In the preceding three months, 25 analysts have released ratings for Reddit (NYSE:RDDT), presenting a wide array of perspectives from bullish to bearish.

The following table summarizes their recent ratings, shedding light on the changing sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 16 | 5 | 3 | 1 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 2 | 2 | 0 | 0 | 0 |

| 2M Ago | 10 | 2 | 2 | 1 | 0 |

| 3M Ago | 4 | 0 | 1 | 0 | 0 |

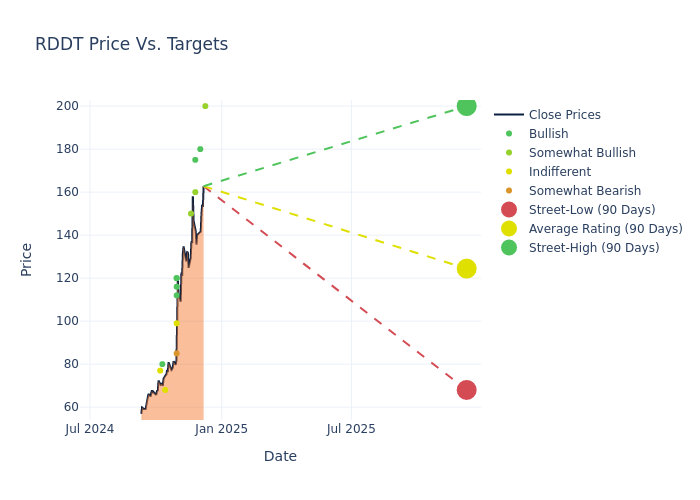

The 12-month price targets, analyzed by analysts, offer insights with an average target of $111.44, a high estimate of $200.00, and a low estimate of $68.00. This upward trend is apparent, with the current average reflecting a 33.7% increase from the previous average price target of $83.35.

Interpreting Analyst Ratings: A Closer Look

The analysis of recent analyst actions sheds light on the perception of Reddit by financial experts. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Brian Nowak | Morgan Stanley | Raises | Overweight | $200.00 | $70.00 |

| Alan Gould | Loop Capital | Raises | Buy | $180.00 | $120.00 |

| John Colantuoni | Jefferies | Raises | Buy | $175.00 | $120.00 |

| Andrew Boone | JMP Securities | Raises | Market Outperform | $160.00 | $118.00 |

| Thomas Champion | Piper Sandler | Raises | Overweight | $150.00 | $115.00 |

| Mark Shmulik | Bernstein | Raises | Underperform | $85.00 | $65.00 |

| Ronald Josey | Citigroup | Raises | Buy | $120.00 | $70.00 |

| Alan Gould | Loop Capital | Raises | Buy | $120.00 | $90.00 |

| Andrew Boone | JMP Securities | Raises | Market Outperform | $118.00 | $84.00 |

| Rohit Kulkarni | Roth MKM | Raises | Buy | $116.00 | $89.00 |

| Naved Khan | B. Riley Securities | Raises | Buy | $112.00 | $87.00 |

| Thomas Champion | Piper Sandler | Raises | Overweight | $115.00 | $70.00 |

| Justin Post | B of A Securities | Raises | Neutral | $99.00 | $84.00 |

| Laura Martin | Needham | Raises | Buy | $120.00 | $85.00 |

| Alan Gould | Loop Capital | Raises | Buy | $90.00 | $80.00 |

| Rohit Kulkarni | Roth MKM | Raises | Buy | $89.00 | $66.00 |

| John Colantuoni | Jefferies | Raises | Buy | $100.00 | $90.00 |

| Naved Khan | B. Riley Securities | Raises | Buy | $87.00 | $75.00 |

| Eric Sheridan | Goldman Sachs | Raises | Neutral | $68.00 | $60.00 |

| Josh Beck | Raymond James | Raises | Strong Buy | $80.00 | $70.00 |

| John Colantuoni | Jefferies | Announces | Buy | $90.00 | - |

| Laura Martin | Needham | Raises | Buy | $85.00 | $75.00 |

| Doug Anmuth | JP Morgan | Raises | Neutral | $77.00 | $59.00 |

| Naved Khan | B. Riley Securities | Announces | Buy | $75.00 | - |

| Laura Martin | Needham | Maintains | Buy | $75.00 | $75.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Reddit. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Offering a comprehensive view, analysts assess stocks qualitatively, spanning from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Reddit compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of Reddit's stock. This examination reveals shifts in analysts' expectations over time.

To gain a panoramic view of Reddit's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on Reddit analyst ratings.

About Reddit

Reddit Inc is engaged in providing internet content. The company provides online services that include gaming, sports, business, crypto, television and others.

Reddit: A Financial Overview

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Revenue Growth: Reddit displayed positive results in 3 months. As of 30 September, 2024, the company achieved a solid revenue growth rate of approximately 67.87%. This indicates a notable increase in the company's top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Communication Services sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 8.57%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): Reddit's ROE stands out, surpassing industry averages. With an impressive ROE of 1.54%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Reddit's ROA excels beyond industry benchmarks, reaching 1.41%. This signifies efficient management of assets and strong financial health.

Debt Management: Reddit's debt-to-equity ratio is below the industry average. With a ratio of 0.01, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

The Core of Analyst Ratings: What Every Investor Should Know

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.