Shares of PayPal (PYPL) on Monday are down about 6%, dipping into the September lows.

A move lower in the US stock market is one factor, but the main one is something of a self-inflicted wound.

Over the weekend, social media lit up on speculation that PayPal was considering fining users over misinformation.

The documents that were reportedly leaked were marked, "Last Updated on November 3, 2022” — suggesting the change may have gone into effect in less than a month.

The company has said that it was an error and that “this language was never intended to be inserted in our policy.”

At least for today, though, investors are selling PayPal stock to an extent a good deal sharper than the S&P 500’s decline.

Trading PayPal Stock

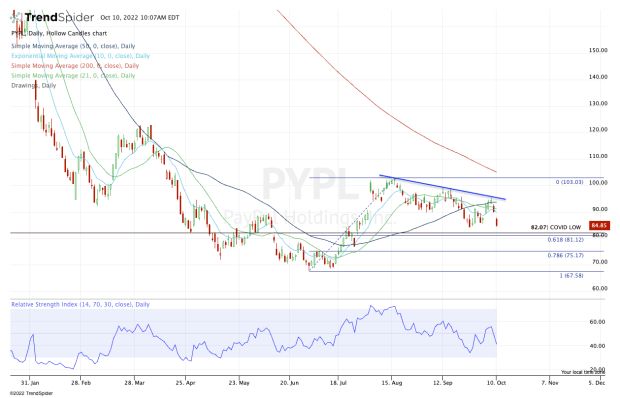

Chart courtesy of TrendSpider.com

PayPal is now trading into the September lows around $84 and I am interested to see how the stock handles this area.

If it buoys the stock — and if the overall market can find its footing — the bulls could be looking at a rebound back toward the gap-fill around $90 and the 10-day moving average.

But if PayPal stock continues to pull back, we could be looking at a test of $81 to $82. That is the 61.8% retracement of the current rally from the June low. It’s also where the covid low of $82.07 comes into play.

If we revisit this zone — call it $80 to $82 because there is a gap-fill at $80.22 from late July — then the bulls will really want to see PayPal stock find support.

If it doesn’t and the stock loses this area as support, then the 78.6% retracement near $75 could be in play next, followed by a retest of the $67.50 to $70 zone.

If we see the latter — $67.50 to $70 — then PayPal stock could make new lows on the year.