/PayPal%20Holdings%20Inc%20HQ%20photo-by%20bennymarty%20via%20iStock.jpg)

PayPal Inc (PYPL) stock remains an analyst favorite, even though PYPL has faltered recently. Nevertheless, out-of-the-money (OTM) put option premiums are high, providing a good yield play for short-sellers.

PYPL is at $70.08 in midday trading on Friday, March 21, just above its recent trough price of $66.91 on March 13. I discussed the stock's appeal based on its free cash flow (FCF) in a Feb. 7 Barchart article ("Is PayPal a Bargain Here? Its Huge Free Cash Flow Could Push PYPL Stock Higher").

Analyst Price Targets

The article showed that it could be worth over $110 per share. Moreover, analysts still have high price targets for PYPL. For example, Yahoo! Finance's survey of 44 analysts has an average price target of $95.00 per share. That is close to my article's Yahoo! Finance target of $95.02 over a month ago.

Similarly, Barchart's survey shows that its mean survey has a price target of $92.56, compared to $94.82 a month ago. However, AnaChart's survey of 37 analysts is at $90.15, compared to $98.99 a month ago.

Nevertheless, the average of these surveys is $92.58 per share, which is still over +32% higher than today's price. The bottom line is that PYPL still looks cheap.

One way to play this is to sell short out-of-the-money (OTM) put options in nearby expiry periods. That way an investor can earn income while waiting for the stock to fall.]

Shorting OTM Puts

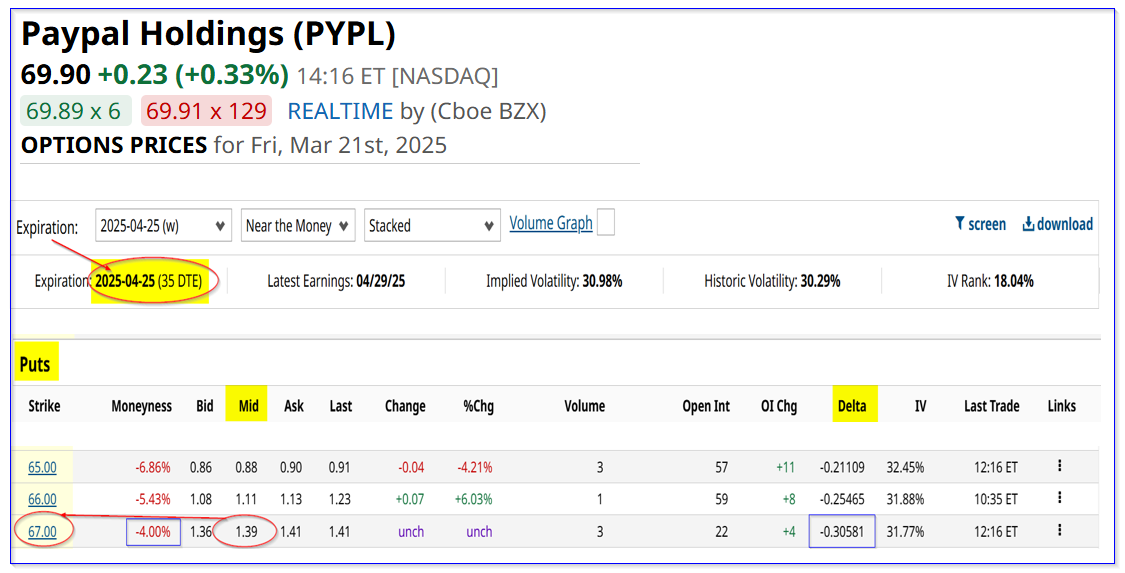

For example, look at the April 25 expiry period for PYPL stock. It shows that the $67.00 put option strike price has an attractive midpoint premium of $1.39 per contract.

That means that an investor who shorts these puts makes an immediate yield of 2.1% (i.e., $1.39/$67.00 = 0.02075).

This means that an investor who secures $6,700 in cash or buying power with their investment brokerage firm can do this trade. That cash acts as collateral to buy 100 shares at $67.00. The account will then immediately receive $139.00 after entering an order to “Sell to Open” 1 put contract at $67.00 for April 25 expiry.

The point is that this sets a good buy-in entry point for an investor, as well as extra income. Moreover, the breakeven point for that investor is $67.00 - $1.39, or $65.61, which is 6.3% below today's trading price.

So, unless the stock falls 4.0% over the next month, the investor will have no obligation to buy 100 shares at $67.00. But even then, the investor has extra room to make a profit unless PYPL falls below $65.61. Even in that case, the loss is only an unrealized capital loss.

The point is that the investor could then sell out-of-the-money covered calls or more OTM puts. That way the investor can make up some of the unrealized capital loss.

Investors should study the associated risks with this type of trade. The Barchart Options Learning Center and related tabs help investors study options trading risks.