For years, coffee has been the beverage of choice for people needing energy to stay awake during a busy day.

However, a younger generation has opted to find new ways to get their daily dose of caffeine, which has driven energy drinks to become the second-most popular dietary supplement consumed by young adults in the U.S.

💰💸 Don’t miss the move: SIGN UP for TheStreet’s FREE Daily newsletter 💰💸

This industry is growing rapidly in the North American market, reaching $19.2 billion in 2023, yet it's still projected to grow at a yearly rate of around 8% and be worth approximately $33 billion by 2030.

Related: Dr Pepper makes bold move to claim energy drink crown

With such a profitable product, many companies have invested in creating their own energy drink imprint or acquiring pre-existing energy drink brands to profit from their popularity.

Molson Coors expands its total beverage portfolio and dives into a new market

Formed in 2005, Molson Coors (TAP) is a multi-drink and brewing company famously known for producing a variety of popular beer brands, spirits, and some non-alcoholic beverages, including Coors Light, Miller Lite, Blue Moon, and more.

As one of the biggest beer-producing companies, Molson Coors' revenue comes mainly from its alcoholic beverages. However, the company has begun to branch out from its usual core products to increase its offerings and attract new markets.

Two months ago, the company announced it joined forces with Australian brand Naked Life to launch a new non-alcoholic beverage in an effort to expand its non-alcoholic sector.

“We’re building a winning portfolio that offers consumers choices across a wide range of occasions, and non-alc is a key part of that strategy,” said Molson Coors Chief Commercial Officer Michelle St. Jacques.

Related: Coca-Cola announces it's bringing back a nostalgic beverage

This month, the brewing company made another partnership deal, but this one is not just an addition to its alcohol-free beverage portfolio; it's also the company's entryway into a not-yet-fulfilled market for its business.

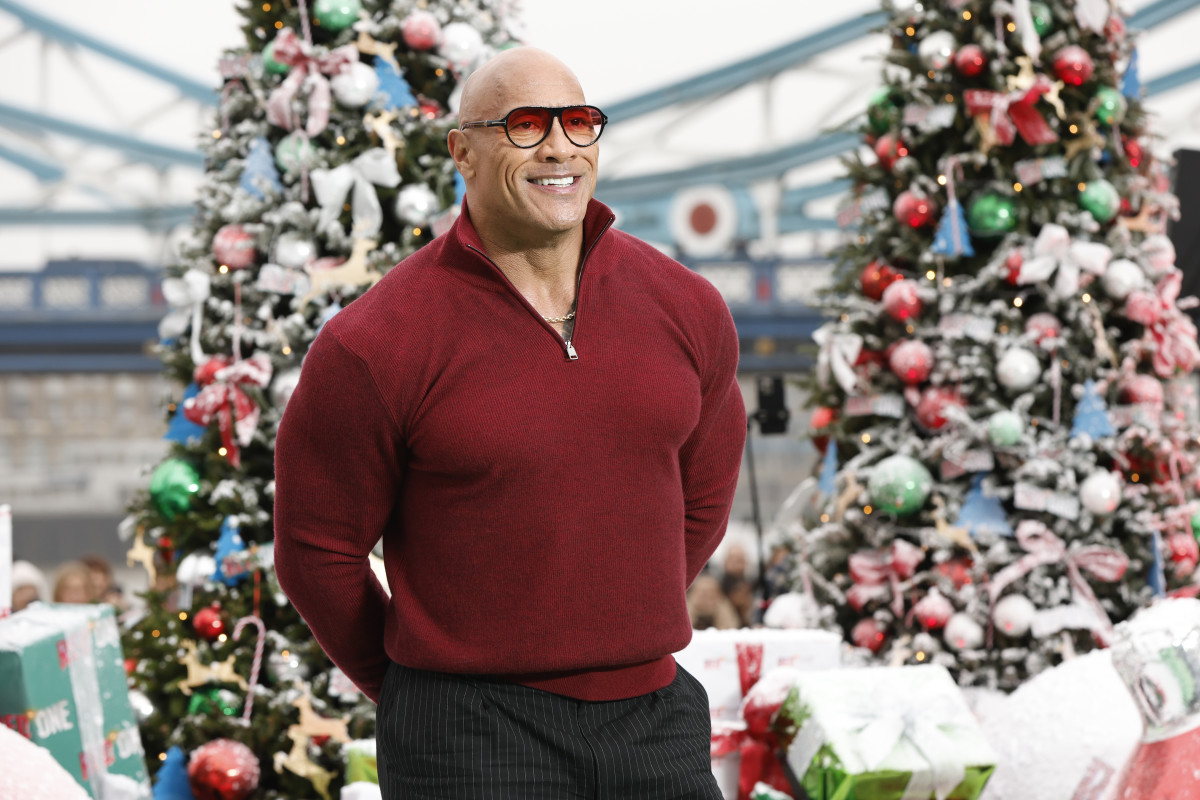

On Thursday, Molson Coors announced it had bought a majority stake in ZOA, a better-for-you energy drink co-founded by American actor and professional wrestler Dwayne “The Rock” Johnson.

Although the specific financial terms have yet to be disclosed by any member of either participating party, with this majority ownership deal, Molson Coors has the right to lead ZOA's marketing, retail, and direct-to-consumer sales and development.

According a statement, ZOA's sales have grown steadily since its creation, so with Molson Coors' help, the brand will be able to better fulfill and adapt to its consumer demand.

Additionally, foundational initiatives for the brand were teased, including developing new packaging, a visual revamp, and its first upcoming national marketing campaign, which will feature Dwayne “The Rock” Johnson.

Molson Coors has believed in the potential of ZOA since its inception

Molson Coors and ZOA have had a close partnership since the energy drink's inception in 2021 when the brewing company acquired a minority stake, which has bonded the two ever since.

Due to their passion and strong belief in the brand, Molson Coors increased its stake in September and became involved in ZOA's Board of Directors.

More Retail:

- A popular breakfast restaurant announces big change, delights fans

- Walmart makes a shocking business move ahead of the Christmas season

- E.l.f. Beauty launches unexpected deal with a struggling retail store

ZOA has grown to be a successful brand, landing it in the top 10 energy drink brands on Amazon (AMZN) due to its 50% repurchase rate and ability to attract new consumers to the energy drink category, with 30% of its consumers being new buyers.

“ZOA opens the door for us to participate in more parts of the day and incremental opportunities beyond our core business. We’ve built a strong foundation with ZOA over the past three years and we see a ton of opportunity for this brand to achieve its next stage of growth and scale,” said St. Jacques.

Related: Veteran fund manager sees world of pain coming for stocks