The climate transition is a materials transition. Decades of international diplomacy around oil, gas and pipelines are now giving way to conversations around the supply of critical raw materials. And not before time: to meet the EU’s energy and climate targets, we need to build the right technologies, in the right quantities, at the right speed. The problem is that many of these technologies are built with materials imported from just a handful of countries.

Critical raw materials are defined as those materials which have significant economic importance and are exposed to a high supply risk, often because of a high concentration of supply from a few third countries.

Demand for these precious resources is expected to increase exponentially in the coming years, not just in the EU, but around the world. This will increase global competition just as the EU’s own needs soar. Against this backdrop, preparedness is crucial.

On 23 May, the EU’s Critical Raw Materials Act comes into force. The Act is a first attempt to provide Europeans with a regulatory bedrock to develop domestic resources, diversify sourcing and strengthen the resilience of supply chains and the circularity of critical raw materials in the EU, all while striving to ensure the highest social and environmental standards.

The new rules outline three goals for the EU’s annual consumption of raw materials: 10% are to originate from local extraction, 40% to be processed in the bloc and 25% to come from recycled materials. The act also claims that no more than 65% of a given mineral can be sourced from a single non-EU country. As a sign of urgency, the Act was adopted in record time – only eight months from its original publication.

Demand for rare earths for clean energy technologies to increase fivefold by 2030

In our work at the EU’s Joint Research Centre (JRC), we showed that in the case of many of the strategic clean energy technologies, the bloc is entirely dependent on single sources – most often China – for raw materials, and also for other segments of the value chain. Our finding that demand for rare earths will increase fivefold by 2030 to satisfy our wind turbine needs alone, was quoted by President von der Leyen when she announced the Commission’s intention to introduce the Critical Raw Materials Act.

The proposed Act was published last year alongside our comprehensive forecast on critical materials supply chains and demand. Our study analyses the supply chains of 15 technologies crucial to achieving the green and digital transitions and the EU’s defence and space agenda, across five key sectors: renewables, electromobility, Information and Communication Technologies (ICT), industry and aerospace & defence. The study also helped to establish the concept of strategic raw materials, and the list of materials it encompasses. Strategic raw materials fulfil some additional criteria: they are key to technologies which are strategic for the EU’s energy and digital transition and its security goals; their demand is forecast to increase rapidly, perhaps outstripping supply; options for substitution are limited; and scaling up production is difficult.

Unprecedented demand and concentration of supply

The study shows a rapid, multi-fold increase in the demand for the critical raw materials which are key to the EU’s green, digital and security goals. The EU relies heavily on imports for these materials. In fact, for raw materials supply, the EU share in global production is never higher than 7%.

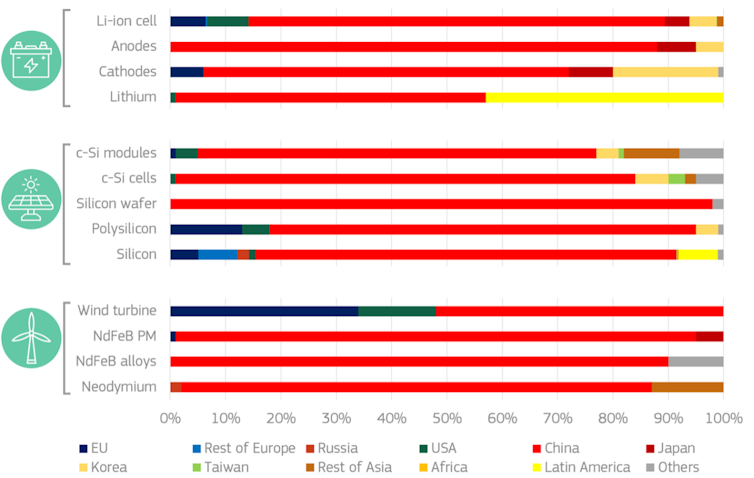

For example, while the EU is a global leader in wind turbine production, it is fully dependent on China for the permanent magnets and the rare earth elements used in them. China is also the major world supplier for crystalline silicon solar photovoltaic cells and modules, the main technology that will be deployed to achieve the almost fivefold increase in the EU’s solar PV capacity by 2030.

Raw materials are also key for hydrogen electrolysers, especially as the bloc’s plan to wean itself off Russian energy imports by 2027, REPowerEU, requires a tenfold increase in electrolyser manufacturing capacity in Europe by 2025. Global shortages in materials such as iridium loom in the 2020s and 2030s, as supply is unlikely to keep pace with demand unless significant actions are taken.

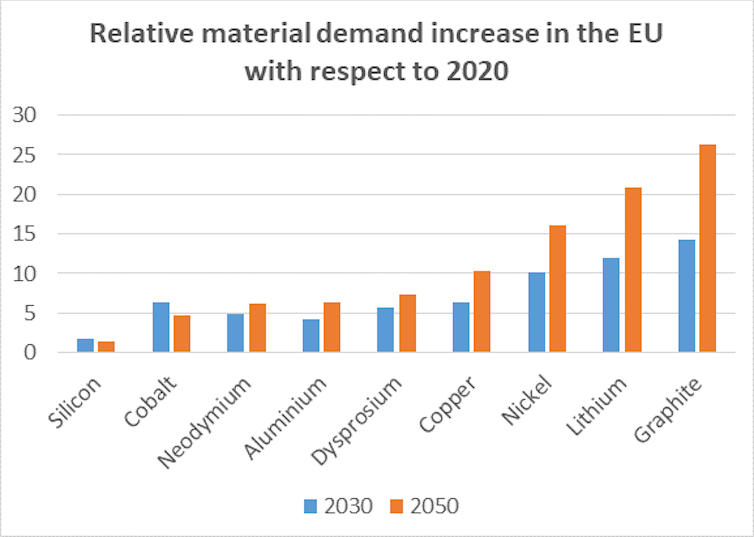

We predict a rapid increase in demand for critical raw materials not only in the EU but also in all regions of the world, precipitating competition for them across countries and sectors. For example, compared to 2020, lithium demand for batteries in the EU is expected to grow 12 times as large in 2030 and 21 times as large in 2050. Globally, the surge with respect to 2020 is 18 times in 2030 and 90 times in 2050.

A similar pattern is found for graphite (natural and synthetic), which is used for components of solar and wind industries and batteries. Demand is expected to increase 14 times by 2030 and 26 times by 2050, compared to 2020.

Hope for the best, prepare for the worst

In addition, the Covid-19 crisis, the Suez Canal obstruction in 2021 and the 2020-2023 global microchips shortages have also reminded us of our supply chains’ vulnerability.

Figure 1 shows global shares in production for materials and key components in the main renewable energy technologies. It also shows how dependencies propagate downstream in the value chain, extending from raw materials to components and to the final products, and how complicated it is to deal with these dependencies in an integrated way. The dominant role of China raises concerns not only about the competitiveness of EU industry but also increases the risk of supply disruptions, thus constituting an important geopolitical risk.

Propagation of dependencies along the value chain

The EU needs to monitor the supply disruption risk and to prepare for these events. Or, as Stephen King said, “we can hope for the best for as long as we are prepared for the worst”.

The Act requires that stress tests are carried out for the supply chain of each strategic raw material at least every three years. These are what-if scenarios, analysing the potential impact of severe supply disruption events and the way supply chains would react. The EU and its Member States would need to know, for example, what sectors would be affected by a potential disruption in the supply of a particular material, what shortages or price spikes might follow, and the cascading effects of those. Such stress tests are not unusual in other sectors such as banking and energy supply, and can provide useful insights into the resilience of supply chains.

Innovation and substitution with advanced materials

Anticipation is key to getting this right. New production and processing capacities take time to develop. While we don’t have good alternative materials yet, research and innovation in advanced materials is of paramount importance both to the EU’s autonomy and to its global leadership.

In fact, energy is one of the key research and innovation priorities identified in a Communication on advanced materials supply for industry published by the Commission in February this year.

Advanced materials can help by decreasing production costs, increasing efficiency, and making production more sustainable (for instance by using lower amounts of critical raw materials).

At the JRC we are looking closely at the gap between demand and innovation, with a particular focus on high-impact areas and supply chain resilience. We find that advanced materials can be good for innovation and substitution in many clean energy technologies, but they often face barriers to widespread adoption. We need to ensure that more efficient, sustainable alternatives reach the market faster.

Optimising the properties and composition of materials is already helping reduce – and could even eliminate – cobalt and nickel from electric-vehicle batteries, and possibly even replacing lithium with sodium. It could also mean a steady reduction of rare-earth content in permanent magnets for wind turbine generators. And new chemical solvents for carbon dioxide capture would offer improved environmental and operational performance.

This article is based on work carried out over several years by the JRC’s “Materials and Supply Chains for the Energy Transition” team, alongside other colleagues in the JRC and the Commission. The authors are grateful in particular for the insights and collaboration of colleagues in the Energy Transition Insights for Policy unit of the JRC, Vangelis Tzimas, Nicola Magnani, Catriona Black, Angel Prior Arce, Teodor Kuzov and Patricia Alves Dias. They also wish to acknowledge the important role of all co-authors of the JRC Foresight Study, and especially the guidance and advice of Constanze Veeh and Milan Grohol of the European Commission’s Directorate-General for Internal Market, Industry, Entrepreneurship and SMEs (DG GROW).

The contents of this article do not necessarily reflect the position or opinion of the European Commission.

Les auteurs ne travaillent pas, ne conseillent pas, ne possèdent pas de parts, ne reçoivent pas de fonds d'une organisation qui pourrait tirer profit de cet article, et n'ont déclaré aucune autre affiliation que leur organisme de recherche.

This article was originally published on The Conversation. Read the original article.