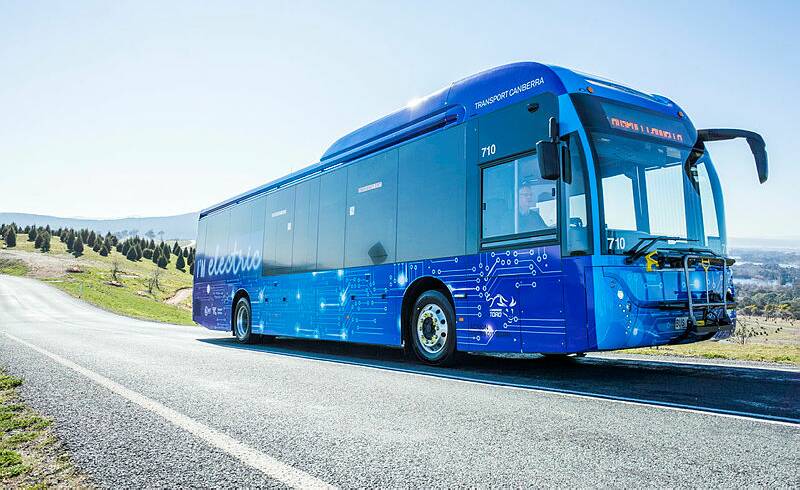

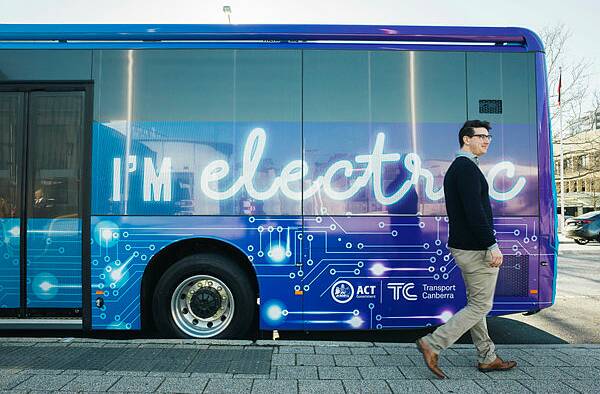

Two international companies pitching for Canberra's electric bus business are planning to bring the latest lightweight composite technology transplanted from Europe here to optimise operating efficiency, with one tenderer offering to set up a "micro-factory" to build the buses in the territory.

The ACT government is just weeks away from announcing the successful tenderer for the $37.5 million contract to replace 34 of the oldest diesel buses in its fleet. Other states and territories are watching the tender outcome with interest.

The deputy director-general of Transport Canberra, Ben McHugh, has gone on the record with his belief the traditional bus fleet ownership and operating model, which has been in effect since ACT self-government, is no longer applicable.

Transport Canberra has a fleet of 451 buses housed across two depots, with a substantial number of these facing retirement in the next decade.

The initial challenge with this tender is that the ACT power grid is already at capacity, and Transport Canberra cannot introduce too many zero-emission buses at once without, as it admitted in its transition plan, "risking major infrastructure upgrades and impacting services".

This means the electric buses coming onto the fleet will need a separate off-depot stabling and charging site in the short term before a dedicated zero-emissions bus depot, most likely at Woden, is built in the next three to four years.

Offsetting their drain on the grid is that electric buses, when charged, plugged in but not in use, effectively deliver a secondary role in helping manage energy demand and stabilise the grid.

Nexport chief executive officer Michel van Maanen said the country's inevitable transition to electric-powered buses offered an opportunity to "change the way we look at everything" in public transport - even down to how the service is charged against the public purse.

"It's time we stopped thinking in traditional terms about a bus as a form of public transport; instead we need to reshape our thinking," the recently-appointed Dutch-born chief executive said.

"Our focus is on mobility solutions. It's about creating an optimised, flexible public network that really works; that manages the peaks and troughs of public demand and patronage but doesn't have a 65-seater bus operating a route with two people on board.

"That makes no sense."

Mr van Maanen arrives in Australia fresh from preparing and scaling up Dutch bus innovator Ebusco to a point where on the back of its future European sales prospects, was floated on the stock market in Europe in October last year for just over $2 billion.

Ironically, he has opted to build a fresh business in an immature (by European standards) electric vehicle industry - and in direct competition against his old company Ebusco.

Dutch busmaker Ebusco pioneered the use of production composites to create lightweight e-buses which are far more efficient and better suited to battery technology than the traditional steel and aluminium type. They also offer a range of 500-plus kilometres per charge.

That same knowhow is set to revolutionise the bus industry here. Nexport is about to open a factory in Bankstown, in western Sydney, to shape a business model which could be picked up and dropped into any market in the country, from Perth to Canberra.

Built from kits, the lightweight Nexport buses can be produced cost-efficiently in the same markets they will eventually serve. Such a concept would be highly appealing politically, as it generates employment and fosters high-tech skills and jobs for local markets

"When you say the words 'bus manufacturing' to people, everyone has this picture in their mind of this huge, noisy space with sparks flying from welding guns, and engines and gearboxes being lifted into place," he said.

"With an electric bus drivetrain, that's gone; this would be a clean, high-tech modern assembly operation."

China is the world's best-developed market for electric buses so both Ebusco and Nexport source their battery packs and battery management systems from there.

Under the Nexport business model, the private company would be paid $1.30 per kilometre of distance travelled, compared with around $1.50 per kilometre for a diesel bus of the same size.

"We would envision a public-private partnership but we carry all the risk," he said.

The charge per kilometre model would be appealing to government because it allows the private consortium to deal with some of the more thorny issues, such as battery degradation and recycling.