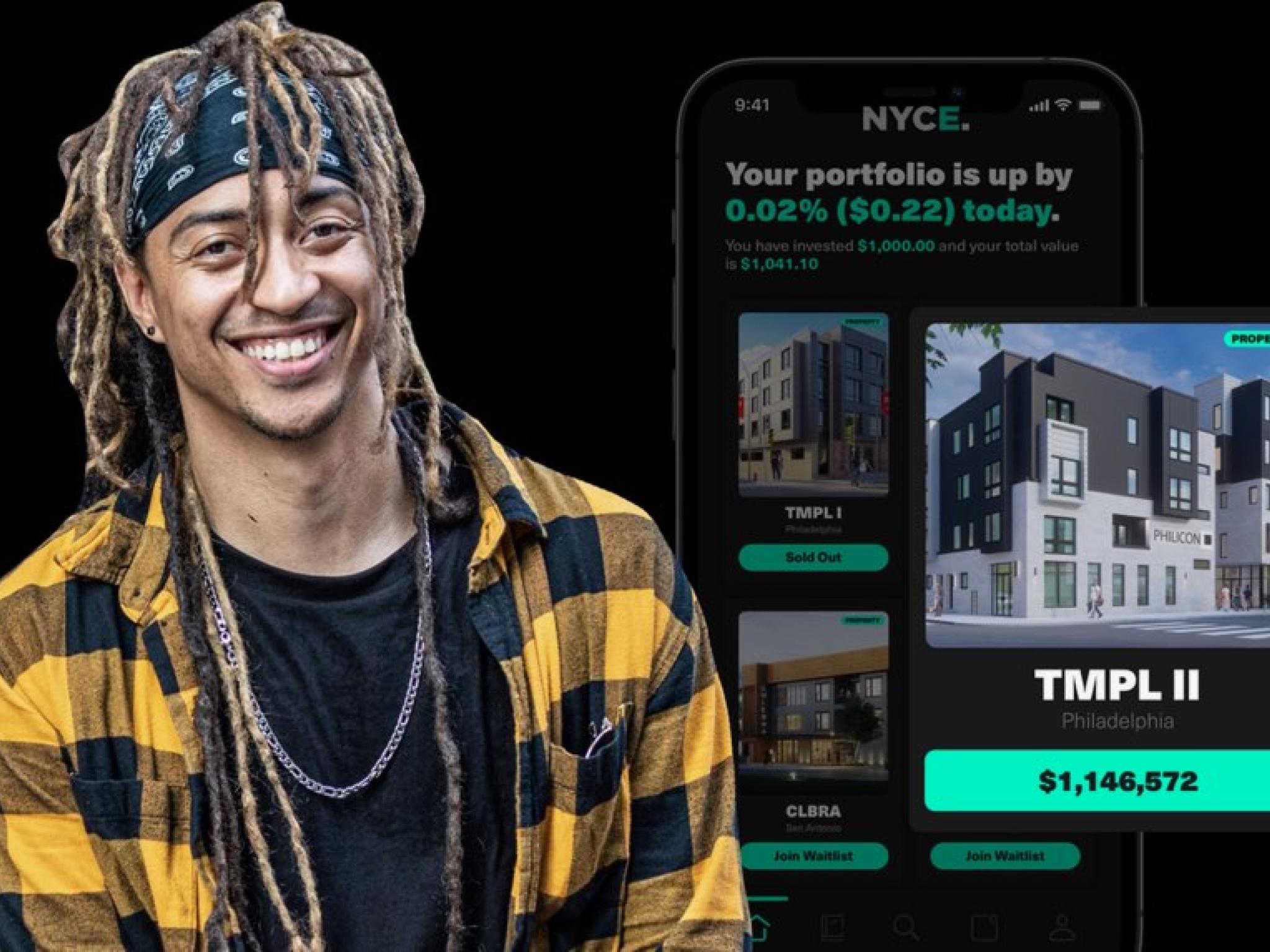

NYCE, a fintech geared toward real estate investing, formally achieved its third real estate crowdfunding record during its raise for TEMPLE II, the Phase II, and III of a 105-bed tech-powered student housing development in partnership with Temple University.

Context: NYCE is the Robinhood of real estate investing. Through its app, micro-investors have the ability to buy into real estate.

The firm was founded by Philip Michael, who is the CEO, and Martin Braithwaite, who also plays soccer for FC Barcelona. Together, the two are mending disparities in social and economic justice among different classes and demographics.

What Happened: This is the third time NYCE has broken a crowdfunding record using the Wefunder and Republic investing platforms.

Before it was the raise of $1 million for TEMPLE I “Tech Mansion,” a living development built on the grounds of and in partnership with Temple University.

This most recent raise is to benefit the building of Phase I and II of TEMPLE II, an 88-unit “hacker house” co-living complex for student entrepreneurs.

This project is powered by Temple University’s Fox Business School and expected to open in 2023.

Graphic: Via NYCE.

Why It Matters: It is NYCE’s commitment to creating 100,000 millionaires of color through non-accredited investment and asset ownership.

“We want to be the ‘gateway drug’ to wealth for first-time investors,” CEO Philip Michael told Benzinga. “People want to own, and we’re proud that we can help bring that to life, in our own way.”

Work on TEMPLE II broke ground last month, with State Senator Sharif Street and media on site. TEMPLE II is part of NYCE’s $250 million portfolio and is offered in stakes of $100 apiece.

Graphic: Via NYCE.

“It’s a different model,” Michael said. “As a company, we’ve taken on the project cost and entitlement risk before bringing on investors to make it less risky for first-timers who may be on the fence about coming into real estate.”

Bonus Points: Per Wefunder, TEMPLE II closes this month with a targeted investor exit through an IPO via LEX Markets, a Nasdaq Inc-powered (NASDAQ:NDAQ) trading platform.

Later this year, NYCE’s Michael says the firm will unveil “three-to-four new properties,” plus broader access to asset classes like stocks, REITs and crypto.

“The approach is simple, really,” he said. “Offer the same opportunities Wall Street offers their wealthy clients, where true wealth is created. But to bring it to the masses at large.”