1-year price targets of and Rush Street Interactive, three key industry players, offering insights into their relative performance expectations and market positioning.

Analysis Summary for Peers

The peer analysis summary provides a snapshot of key metrics for and Rush Street Interactive, illuminating their respective standings within the industry. These metrics offer valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Rush Street Interactive | Buy | 36.63% | $80.69M | 1.79% |

Key Takeaway:

Rush Street Interactive ranks at the bottom for Revenue Growth among its peers. It is also at the bottom for Gross Profit. However, it is at the top for Return on Equity.

About Rush Street Interactive

Rush Street Interactive Inc is an online gaming and entertainment company that focuses primarily on online casinos and online sports betting in the U.S. and Latin American markets. It provides customers with an array of gaming offerings such as real-money online casinos, online sports betting, and retail sports betting, as well as social gaming, which involves free-to-play games that use virtual credits that can be earned or purchased. The company generates revenue by offering online casinos, online sports betting, and social gaming directly to the end customer through its websites or apps. The company generates revenue through business-to-consumer (B2C) and business-to-business (B2B) models.

Unraveling the Financial Story of Rush Street Interactive

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Revenue Growth: Rush Street Interactive displayed positive results in 3 months. As of 30 September, 2024, the company achieved a solid revenue growth rate of approximately 36.63%. This indicates a notable increase in the company's top-line earnings. When compared to others in the Consumer Discretionary sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: Rush Street Interactive's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 0.51% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Rush Street Interactive's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 1.79% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): Rush Street Interactive's ROA stands out, surpassing industry averages. With an impressive ROA of 0.34%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.08.

This article was generated by Benzinga's automated content engine and reviewed by an editor.