PepsiCo (PEP) is about to unofficially kick off earnings season when it reports its quarterly results before the open on Tuesday.

While the drinks giant is just one report in a sea of thousands, it comes at a busy juncture in the market. Stocks are trying to prolong the current bear-market rally after recently navigating the jobs report on Friday.

Following PepsiCo's report on Tuesday, we’ll hear from Delta Air Lines (DAL) on Wednesday and navigate the monthly CPI report. All three items should shed some light on consumers and inflation. The banks start reporting on Thursday.

As for PepsiCo stock, it recently underwent a tough stretch of trading. But Morningstar all but nailed the bottom in mid-June when it said the stock was becoming a bargain.

Then just last week, Bank of America analysts slapped a $190 price target on the stock. To get there, though, PepsiCo will need to fight through one very key level on the upside.

Trading PepsiCo Stock on Earnings

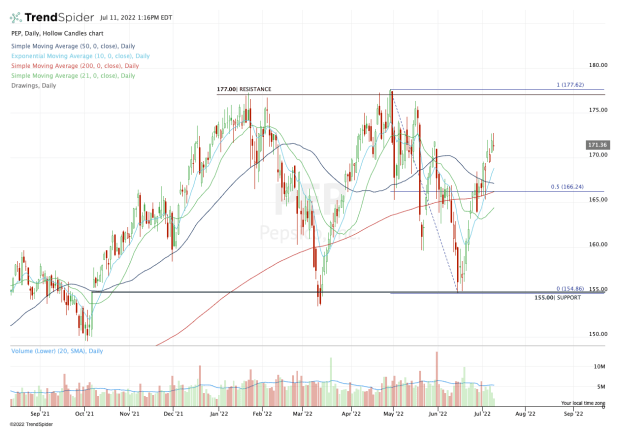

Chart courtesy of TrendSpider.com

From its all-time high on April 29 to its low in mid-June, PepsiCo stock fell about 12.7%. Given the current state of the market, that looks pretty good right now.

The action over the past few weeks has made it even better, with the shares rallying about 11% from the low. The stock is down just 3.5% from its all-time high going into the earnings report.

As it does so, two very key levels stand out to me on the charts: $166 on the downside and $177 on the upside.

That doesn’t mean that PepsiCo stock will find support at $166 if we see a bearish reaction to earnings. It also doesn’t mean that PepsiCo will even fall that far in the first place.

Starting with the downside, look for support from the 10-day moving average, currently near $168.50. This measure has been active support amid the rally and I would look for that to continue if we see a post-earnings dip in PepsiCo.

Below that summons our key zone at $166. Near that level we find the 200-day moving average, recent support and the 50% retracement. Just above $166 is the 50-day and just below it is the 21-day.

In short, the $165 to $167 zone is critical for PepsiCo bulls to maintain their short-term momentum.

If this level is lost, it opens the door back down to $160, then potentially down to strong support near $155.

On the upside, the $175 to $177 zone has been a tough hurdle for PepsiCo stock all year. If it’s able to rally on the earnings report, beware of a potential gap-up to this zone that fades from the highs.

Above $178 could open the door toward a test of B of A’s $190 price target.

As long as the shares hold above the $165 to $167 zone, I would consider PepsiCo stock relatively healthy from a price-action perspective.