When South Korean tech giant Naver confirmed earlier this week that it would purchase Poshmark Inc. (NASDAQ:POSH) at $17.90 per share, many observers said the offer was fair.

Was it? After all, Poshmark — an Instagram-like site specializing in apparel resale — went public in 2021 at $42 a share. On Thursday, it closed at $17.80.

Here's a look at why the Redwood City, California-based company plummeted in value.

See Also: 4 Analysts Have This To Say About Poshmark

What Happened: Over the last three months, analysts offered 12-month price targets for Poshmark, giving it an average of $15.38 with a high of $17.50 and a low of $11. Naver's offer, generous when compared to that range, values Poshmark at $1.6 billion.

That's a humongous discount from the company's peak market capitalization of $7.3 billion when it went public in January 2021.

Under the helm of founder and CEO Manish Chandra, Poshmark's losses mounted and revenue growth slowed over the last year or so. In July 2021, Stifel analyst Scott Devitt upgraded the rating for Poshmark from Hold to Buy and maintained a price target of $50.

But by Aug. 11, 2021, the company's stock hovered at around $30.65. At the time, that was an all-time low.

Poshmark's share price continued to slip as it lost much of the shine it enjoyed during the COVID-19 pandemic when customers relied on the web for all shopping needs. It also faces stiff competition from eBay Inc. (NASDAQ:EBAY), Meta Platforms Inc.'s (NASDAQ:META) Facebook marketplace, ThredUp Inc. (NASDAQ:TDUP) and The RealReal (NASDAQ:REAL).

When it missed earnings in March, shares were down 71.09%.

Why It Matters: Naver's acquisition of Poshmark comes at a time when companies on the auction block are selling at a steep discount and M&A activity in general has chilled due to a looming global recession.

According to Bloomberg, deal volume is expected to dip for the sixth straight quarter, which is a level akin to where it was at the onset of the COVID-19 pandemic.

See Also: RealReal Inks Partnership With Jimmy Choo

Poshmark, which touts 80 million users, can potentially benefit from Naver’s own discovery-based shopping platform without stressing about market volatility as a publicly traded business.

Whether the deal inspires other buyers to consider RealReal or ThredUp as inexpensive M&A targets remain to be seen. Like Poshmark, both companies are trading significantly less than their share prices at the time of their 2021 IPOs.

POSH Price Action: Poshmark has a 52-week high of $17.90 and a 52-week low of $8.97. The stock closed 1.08% higher Thursday at $17.80, according to Benzinga Pro.

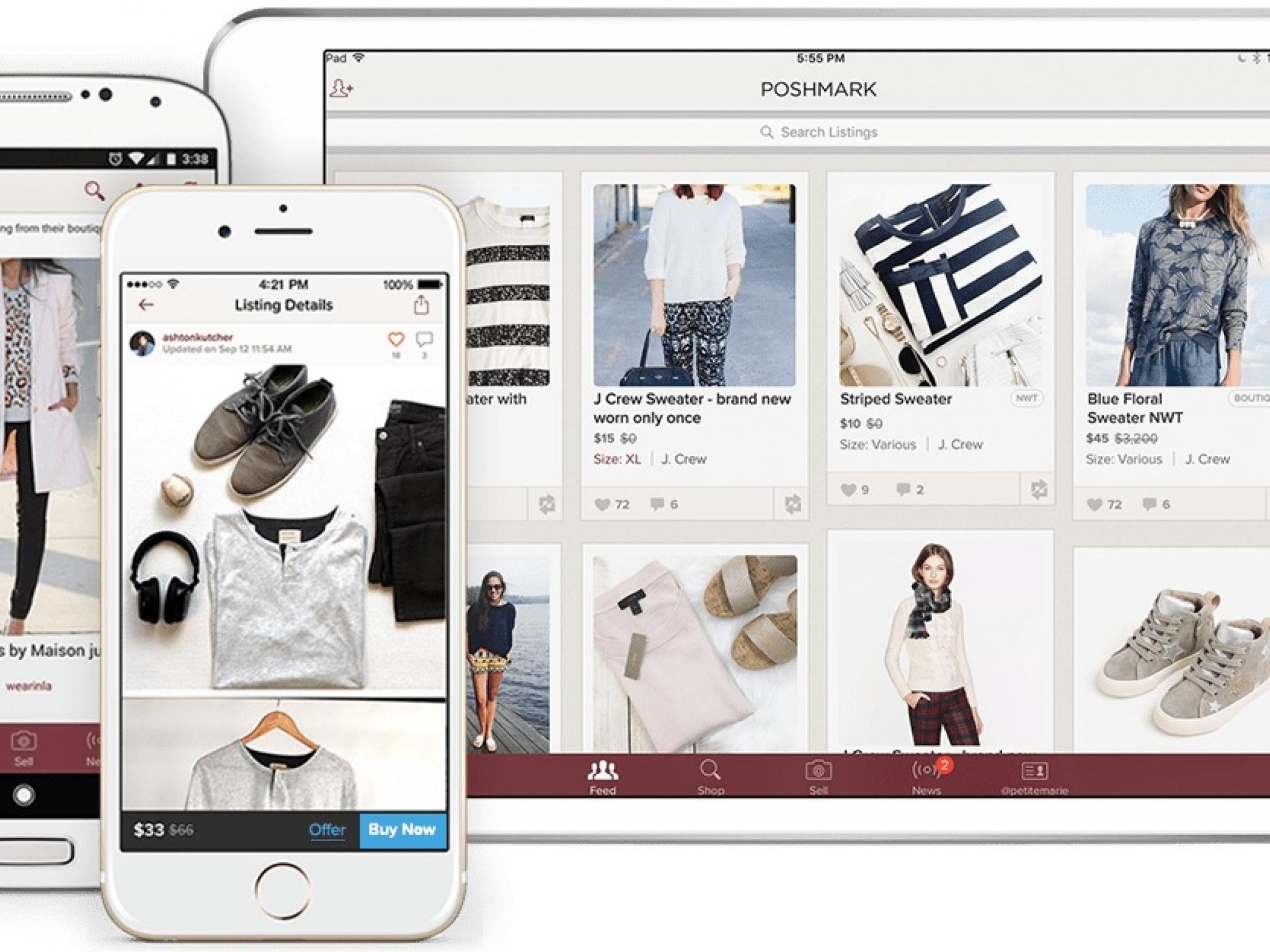

Image: Poshmark.com