New measures to better protect customers’ money and stop energy suppliers using some of their cash “like an interest-free company credit card” are to be announced on Monday by the industry regulator.

Ofgem said its package of “tough” measures was aimed at reducing the risk of more energy suppliers going bust, and would also include changes designed to stop firms raising customers’ direct debit payments by more than necessary.

The shake-up is intended to ensure that suppliers “can weather the ongoing storm” and to prevent a repeat of last year’s failures “that put unfair and unnecessary costs and worry on to consumers”.

More than 30 energy suppliers have gone bust since the start of last year as a sharp increase in wholesale energy costs triggered widespread losses.

In April, Ofgem’s energy price cap rose by 54% – or almost £700 – to £1,971 a year, and last month the regulator indicated that it was set to rise again, by £800 or more, to about £2,800 in October. That in turn is expected to help push inflation above 11% later this year.

Ofgem said the measures were designed to improve the financial health of suppliers so that they could stand up to any future shocks, especially over the autumn and winter. It added that if some did still fail, customer credit balances and green levy payments would now be protected.

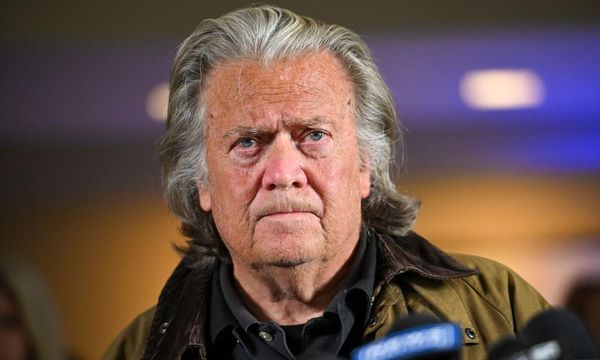

“Currently, they are used by some suppliers like an interest-free company credit card,” said Jonathan Brearley, the chief executive of Ofgem. “Moving forward, all suppliers will have to have enough working capital to run, without putting their customers’ credit balances at risk.”

When a supplier fails, customers are moved to a new energy supplier with their credit balances intact. However, under the existing rules, the new supplier does not get the customer credit balances from the failed supplier, so the cost of replacing them is spread across all consumer bills.

The regulator has proposed rules that would require suppliers to place customer funds in a separate account, ensuring that any overpaid credit would be preserved in the event of a collapse.

Last month the government said some suppliers had been increasing people’s direct debit payments by more than was necessary.

Ofgem said its proposed changes also included a tightening of the rules on the level of direct debits that suppliers can charge customers, “to ensure credit balances do not become excessive”.