PepsiCo (PEP) shares on Wednesday are trading about 4% higher after the soft-drinks-and-snacks behemoth reported third-quarter results.

That stock move comes even as the early momentum in the overall market has been sapped following the PPI report, which was released before the open.

PepsiCo, Purchase, N.Y., delivered a great report. Earnings of $1.97 a share beat expectations by 12 cents, while revenue of $21.97 billion grew 8.8% year over year and beat expectations by more than $1.1 billion.

Even better, management raised its full-year 2022 outlook. The company now expects revenue growth ex-acquisitions of 12% vs. a prior expectation of 10%. It sees earnings of $6.73 a share vs. a prior outlook of $6.63 a share and a consensus expectation of $6.70 a share.

So is PepsiCo stock a buy? Let’s look at the chart.

Trading PepsiCo Stock on Earnings

Chart courtesy of TrendSpider.com

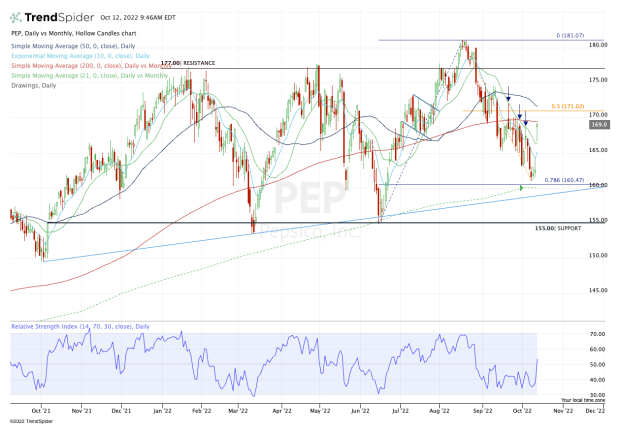

The early gains in the regular session are outpacing that of the premarket, which is a good sign for the bulls if the stock can maintain momentum.

As recently as mid-August, PepsiCo stock was hitting new highs. Now it’s trying to snap out of a nasty downtrend that sent the stock more than 10% lower.

Along the way, the 21-day moving average had been active resistance. With the stock now gapping above this measure, the bulls are gaining control. The key question is whether they can hold onto it.

Clearing the $169.50 to $171.50 area would go a long way to shifting momentum back to the bulls' favor.

In that zone, PepsiCo stock faces the 200-day and 50-day moving averages, as well as the 50% retracement of the current pullback.

If the stock can clear this zone, the door opens to $177 resistance, then the highs near $180 to $181.

If the stock can’t clear the $169.50 to $171.50 zone, then there is a gap-fill down at $164.27, as well as the 10-day moving average near $165. If the shares indeed fade, the bulls will want to see PepsiCo stock find its footing in this zone.

Otherwise, $160 to $161 could be back in play.