Peloton (PTON) stock is like so many other growth holdings right now: toast.

The stock is down 12.5% on the day after the connected-fitness company's earnings report. That's well off the lows shortly after the open, when it was down 20%.

The company missed on profit expectations and issued weaker-than-expected guidance.

At today’s low, Peloton stock was down 40% over the past four days. The stock is down in four straight weeks and in six of the past seven. Amid that stretch, we’ve seen a peak-to-trough decline of 60%.

From its highs, the stock is down more than 93%.

These days even companies delivering strong results and upbeat guidance — like Advanced Micro Devices (AMD) — are seeing their share prices sink.

Is there anything bulls can do? Let's look at the chart.

Trading Peloton Stock

Chart courtesy of TrendSpider.com

Hope is not a good strategy, particularly for growth stocks when they are in a bear market and widely out of favor.

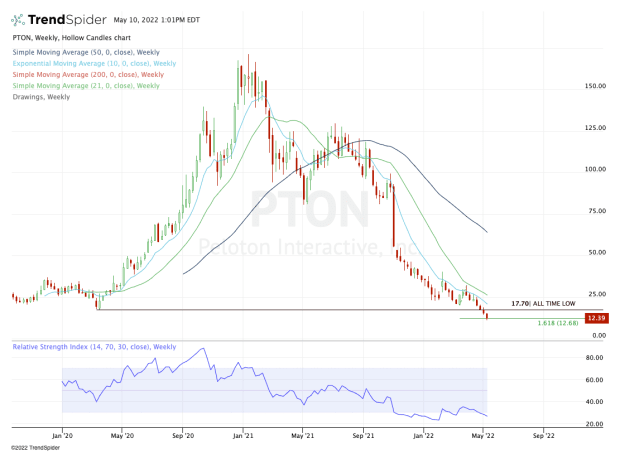

As we look at the chart, notice how long the 10-week moving average has been resistance in this stock. That isn’t a newsflash for trend traders. The 10-week moving average went from support in the first quarter of 2021 to resistance, and that was the beginning of a new downtrend.

As for the current setup, watch today’s low and the $12.68 level. The latter is the 161.8% extension of the recent range, but it’s not much to go on.

We’re getting a decent bounce off today’s low, so if anything this would be our risk level to watch.

Peloton has been hit hard and is not a stock that many investors will feel comfortable owning. There are thousands to pick from: Why focus on the one that’s down 90%-plus from the highs?

If a rebound is brewing, a move back to the prior all-time low at $17.70 could be in the cards. Near there, Peloton stock may very well test the 10-week moving average as well.

On the downside, a break of today’s low — and especially a close below it — opens the door down to $10 and lower.