MicroStrategy (MSTR) is an enterprise-facing software company with a market capitalization of $76.4 billion. It is also the largest institutional holder of Bitcoin (BTCUSDC), which means the performance of MSTR stock is tied to the performance of the world’s largest cryptocurrency. Bitcoin has risen by more than 1,075% in the last five years. Comparatively, since April 2020, MSTR stock has returned 2,246%.

Long-time Bitcoin critic Peter Schiff recently took another swipe at MicroStrategy founder Michael Saylor as Bitcoin fell below $80,000 amid market turbulence triggered by President Donald Trump’s tariff strategy. On April 7, Schiff directly challenged Saylor on X: “Attention Saylor, now that Bitcoin is below $80K, if you want to prevent it from crashing below your average cost of $68K, you had better back up the truck with borrowed money today and go all in.”

The taunt came as Bitcoin posted its worst first quarter in a decade, falling 11.7%.

At the time of writing, BTC prices are below $80,000, down over 25% from record levels. In the last week of March, MicroStrategy purchased 22,048 BTC for $1.92 billion at an average price of $86,969 per coin, pushing its total holdings to 528,185 BTC with an average cost of $67,458.

Market turbulence followed Trump’s “Liberation Day” tariffs, which imposed a 10% blanket tariff on imports, with higher rates for specific countries. This triggered retaliation from China and wiped $5.4 trillion from U.S. equities in two days. Although Trump has announced a 90-day pause on reciprocal tariffs, with the exception of tariffs on China, the market is still trading uncertainly.

MicroStrategy Doubles Down on Financing to Buy BTC

At the end of March, MicroStrategy recently announced the pricing of its offering of 8.5 million shares of preferred stock at $85 per share. After deducting underwriting fees and expenses, it expects net proceeds of $711.2 million from the offering.

Strategy intends to use the proceeds for “general corporate purposes, including the acquisition of bitcoin and for working capital,” continuing its aggressive BTC accumulation strategy.

Beginning June 30, 2025, the preferred stock will pay a fixed 10% quarterly dividend rate. Notably, the structure includes provisions for compounded dividends on any unpaid regular dividends, with rates that can increase to 18% annually if payments are missed. The liquidation preference will start at $100 per share but includes adjustment mechanisms tied to trading prices, increasing the value based on market performance.

This offering follows Strategy’s announcement of an at-the-money program that could raise up to $21 billion through 8.00% Series A preferred stock, indicating ambitious plans to continue expanding its Bitcoin holdings.

What Is the Target Price for MSTR Stock?

MicroStrategy offers you indirect exposure to Bitcoin. So, it makes sense to invest in MSTR stock if you are a long-term Bitcoin bull.

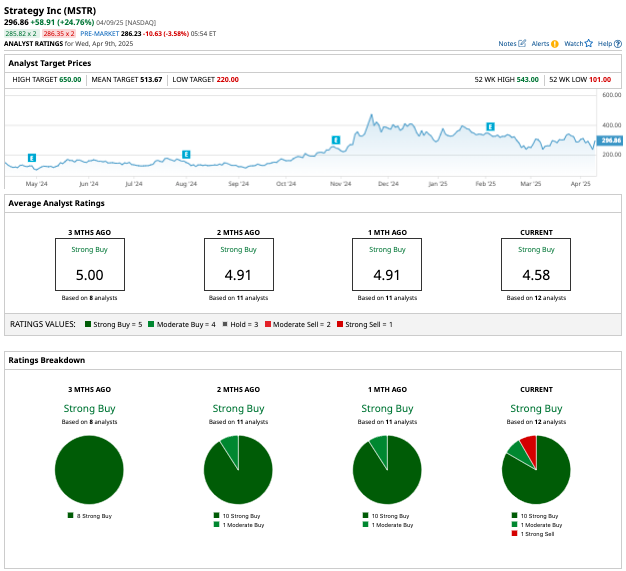

Out of the 12 analysts covering MSTR stock, 10 recommend “Strong Buy,” one recommends “Moderate Buy,” and one recommends “Strong Sell.” The average target price for MSTR stock is $513.67, up over 80% from current levels.