Key Takeaways:

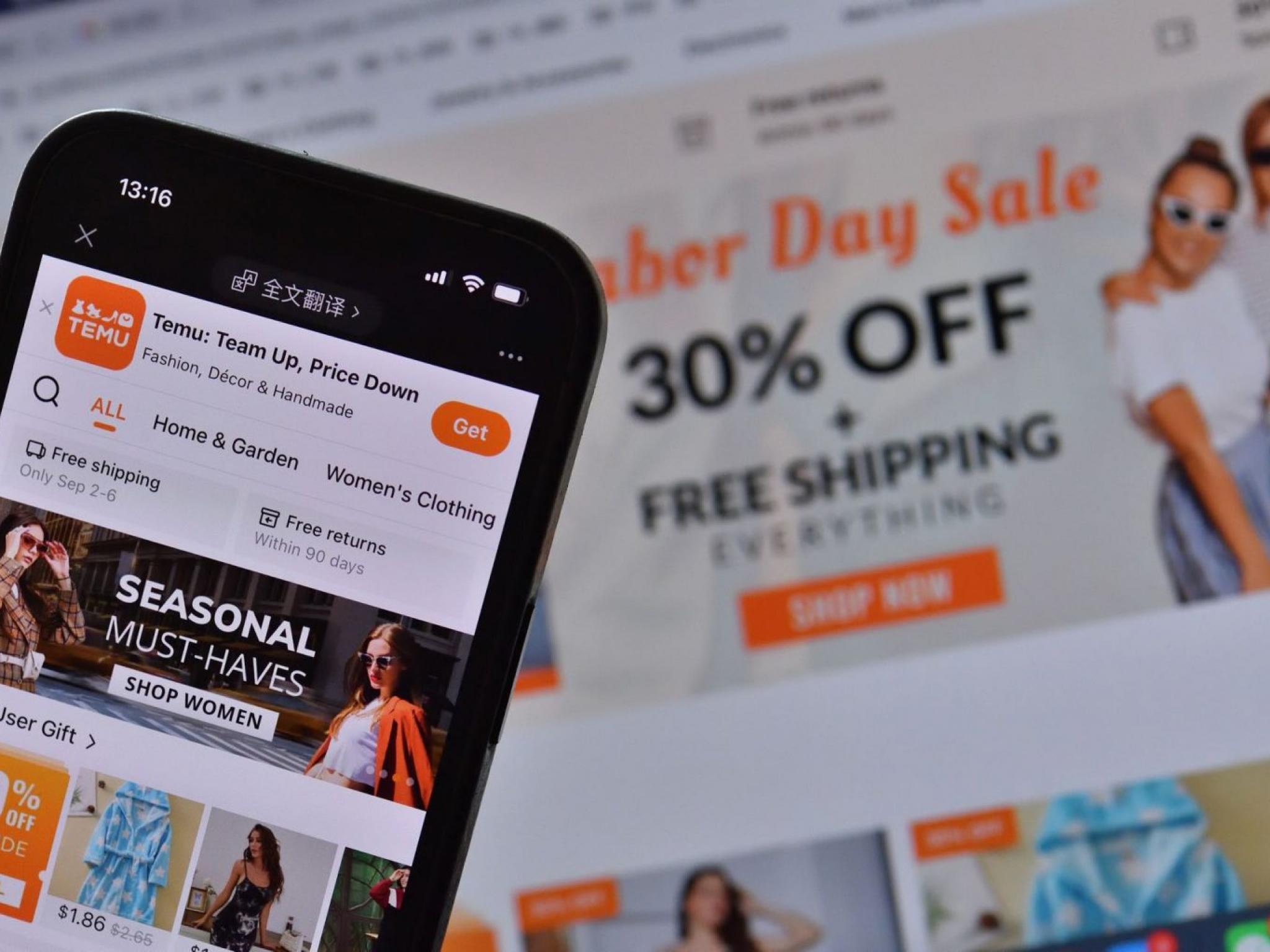

- Nearly two months after its launch, Pinduoduo’s cross-border e-commerce Temu app is among the top U.S. e-commerce apps based on new download rankings

- Despite its early success, the app will face a series of challenges in its target U.S. market, including cutthroat competition and high marketing expenses

By Trevor Mo

Chinese internet giants have been busy trying to expand overseas lately as their growth stalls at home with peaking internet penetration and lackluster consumer spending as the economy slows. But most have found limited success so far due to stiff local competition and lack of familiarity with overseas markets.

While the group has found some traction in developing regions like Southeast Asia, which shares many qualities with China, stiff competition has kept most out of more lucrative U.S. and European markets. But innovative low-cost e-commerce expert Pinduoduo Inc. (NASDAQ:PDD) is trying to break that cycle with the launch of its cross-border e-commerce platform Temu in early September, targeting the U.S. before potentially expanding to other markets.

Now, about two months after the launch, the platform – which boasts a wide range of items like key chains and storage containers selling for less than $1 – appears to be gaining some momentum. Temu was the No. 1 U.S. shopping app in the iPhone app store on Oct. 17, and has been in the top 10 in the iPhone and Android app stores for over a week, according to Marketplace Pulse.

Still, the rankings only reflect new downloads, and say little about user retention or activity levels. Pinduoduo is certain to face significant challenges as it tries to carve out a place in the ultra-competitive market, including the need for heavy spending to acquire uses. But before we explore that, we’ll step back for a quick review of this highly successful new kid on the Chinese e-commerce scene.

Despite a history only dating back to 2015, Pinduoduo rose quickly to become one of China’s top three e-commerce companies on the back of a clever strategy connecting manufacturers directly with consumers, allowing it to cut out costs added by layers of middlemen borne by most of its larger rivals. The company also got a boost from its aggressive group buying model with social elements that encourages buyers to invite their contacts to form groups for better discounts.

Pinduoduo now appears to be taking that formula on the road. Temu’s many new U.S. users were probably attracted by its aggressive pricing, heavy promotions and discount coupons, as well as a temporary free shipping policy. A scan through the platform reveals products costing as little as 20 U.S. cents, mirroring Pinduoduo’s early focus on the millions of Chinese consumers at the lower end of market who were neglected by larger rivals such as Alibaba (NYSE:BABA) and JD.com (NASDAQ:JD).

Having found some early success, now comes the hard part as Temu will need to carve out its own unique position in a U.S. market already crowded with others bringing cheap goods from China. That group includes names like Shein, Alibaba-owned AliExpress, and Wish. Then there’s local behemoth Amazon (NASDAQ:AMZN), whose platform is also used as a conduit to U.S. consumers by many China-based companies like Zibuyu Group, which recently filed for a Hong Kong IPO.

Manufacturing partners

Pinduoduo faced similar long odds when it rose to prominence in China despite its short history and entrenched competition from Alibaba and JD.com. One of its biggest edges is its vast network of Chinese manufacturing partners built up over the years. It continues to work diligently with that group, announcing last month it would invest billions of dollars to “cultivate 100 export-oriented brands.”

Apart from cutting out middlemen, Pindouduo has also taken other cost-cutting steps to boost its chances for Temu’s success in the U.S. and other overseas markets. Its initial cooperation policy stipulates the company doesn’t need to pay merchants until an overseas customer places an order and confirms receipt of the merchandise. The company can also return unsold inventory to merchants after a period of time, meaning it shoulders relatively low inventory risk.

That said, Pinduoduo will still need to invest heavily in overseas user acquisition and retention, which could be its biggest challenge. While its group-buying gimmick has proved highly effective for attracting users in smaller, underserved Chinese markets, the model is less familiar to U.S. consumers. That may explain why Temu has yet to roll out similar group-buying features in the U.S., and instead is initially relying on more traditional marketing tactics such as promotional coupons.

Pinduoduo’s rapid rise in China also built on its strong relationship with shareholder Tencent (0700.HK), whose ubiquitous WeChat social media app promoted Pinduoduo across its vast network of more than 1 billion users. It has no such partnership to draw on in the overseas campaign.

Pinduoduo could also discover that acquiring U.S. users is far more expensive than their Chinese counterparts, with as much as $75 required to acquire a single new user in the U.S., according to a September research note by China Renaissance. The investment firm estimates Pinduoduo will need to spend up to 10 billion yuan ($1.4 billion) a year to quickly expand its U.S. customer base.

Such major investment could weight on the company’s bottom line, even as it has ample cash flow and has managed to improve its finances over the last two years. For the three months through June, Pinduoduo’s revenue rose 36% to 31.4 billion yuan, while its net income rose 268% to 8.9 billion yuan, according to its latest quarterly results. The company reversed its years of loss-making status to become profitable in early 2021 after adopting measures to sharply cut its marketing spending.

At the end of the day, Pinduoduo’s ability to replicate its domestic success in the U.S. will depend heavily on how willing it is to back the initiative with resources. The company may also need to become savvier in how it acquires users. In that regard it could look for inspiration from fellow Chinese online retailer Shein, which has quickly become a U.S. fast-fashion leader by using TikTok and Instagram influencer marketing.

Pinduoduo’s shares have tumbled over the past year, following a trend among most U.S.-listed Chinese technology stocks as they took a hit from a crackdown by Chinese regulators and geopolitical tensions between China and the U.S. Its latest stock price of about $45 – including a 25% decline during a bloodbath for Chinese stocks on Monday in the U.S – is less than a quarter of the the more than $190 it recorded at its peak early 2021.

Following the sell-down, Pinduoduo now trades at a price-to-earnings (P/E) ratio of 22, trailing Alibaba at 30 and well behind Amazon’s inflated trailing P/E ratio of 107.