Nvidia shares tumbled in early Monday trading, extending the stock's one-month decline to around 23%, amid a major pullback in global tech stocks and reports of a delay in the delivery of its newly designed AI chips known as Blackwell.

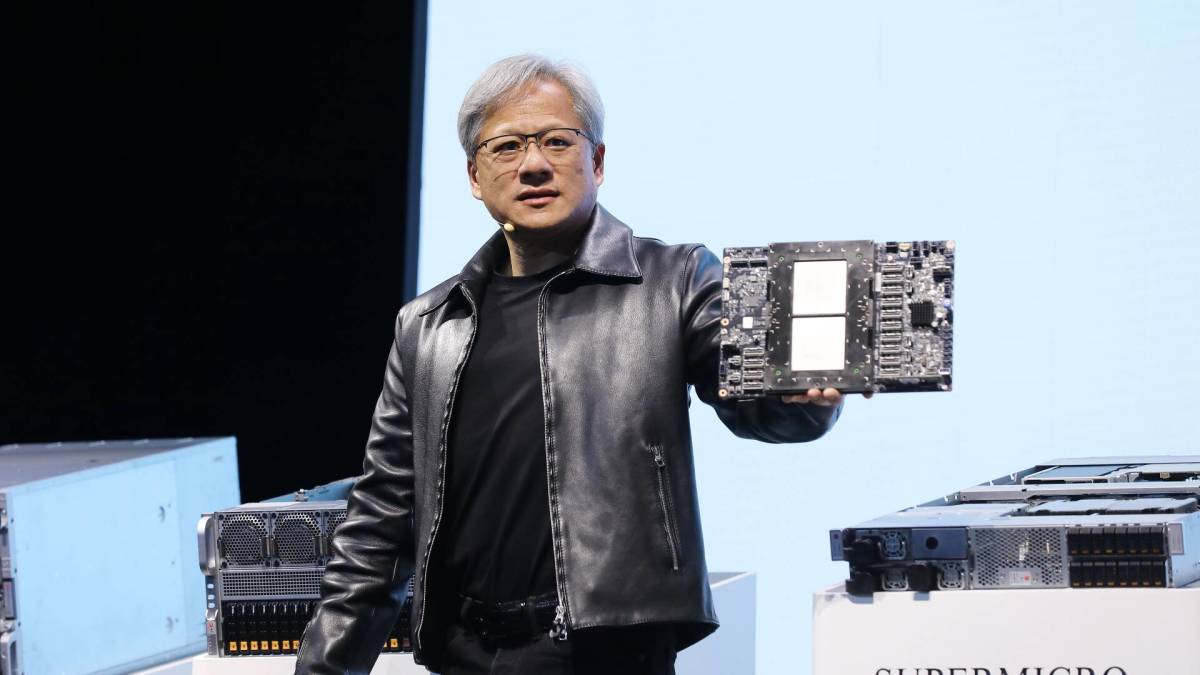

Nvidia (NVDA) , which unveiled the Blackwell line of processors earlier this year, has said the flagship chips perform artificial-intelligence tasks at more than twice the speed of its current Hopper chips, while using less energy and providing more bespoke flexibility.

Related: Veteran fund manager who predicted stocks drop updates outlook

The tech giant said it would ramp production of the new processors over the second half of this year while continuing to sell its H100 Hopper series to hyperscaler clients such as Microsoft (MSFT) , Meta Platforms (META) and Google parent Alphabet (GOOGL) .

Hyperscalers, the major providers of massive data-center and cloud services, are in fact are poised to spend around $500 billion over the next two years building out their massive infrastructure, according to estimates from Barclays. This investment will come as they leverage their massive datasets to enhance sales of everything from drive-through dining to the most complicated pharmaceutical testing.

Tech-focused news outlet the Information, however, has reported that Nvidia had informed Microsoft, as well as an unnamed cloud-service provider client, that a design flaw had been found in the Blackwell architecture, which could delay its production ramp and delivery dates by around three months.

Blackwell revenue key to Nvidia outlook

Analysts had expected Blackwell to generate revenue for Nvidia starting in the third quarter and find their way into global customer data centers by the final three months of the year.

AI demand, as well as Nvidia's commanding market share, is predicted to drive the group's data-center revenue as high as $150 billion next year, powered largely by this year's Blackwell launch.

Related: Top analyst puts Nvidia stock on key list after $500 million slump

"With Blackwell said to be in full production in the second quarter, Nvidia is working to bring up its enterprise system and cloud partners for global availability later this year, with the ramp expected in Q3 and the company anticipating data centers should be operational by Q4," Benchmark analyst Cody Acree said in a note that followed Nvidia's second quarter earnings.

"Demand for H200 and Blackwell is well ahead of supply, and the company expects demand may exceed supply well into next year," he added.

Goldman Sachs analyst Toshiya Hari, who reiterated his conviction-buy rating and $135 price price target on Nvidia stock following the weekend report, said he remained confident that Blackwell revenue would remain a major part of the group's near-term growth story.

"While (the report), if true, could drive some volatility in Nvidia’s near-term fundamentals (i.e., muted growth in the October and/or January quarters followed by a steeper than previously expected ramp), we expect there to be little to no impact on calendar year 2025 earnings and, most importantly, the company’s long-term competitive position," he said.

Nvidia, which reports fiscal-third-quarter earnings later this month, told investors in May that current-quarter revenue would rise to around $28 billion, a stronger-than-expected tally that assuaged investors concern about a so-called air pocket created by the Blackwell launch.

More AI Stocks:

- Analyst adjusts Nvidia stock rating on valuation

- Analyst revises Facebook parent stock price target in AI arms race

- Google falling behind climate goals thanks to AI ramp up

Some investors had worried that customers would cancel orders for the older H100 chips and wait for the newer system processors to ship later in the year.

Related: Analyst puts Nvidia stock on watch; report points to new China chip

Nvidia shares were marked 7.4% lower in early Monday trading to change hands at $99.37 each.

That move, if it holds through the trading session, would drag the stock into bear market territory, which is typically defined as a 20% decline from a stock's recent peak. Nvidia shares closed at an all-time high of $135.58 each on June 18.

Google parent Alphabet was marked 2.7% lower at $163.84 each while Microsoft fell 3.3% to $395.14 each.

Related: Veteran fund manager sees world of pain coming for stocks

.jpg?w=600)