Safe-haven stocks lately have been winning the race, and investors don’t have to look past Procter & Gamble (PG) to see that that’s the case.

The consumer-products giant's shares are up a modest 2.5% on the day but are hitting multimonth highs.

Look at the landscape.

Utilities continue to trade well. So do the dollar and gold — two more safe-haven names. See how PepsiCo (PEP) and McDonald’s (MCD) are trading ahead of their earnings reports. Notice how Johnson & Johnson (JNJ) is trading after earnings, hitting new all-time highs.

Then look at growth stocks, notably the plunge in Netflix (NFLX).

There’s a clear divide between risk-on and risk-off assets at the moment, and so far the latter group is leading the way.

In the case of P&G, the company beat on earnings and raised its full-year revenue outlook.

While the momentum in this group is slower than we typically see for our in-focus stocks, it’s hard to deny that these stocks are the ones that have momentum.

Trading Procter & Gamble Stock

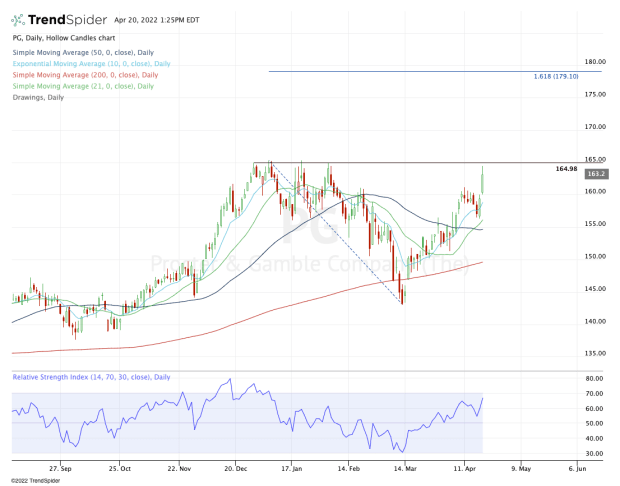

Chart courtesy of TrendSpider.com

As we look at the chart, the $165 level poses very clear resistance. Not only was this resistance in the fourth and first quarters, but it’s acting as resistance again today.

Even on the post-earnings pop, Procter & Gamble stock is topping out near $164.50.

If we can see a continued rally, $165 is the key level for P&G to break out over. If it can’t clear this level, then it may need to pull back before continuing higher.

If that’s the case, I will keep a close eye on the $160 level — which was recent resistance — and the rising 10-day moving average. It would be quite bullish to see prior resistance turn to support and for a short-term moving average like the 10-day to buoy the share price.

Below these measures would put the 21-day moving average in play.

On the upside, clearing $165 would be quite bullish. If Procter & Gamble stock can do that, then it opens the door to the $175 to $179 area. Near the latter end of that range, it puts the 161.8% extension in play.

That would be one powerful move for a slow-mover like Procter & Gamble, but it could be in the cards if these risk-off stocks continue trading well.