US food giant Mondelez, maker of Oreo cookies, has been hit with a hefty €337.5 million (£288 million) fine by the European Commission for anticompetitive practices. The company is accused of hindering sales of its products across EU member states on Thursday.

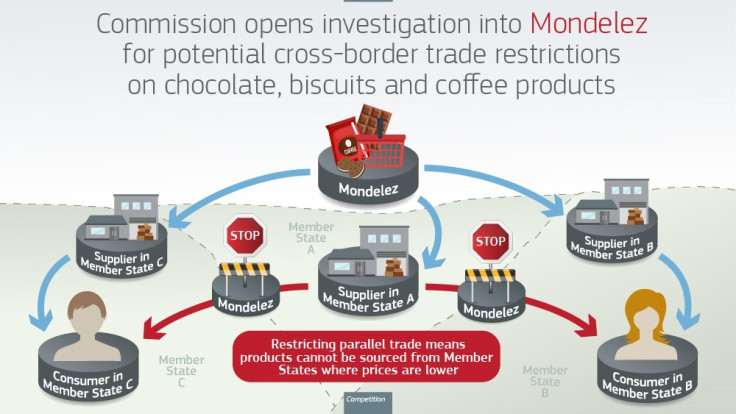

According to the Commission, Mondelez sought to restrict cross-border sales, fearing it would trigger price reductions, ultimately harming consumers who would pay more for their favourite chocolates, biscuits, and coffees.

"Such illegal practices allowed Mondelez to continue charging more for its products, to the detriment of consumers in the EU," it said in a press release. The EU Commission fined Chicago-based Mondelez for breaching competition rules.

The EU's findings come at a tough time for European and American consumers. A 2022 data and industry leader comments revealed a concerning trend: rising costs of living are forcing consumers to cut back on chocolate purchases.

Mondelez's snack portfolio includes chocolate giants Cadbury and Toblerone, cookie favourites Oreo and Chips Ahoy, and healthy options like Triscuit crackers and Perfect Snacks nutrition bars.

EU Commission Accuses Mondelez of Stifling Cross-Border Sales

The company allegedly engaged in "anticompetitive agreements or concerted practices aimed at restricting cross-border trade of various chocolate, biscuit and coffee products," the Commission said. Mondelez also abused its dominant market position in specific national chocolate markets.

Underscoring the importance of protecting the free movement of goods, especially during high inflation and grocery prices, European Competition Commissioner Margrethe Vestager commented, "It is also about the heart of the European project: the free movement of goods in the single market."

The European Commission claims Mondelez engaged in 22 anticompetitive agreements or practices. One particularly egregious example involved a provision that forced Mondelez's customers to charge higher prices for exports than domestic sales.

Mondelez's anticompetitive practices, uncovered by the EU, have been in place since at least 2022. This coincides with when many food companies, including General Mills, Coca-Cola, and PepsiCo, raised prices due to inflation.

However, Mondelez's strategy exceeded price hikes, as they allegedly restricted competition to maintain high prices artificially. The Commission further alleged that Mondelez restricted its distributors' freedom as well. Without the company's green light, ten exclusive distributors across the EU were allegedly prohibited from fulfilling customer sales requests in other member states.

Mondelez Disputes Allegations

The Commission's investigation uncovered a scheme by Mondelez to restrict sales across the EU. From 2012 to 2019, they limited the number of wholesale buyers who could resell their products. Even earlier, between 2006 and 2020, ten exclusive distributors in some EU countries were prevented from responding to sales inquiries from customers in other member states.

The EU watchdog further revealed that Mondelez's anticompetitive practices extended beyond restricted sales territories. Between 2015 and 2019, they refused to supply a German broker to prevent chocolate resales in four higher-priced countries. The EU investigation also found that Mondelez cut off supplies to a Netherlands distributor to stop them from importing products into Belgium.

In response to the EU's accusations, Mondelez downplayed the issue, characterizing the alleged anticompetitive practices as historical, isolated incidents. They claim most of these practices had ceased or been addressed well before the Commission's investigation began.

"This historical matter is not representative of who we are and the strong culture of compliance we strive for," a Mondelez spokesperson said via Reuters.