More than $1 billion was liquidated from crypto markets as Bitcoin (CRYPTO: BTC) lost support at $30,000.

What Happened: According to data from Benzinga Pro, Bitcoin fell 8% on Monday to $29,944 – the lowest since July 2021.

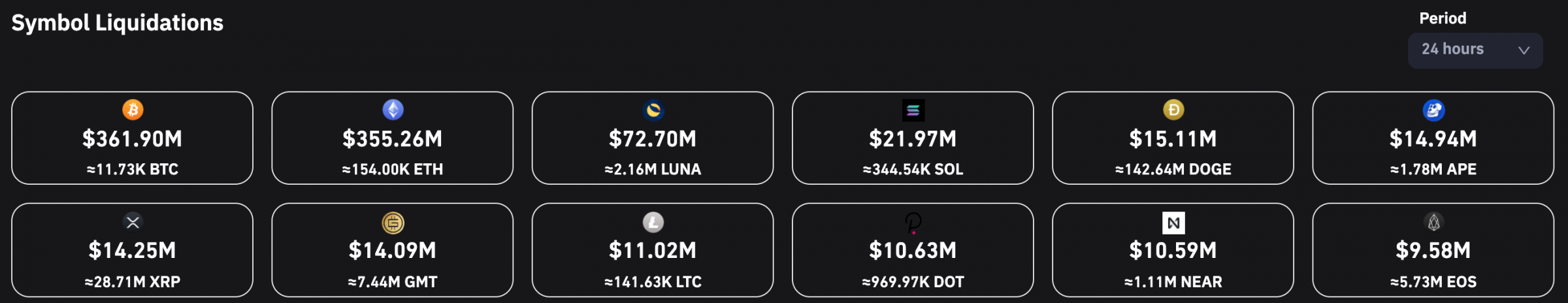

Data from Coinglass shows that over 280,000 crypto traders were liquidated over the last 24 hours with total liquidations exceeding $1.1 billion.

There were $361 million Bitcoin liquidations, $355 million Ethereum (CRYPTO: ETH) liquidations, and $72 million Terra (CRYPTO: LUNA) liquidations.

Meme-based cryptocurrency Dogecoin (CRYPTO: DOGE) saw $15.11 million liquidated. Popular altcoins like XRP (CRYPTO: XRP), Solana (CRYPTO: SOL), and ApeCoin (CRYPTO: APE) also saw liquidations on a similar scale.

Wow - $82 million in #Bitcoin Long Liquidations in 2 hours, with almost $63 million in 1 hour pic.twitter.com/BXF84eONgC

— On-Chain College (@OnChainCollege) May 5, 2022

Unsurprisingly, the majority of liquidations were faced by traders in long positions with data showing that $787 million longs were liquidated over the last 24 hours.

The single largest liquidation order took place on cryptocurrency exchange BitMEX on a Bitcoin/U.S. dollar trading pair. The trader in question lost $6.3 million.

Industry watchers concluded that Bitcoin is vulnerable at these levels despite strong long-term fundamentals.

See Also: BEST CRYPTOCURRENCIES

Price Action: At press time, Bitcoin was trading at $31,151, Ethereum was trading at $2,337 and Dogecoin was trading at $0.10.