Pfizer (PFE) stock inched lower shortly after the open, but has flipped to positive territory in midday Tuesday trading, up about 3%.

The rally comes after the company reported earnings amid uncertainty with Covid vaccines worldwide.

It wasn’t long ago that Johnson & Johnson (JNJ) said it would suspend its outlook for its Covid vaccine amid that uncertainty. However, that didn’t stop the stock from running to all-time highs.

Pfizer was able to breeze past analysts’ earnings and revenue expectations for the most recent quarter. While it was able to maintain its full-year revenue outlook, it did trim its earnings outlook.

Does that mean a run to all-time highs may be in the cards for Pfizer stock too?

At least in the short term, it doesn’t seem likely. Despite today’s modest rally, shares are still down about 20% from the all-time high.

However, Pfizer continues to hold some very key levels.

Trading Pfizer Stock

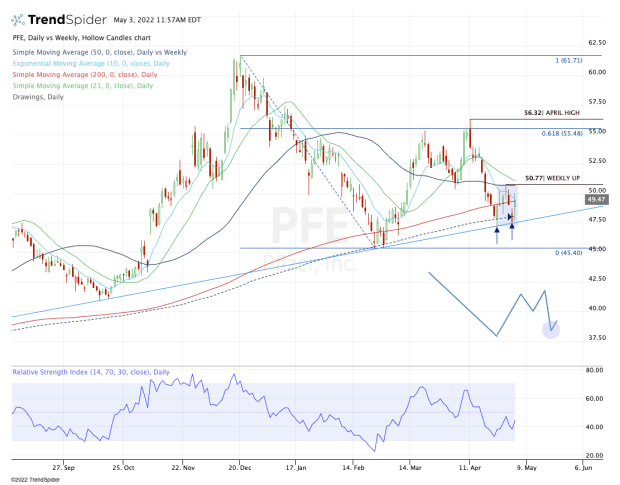

Chart courtesy of TrendSpider.com

Pfizer stock endured a brutal selloff from its high in December to its low in late February. In fact, during that stretch it registered seven weekly declines in an eight-week stretch.

However, there are positives.

First, even though the 200-day moving average gets all the attention, the 50-week still matters too. So far, this measure has continued to act as support. It’s also holding uptrend support, which stretches all the way back to March 2021.

Second, while many stocks went on to test new lows in March, April and now May, Pfizer has avoided breaking its February low thus far.

Lastly, it’s putting in a higher low. While not monumental, it's a key technical development that shows bulls may be gaining some control.

From here, the downside is very defined. We do not want to see a break of $47.10 to $47.90. That would put Pfizer stock below the last three weeks’ worth of lows, as well as the 50-week moving average and uptrend support (blue line).

That would open the door down to the 2022 low. Below $45 and $40 could be on deck.

The upside is less clear. The stock is currently contained within last week’s range and trading below a number of key moving averages.

If Pfizer stock can go weekly-up over $50.77 and clear the 21-day, then that could open up quite a bit of upside as it puts it above all of its daily moving averages.

Specifically, $55 to $56.50 could be in play next. Above that opens the door back to the $60 to $62 area. However, it all starts with clearing last week’s high.