For Intel, 2024 has been a cruel year, maybe the worst of years.

Intel (INTC) has struggled to jumpstart a storied business that has been unable to cope with the violent and dynamic changes that have overtaken the semiconductor industry.

💰💸 Don’t miss the move: SIGN UP for TheStreet’s FREE Daily newsletter 💰💸

The shares ended Friday at $23.20, up 7.8% on the day but down a sickening 54% on the year.

Intel's market cap is "only" $100 billion, but that's down from $282 billion in February 2020.

Related: Veteran trader makes surprising call between Palantir, Nvidia stock

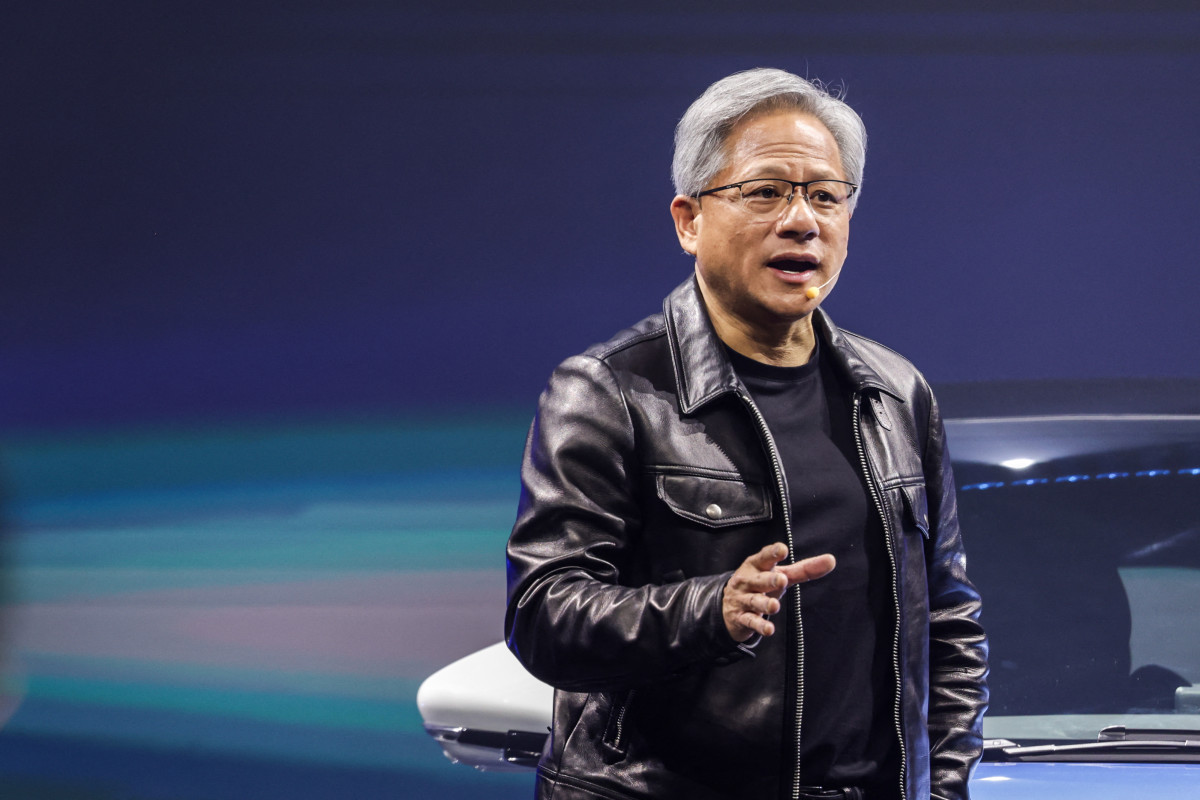

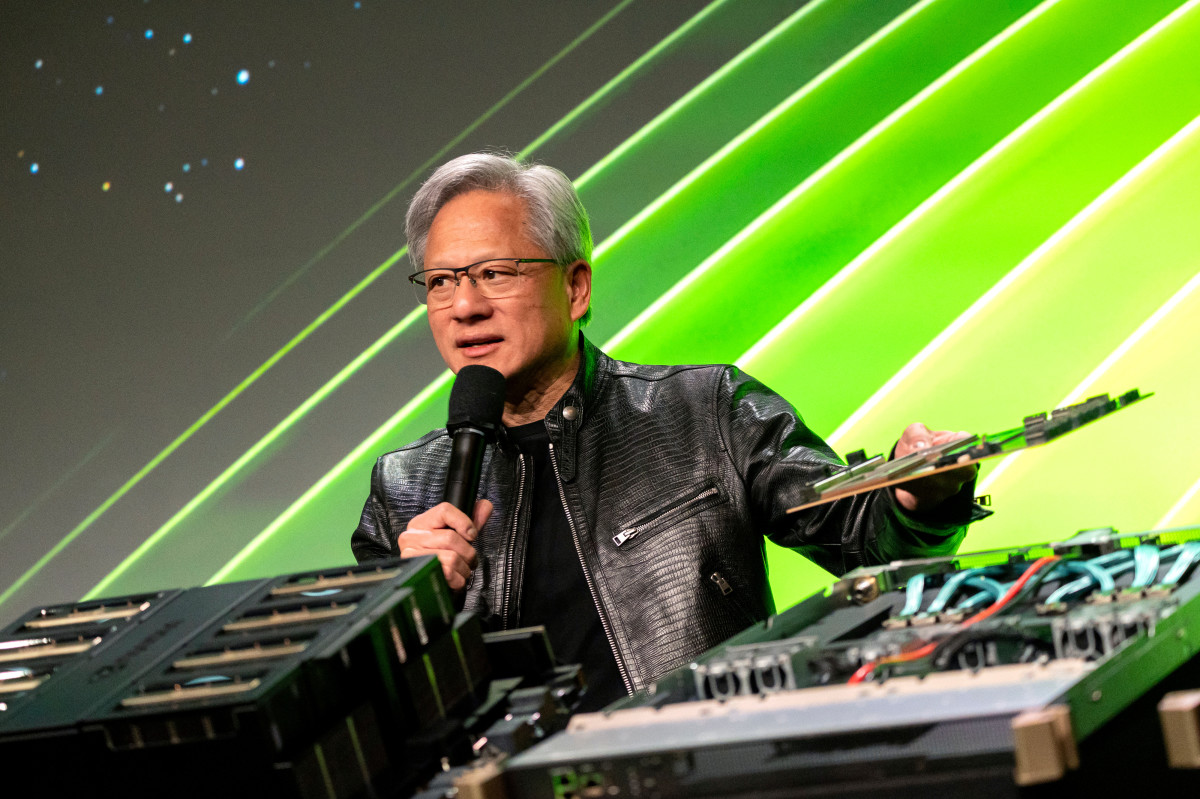

For Nvidia (NVDA) , this has been the best of years. The company, led by Jensen Huang, makes the graphic processing chips that are the foundation of artificial intelligence, and everyone wants a piece of the company. The shares were up 2% to $135.40 on Friday and are up 173.4% on the year.

Its market capitalization is now at $3.32 trillion, second only to Apple (AAPL) , whose market cap is now $3.37 billion. Huang is now a billionaire.

Small wonder that S&P Dow Jones Indices, the company that manages the Dow Jones Industrial Average, announced Friday that Nvidia will replace Intel in the Dow before the U.S. stock market opens on Nov. 8.

The reason, the index manager said, was to ensure a more representative exposure to the semiconductor industry.

Why Nvidia goes into the Dow Jones 30

Nvidia enters the Dow in part because its stock price is so high compared with Intel's. The Dow is a price-weighted index, and changes in a low-priced stock have little effect on the index.

Related: Nvidia to reap billions in AI spending as Mag 7 peers ramp investments

Nvidia's inclusion in the Dow became increasingly probable after it split its stock 10-for-1 earlier this year.

In the grand scheme of things, however, being in the Dow is not as important as getting into the S&P 500. Few money managers benchmark their results against the Dow Jones Industrial Average despite it being a commonly referenced index. The S&P 500 dominates that world.

Nvidia's forte originally was making fast chips for video games. Then, developers of artificial intelligence discovered the technology could completely remake computing.

Its H100 AI chips quickly became in high demand because they were far more efficient at training and operating AI models like ChatGPT than CPUs, which dominate data centers.

The H100 was followed by the H200, which will soon be replaced by Nvidia's latest chips, Blackwell.

Nvidia's market capitalization jumped from $18 billion at the end of 2015 to $3.32 trillion, a gain of some 18,350%.

Intel, a Dow component since 1999, has been the index's worst performer in 2024.

Its struggles represent a massive comedown from the 1980s and 1990s when it dominated the semiconductor industry, designing and making the chips used to run personal computers.

More Economic Analysis:

- Goldman Sachs analyst overhauls S&P 500 targets for 2024, 2025

- PCE Inflation report resets bets on another big Fed rate cut

- Why stocks are soaring and the rally has room to run

Under the leadership of the late Andrew Grove, Intel became a major technology force when it joined Microsoft (MSFT) to create the chips to power the Windows operating system, which powered nearly all non-Apple personal computers in the 1980s and 1990s. Together, they were known as "Wintel."

Since summer, there has been speculation that Intel might be replaced in the Dow by Nvidia. There was even talk that Qualcomm (QCOM) wanted to buy the company.

Qualcomm focuses on chips used in telecommunications and smartphones, and artificial intelligence.

Sherwin-Williams joins the Dow Jones Industrial Average; Vistra goes into the utility index

S&P Dow Jones announced two other changes in its indexes.

Chemical maker Dow Inc. (DOW) will be replaced by paint-and-coatings maker Sherwin-Williams (SHW) , also on Nov. 8. In terms of market capitalization, it was the smallest of the Dow stocks. The shares closed Friday at $48.97, down 0.83%.

Sherwin-Williams finished at $357.97 and will be the sixth-highest priced Dow stock after UnitedHealth Group (UNH) , Goldman Sachs (GS) , Microsoft, Home Depot (HD) and Caterpillar (CAT) .

In a third move, S&P Dow Jones also said it will add Vistra Corp. (VST) , the giant electric utility company, to the Dow Jones Utilities Average. The Texas company replaces AES Corp. (AES) . AES, based in Arlington, Va., operates electric generation facilities and sells the power to others.

Related: Veteran fund manager sees world of pain coming for stocks