The pound has dropped following the Bank of England’s aggressive 0.75 percentage-point rate rise and warnings of a recession that could last for two years.

Sterling fell 1.4 per cent to 1.123 against the US dollar, and was 0.8 per cent lower against the euro at 1.15.

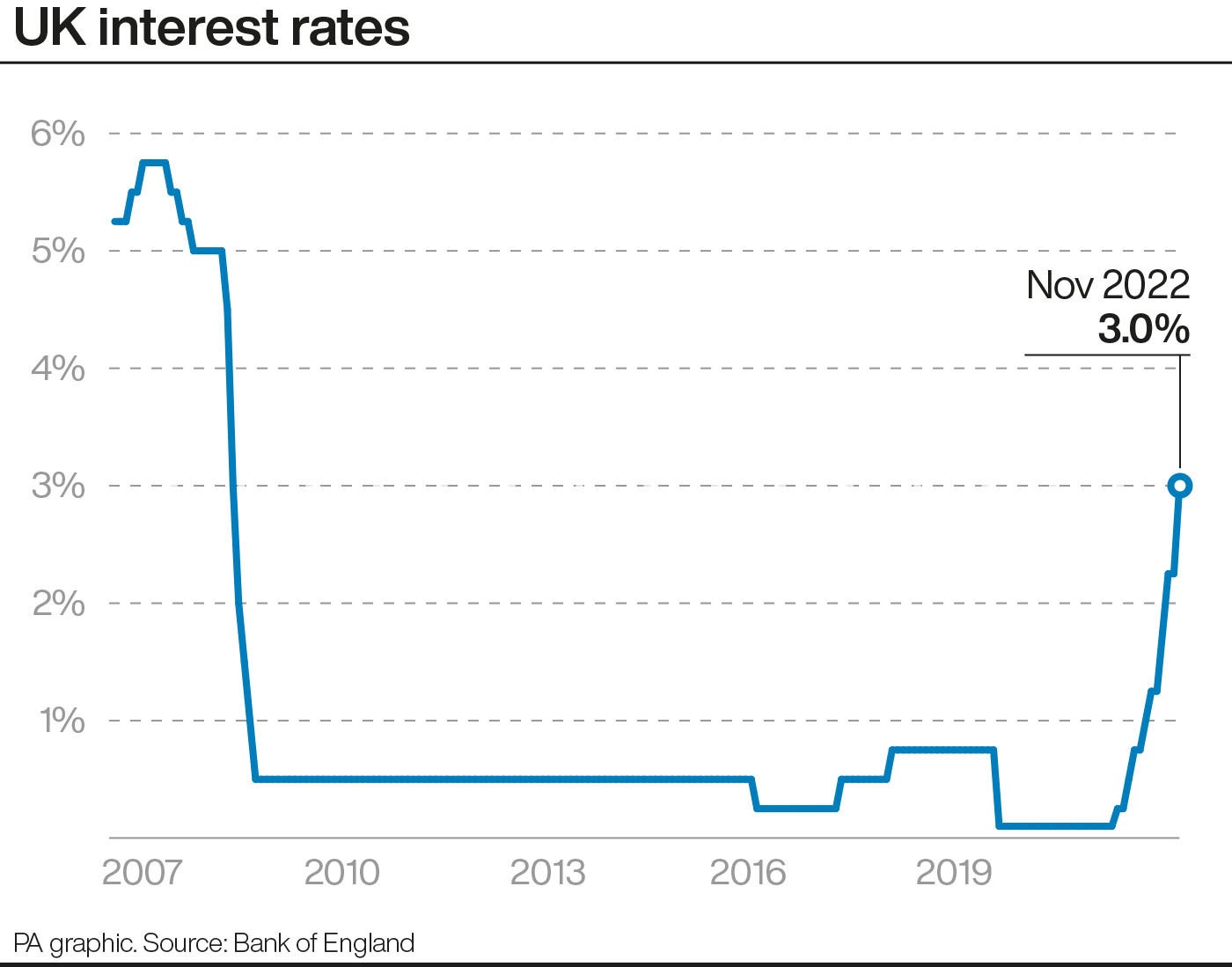

The Bank raised the base rate to 3 per cent – its highest level since 2008 – in the largest increase in 33 years.

The Monetary Policy Committee had warned last month that growing inflationary pressures would require a stronger response than previously thought. As members voted to raise the base rate, they warned that the UK could be on course for the longest recession since reliable records began in the 1920s.

Gross domestic product (GDP) could shrink for every quarter for two years, with growth only coming back in the middle of 2024, they said. However, the Bank cautioned that this forecast was based on interest rates reaching as high as 5.2 per cent, which the Bank said it did not necessarily expect to happen.

A recession could be drawn-out, but will be less than half as severe as the 2008 financial crisis, it said.

Markets have been expecting the base rate to peak at 5.25 per cent, but the pound was forced down after the Bank signalled that this might not happen. The UK economy is now forecast to contract by 1.9 per cent next year – worse than August’s projection of 1.2 per cent.

On Wednesday the pound staged its biggest monthly rally in a year, shaking off the effects on the market of weeks of political turmoil, but the bounceback was only fleeting. It crashed to a record low of $1.0327 against the dollar in late September after the government announced plans to slash taxes and ramp up borrowing.

Some analysts expect the pound to fall further during the rest of this year. This week, Nomura forecast a fall to around $1.05 by the end of the year, and Goldman Sachs predicted $1.10 in three months’ time.