Shares of Peloton (PTON) are trying to rally on Thursday (Oct. 6), which is not only surprising given that the stock market is down on the day, but also given the news flow.

Peloton shares were active in morning trading following news that the company would trim 500 jobs, reducing its workforce by roughly 12%.

While job cuts are not exactly the worst news from a company as it’s reducing costs, it doesn’t send a great signal before the holiday season.

The news comes less than a month after co-founders departed the company and just days after Lululemon Athletica (LULU) won a legal battle against the firm.

Despite all this, Peloton stock is up 2% today and more than 24% this week.

Trading Peloton Stock

Chart courtesy of TradingView.com

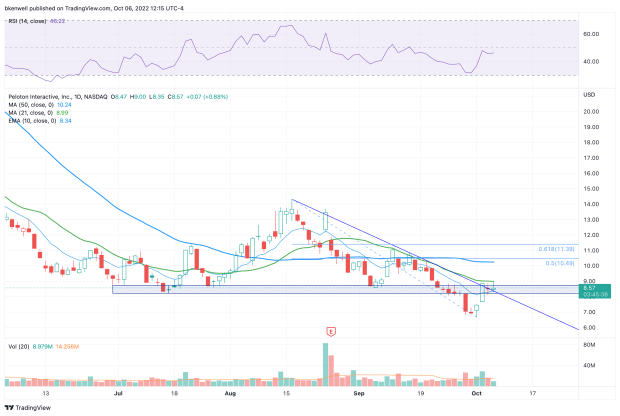

Looking at the chart, it’s clear that Peloton is running into a very key area.

There’s a 50-cent wide range where shares had previously found support, between $8.25 and $8.75. That zone was support from July through September before failing at the end of last month.

Now trying to reclaim this zone, Peloton stock is also running into the 21-day moving average and downtrend resistance (blue line).

From here, it’s a bit tricky.

Peloton stock is trading well in a tough tape and on negative news, which is bullish. That said, the stock has been massacred and isn’t exactly a relative strength candidate if we zoom out to the year-to-date performance.

If shares can clear today’s high near $9 and the 21-day moving average though, it could put even more upside in play. That’s especially true on a close above these measures.

It could put the 50-day moving average and the 50% retracement in play between $10 and $10.50. Above that could put the 61.8% retracement in play near $11.40.

On the downside, a move below $8 (and especially a close below it) would be concerning, putting Peloton below downtrend resistance and all of its key daily moving averages.

The next stop would be the gap-fill level at $7.48.