PayPal Holdings, Inc (NASDAQ:PYPL) gapped down and lost 6.27% in Monday's session after the financial technology company walked back a change it published to its acceptable use policy (AUP), which would have allowed PayPal to debit users $2,500 for spreading “misinformation.”

PayPal said the AUP was published in error and contained incorrect information.

“PayPal is not fining people for misinformation and this language was never intended to be inserted in our policy. Our teams are working to correct our policy pages. We're sorry for the confusion this has caused," a PayPal spokesperson said.

The policy change was met with widespread condemnation, including from former PayPal president David Marcus, who called the company’s new policy “insanity.”

PayPal had plunged about 70% between July 26, 2021 and Friday, but the company’s most recent mishap appears to have caused more traders and investors to turn away from the stock.

Want direct analysis? Find me in the BZ Pro lounge! Click here for a free trial

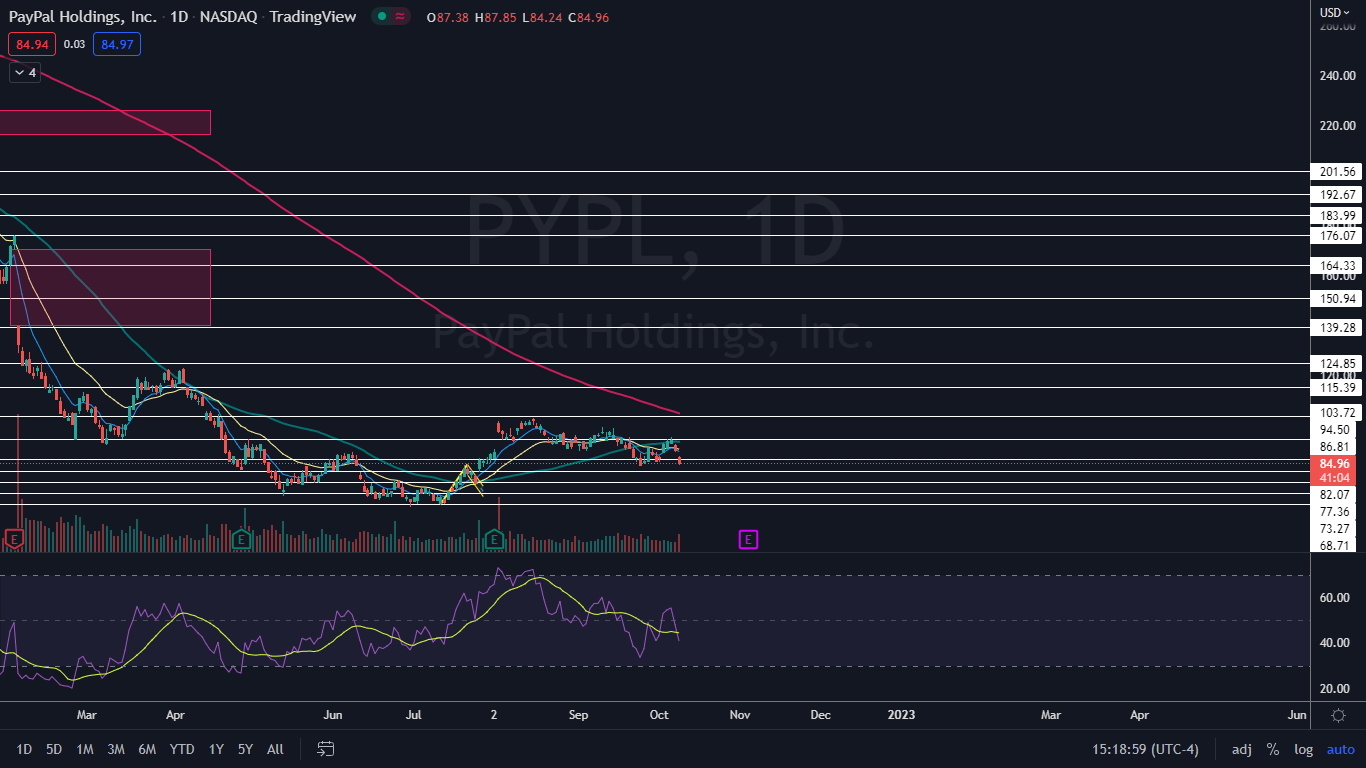

The PayPal Chart: PayPal has been trading in a fairly consistent downtrend since Aug. 16, with the most recent lower high formed on Oct. 6 at $95.57 and the most recent confirmed lower low printed at the $84.13 mark on Sept. 26. On Monday, PayPal held slightly above the most recent lower high, and if the stock can bounce on Tuesday, a bullish double bottom pattern near $84 may print.

- If PayPal closes the trading day near its low-of-day price, the stock will print a bearish kicker candlestick, which could indicate lower prices will come again on Tuesday. If that happens, PayPal will print another lower low, which will confirm the downtrend is intact.

- If PayPal bounces up to close the trading session with a lower wick, the stock will print a hammer candlestick on the daily chart, which could indicate a bounce will come on Tuesday. If that occurs, the downtrend will be negated.

- PayPal’s decline came on higher-than-average volume, which indicates a high level of bearish interest in the stock. On Friday afternoon, PayPal’s trading volume was measuring in at over 15 million, compared to the 10-day average of 11.42 million.

- PayPal has resistance above at $86.81 and $94.50 and support below at $82.07 and $77.36.

Photo via Shutterstock.