No one seems to be talking about International Business Machines (IBM) lately, but that's because no one ever seems to be talking about IBM!

Yet, it's been one of the best-performing stocks in the tech sector.

While IBM is a big firm with a $130 billion market cap, the rise of other tech conglomerates now dwarf IBM and its once-mighty hold on the sector.

Alphabet (GOOGL) (GOOG) is more than 10 times the size of IBM, while Apple (AAPL) is 20 times larger. About 13 years ago, IBM was slightly bigger than both Apple and Alphabet, as measured by market cap.

That puts into context how IBM has failed to keep pace over the years. However, the stock has not failed to keep pace this year.

So far on the year, IBM stock is actually up 5.6%. That’s as Apple and Alphabet are down 16.6% and 19.1%, respectively. For what it’s worth, the Nasdaq is down 22.5% so far in 2022.

Further, IBM stock is down just 2.2% from its 52-week high (adjusted for the dividend), which it hit earlier this week. The others — Apple, Alphabet and the Nasdaq — are down much more, at 18.6%, 21.8% and 24.6%, respectively.

Trading IBM Stock

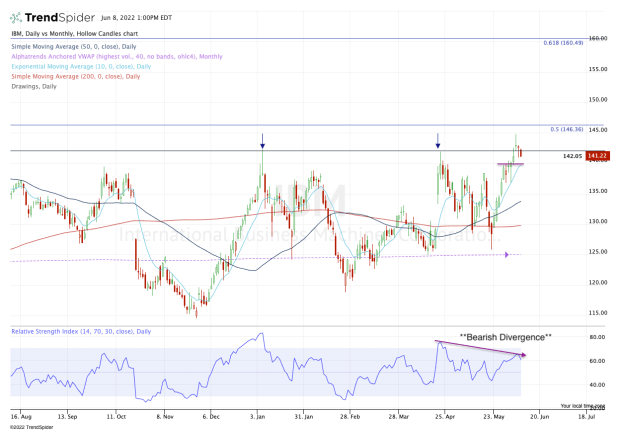

Chart courtesy of TrendSpider.com

IBM stock has been enjoying quite the ride, recently rallying in nine out of 10 sessions. However, it’s now pulling back, which could be good for the bulls.

It’s pretty simple: I want to see IBM hold the $140 level — which was minor resistance last week — and active support via the 10-day moving average.

If we get a test of this area and support holds, then IBM stock could rotate higher once again. That puts $142 back in play almost immediately, followed by the recent high near $145.

Above that opens the door to the 50% retracement of the full range near $146.50 (as measured from the Covid-19 low to the all-time high in 2013), then the $150 level.

On the downside, a break of active support could quickly usher in the $133 to $135 zone and the 50-day moving average.

Obviously, IBM stock is a surprising outperformer in a tech space that tends to be loaded with “risk-on” names and high-growth firms — categories that IBM doesn't fit in.

I don’t expect this outperformance to last forever. Eventually Alphabet, Apple and many stocks in between will eventually find their footing and investors will bail on stocks like IBM to go into the higher beta holdings.

But for now the trend is our friend and the trend in IBM stock is strong.