In the latest quarter, 14 analysts provided ratings for Parker Hannifin (NYSE:PH), showcasing a mix of bullish and bearish perspectives.

The table below summarizes their recent ratings, showcasing the evolving sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 4 | 7 | 3 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 2 | 1 | 2 | 0 | 0 |

| 2M Ago | 1 | 4 | 0 | 0 | 0 |

| 3M Ago | 1 | 1 | 1 | 0 | 0 |

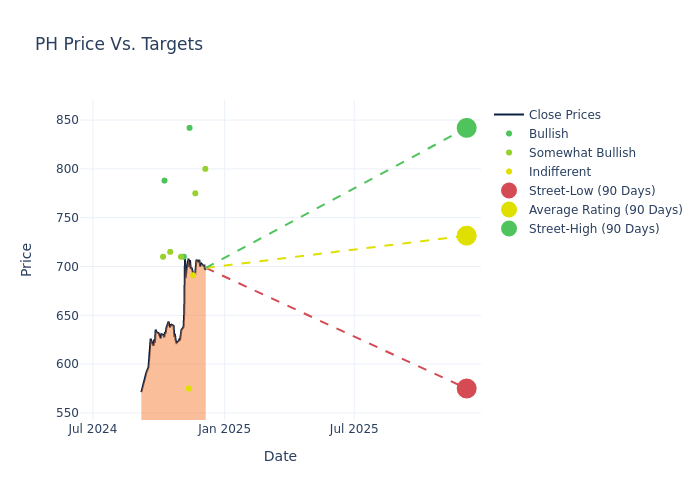

The 12-month price targets, analyzed by analysts, offer insights with an average target of $711.07, a high estimate of $842.00, and a low estimate of $520.00. This current average has increased by 10.24% from the previous average price target of $645.00.

Analyzing Analyst Ratings: A Detailed Breakdown

In examining recent analyst actions, we gain insights into how financial experts perceive Parker Hannifin. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Julian Mitchell | Barclays | Raises | Overweight | $800.00 | $703.00 |

| Jeffrey Hammond | Keybanc | Raises | Overweight | $775.00 | $725.00 |

| Nathan Jones | Stifel | Maintains | Hold | $691.00 | $691.00 |

| Amit Mehrotra | UBS | Announces | Buy | $842.00 | - |

| Joseph Giordano | TD Cowen | Raises | Hold | $575.00 | $520.00 |

| John Eade | Argus Research | Raises | Buy | $710.00 | $650.00 |

| Mircea Dobre | Baird | Raises | Outperform | $710.00 | $695.00 |

| Brett Linzey | Mizuho | Raises | Outperform | $715.00 | $665.00 |

| Jeffrey Hammond | Keybanc | Raises | Overweight | $725.00 | $640.00 |

| Jamie Cook | Truist Securities | Raises | Buy | $788.00 | $673.00 |

| Joseph O'Dea | Wells Fargo | Raises | Overweight | $710.00 | $640.00 |

| Julian Mitchell | Barclays | Raises | Overweight | $703.00 | $650.00 |

| Nathan Jones | Stifel | Raises | Buy | $691.00 | $633.00 |

| Joseph Giordano | TD Cowen | Raises | Hold | $520.00 | $500.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Parker Hannifin. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Parker Hannifin compared to the broader market.

- Price Targets: Analysts provide insights into price targets, offering estimates for the future value of Parker Hannifin's stock. This comparison reveals trends in analysts' expectations over time.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into Parker Hannifin's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on Parker Hannifin analyst ratings.

Unveiling the Story Behind Parker Hannifin

Parker Hannifin is an industrial conglomerate operating through two segments: diversified industrial, which serves a variety of end markets, and aerospace systems, which sells engine and actuation components. The diversified industrial segment consists of six groups, including engineered materials (sealing devices), filtration (filters and systems monitoring and removing contaminants from liquids and gases), fluid connectors (valves, couplings, and other fittings), instrumentation (flow manufacturing components and fluid control applications), and motion systems (hydraulic, pneumatic, and electromechanical components in industrial machinery and equipment). The segment boasts 17,100 independent distributors, and about 40% of its business occurs outside the United States.

Parker Hannifin: Delving into Financials

Market Capitalization Analysis: With an elevated market capitalization, the company stands out above industry averages, showcasing substantial size and market acknowledgment.

Revenue Growth: Over the 3 months period, Parker Hannifin showcased positive performance, achieving a revenue growth rate of 1.17% as of 30 September, 2024. This reflects a substantial increase in the company's top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Industrials sector.

Net Margin: Parker Hannifin's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 14.24% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 5.6%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Parker Hannifin's ROA is below industry standards, pointing towards difficulties in efficiently utilizing assets. With an ROA of 2.37%, the company may encounter challenges in delivering satisfactory returns from its assets.

Debt Management: Parker Hannifin's debt-to-equity ratio surpasses industry norms, standing at 0.79. This suggests the company carries a substantial amount of debt, posing potential financial challenges.

What Are Analyst Ratings?

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.