Paychex is one of the best payroll software platforms available for small and medium-sized businesses. With this platform, you can easily manage payroll for dozens of employees and integrate benefits like healthcare and retirement into your payroll process. Plus, all Paychex plans include tax documentation and accounting software integration. The biggest downside is that the software is surprisingly expensive.

In our Paychex review, we’ll help you decide whether this payroll software is right for your business.

- Our guide to the best payroll software

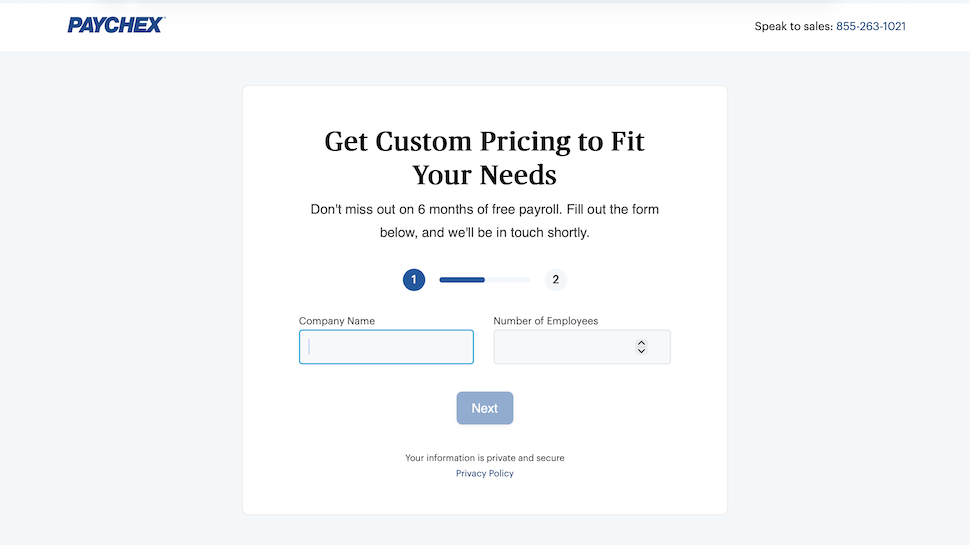

Paychex: Plans and pricing

Paychex used to operate on a three-tier system: Go, Flex Select and Flex Enterprise. As a guide, Paychex Go started at $59 per month plus $4 per employee, with higher plans coming at an undisclosed cost via a customized quote.

Unfortunately, Paychex has decided to apply this method across the whole platform now, so exact pricing is illusive.

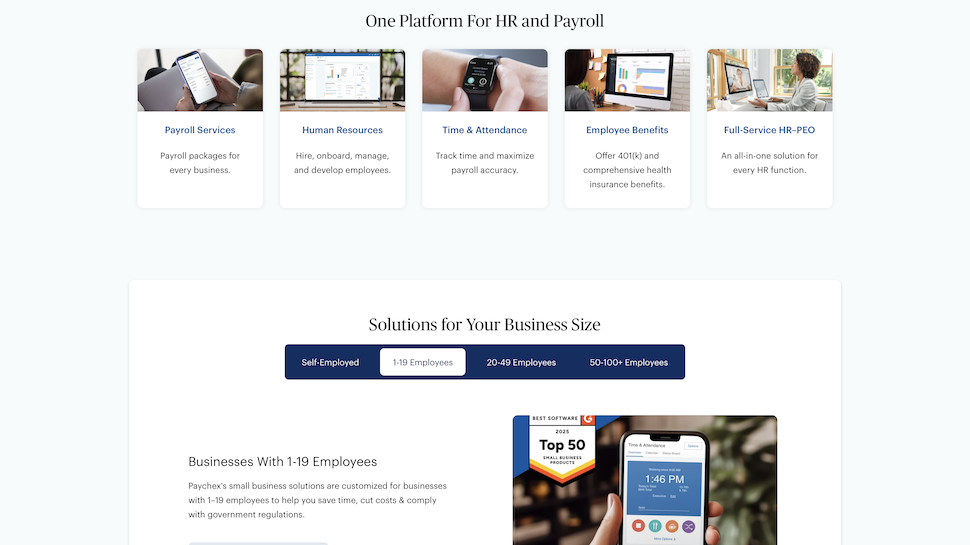

On the website, it describes four different sizes of business: self-employed (1), 1-19, 20-49 and 50-100+, suggesting four tiers of membership may be available.

Paychex: Features

Because Paychex comes with a couple of different subscription levels, what you get depends on how much you pay, but as a guide you can expect full payroll processing with W-2 and 1099 support, tax calculations and filing, and new hire reporting.

To pay your employees, Paychex enables you to make direct deposits or print your own paper checks. You have some flexibility, as you can set up multiple payment accounts for each employee.

You can also request prepaid debit cards for each employee and set up Paychex so that payments are automatically transferred onto these cards.

Onboarding tools are also available to help reduce the burden on HR teams, with workers gaining access via their own portal.

Employee dashboards have a built-in time tracker, which enables commenting, making it easy to see what your employees were spending time on throughout the pay period. They can also check their scheduling from here, too.

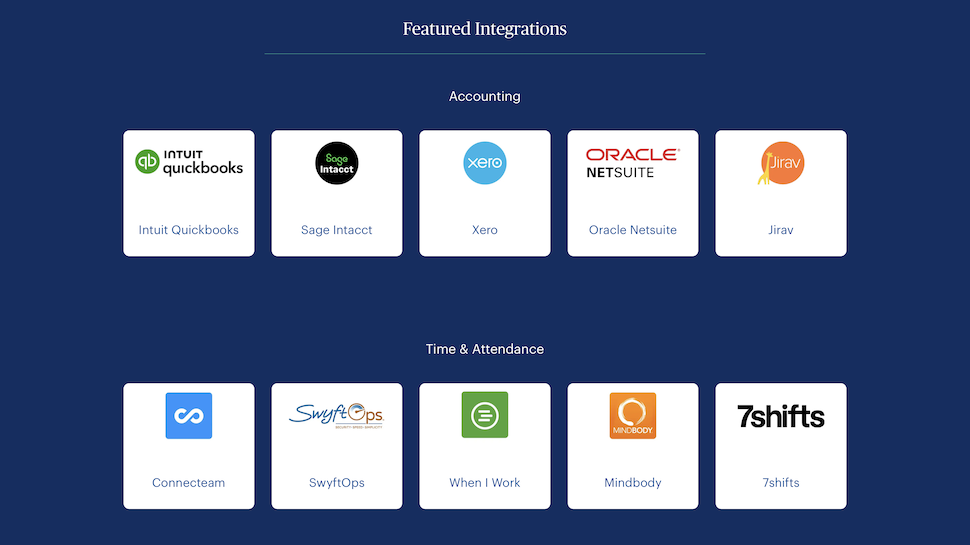

Importantly, Paychex can also integrate with most popular accounting software, including QuickBooks and Xero, to make calculating quarterly and annual tax payments much simpler.

One of our favorite things about Paychex is that the software also enables you to keep track of healthcare, retirement, along with other key benefits right alongside payroll.

You can set up a 401(k) for your business through Paychex Retirement Services or enroll employees in an HSA or FSA. When you enter payroll, Paychex will automatically calculate your employer contributions to these accounts and transfer the funds at the same time that checks go out to employees.

Beyond basic payroll and human capital management tools, Paychex also helps HR teams monitor performance and job costing/labor distribution, supporting growth strategies and summarizing figures to help predict the impact of growth.

Paychex: Ease of use

Paychex offers a simple online dashboard that’s fairly easy to navigate. You can see at a glance how much cash you need to have on hand to cover your last payroll period, as well as on what date the current period’s payroll needs to be approved.

To enter employee hours, Paychex uses a simple grid layout that saves a significant amount of time compared to the series of drop-down menus that some other payroll platforms use.

Another nice thing about Paychex is that it includes detailed analytics about your payroll. You can generate reports sorted by employee, office location, position, or any number of custom filters. In all, Paychex has more than 160 built-in standard reports for Go and Flex Select customers - and Flex Enterprise customers can set up even more.

On the whole, the interface is fairly intuitive for core tasks, but there does appear to be somewhat of a learning curve for some features and modules, which users occasionally report to be overwhelming.

We were happy to see that Paychex offers a mobile app, although we wish it were available to subscribers on the Go plan. The mobile app is particularly nice for employees, since they can use it to check their pay stubs, change their payment account details, or manage their 401(k) plan and health benefits.

Paychex: Support

Paychex provides multiple support channels including phone, email and online help, with employers getting 24/7 phone support and employees also able to access 24/7 support (but chat, not phone).

Employees can still phone Paychex, but they’ll only be granted support within office hours (from one of the 100+ US-based offices).

Support broadly feels better for higher-tier plans, which is often the case, but it would be nice to see companies offer strong support across all tiers.

There’s also a large library of HR and legal documentation as well as policy templates that can be useful for compliance, but some users note varying availability for other resources like tech support for integrations or less common modules.

For these, you’re probably better off getting in touch with a human, rather than using self-service options.

Paychex: Final verdict

Paychex is a feature-rich payroll software with a lot to like. If you want to integrate healthcare, retirement, or other benefits into your payroll, there are few better options for your business.

However, if you don’t need these integrations, it can be hard to justify Paychex’s price tag. The platform is very capable, but its main features are matched by Gusto at a more accessible price.

Paychex has a lot of features, but this platform can be prohibitively expensive for some small businesses. For a cheaper option, consider SurePayroll.

Regardless, we think Paychex offers a strong comprehensive solution with support spanning payroll, HR, compliance and other benefits. It has good regulatory compliance, particularly for US customers, and isn’t as hard as some other systems to use.

- Read our guide to the best payroll software