Nvidia's stock price fell following reports that Chinese officials have targeted the market's dominant AI chip maker in an antitrust probe.

Nvidia (NVDA) , which generates around 10% of its revenue from China-based customers, has found itself amid an ongoing trade war between Washington and Beijing that continues to target high-tech chipmakers.

Earlier this month, the Biden administration issued its third export ban on China-bound exports, citing national security concerns. Meanwhile, officials in Beijing have urged domestic companies to avoid U.S.-made chips that they have deemed "no longer safe" in the current political environment.

Related: Nvidia's next move could be a big deal for another AI stock

The restrictions, which expand upon export rules first put in place in 2022, are designed to limit China's access to "advanced semiconductors that could fuel breakthroughs in artificial intelligence and sophisticated computers that are critical to (Chinese) military applications," according to U.S. Trade Secretary Gina Raimondo.

Last year, Raimondo told CNBC that “the threat from China is large and growing" with respect to Beijing's ability to acquire AI technologies that could find their way into the military.

China ratcheted up tech trade tension again Monday as the country's State Administration for Market Regulation launched an investigation into Nvidia over allegations it has breached anti-monopoly laws.

The government division said the probe was tied to Nvidia's $6.9 billion purchase of Mellanox Technologies, which closed in April 2020.

Nvidia vows to support US trade policy

Nvidia, for its part, has been attempting to maintain its access to the world's second-largest economy by working around the sanctions the Biden administration put in place last year by retooling three different chips for the China-bound market.

It's also preparing for potential changes to U.S. trade policy when President-elect Donald Trump takes office in late January.

Related: Nvidia stock extends November gains as investors bet on 2025 AI dominance

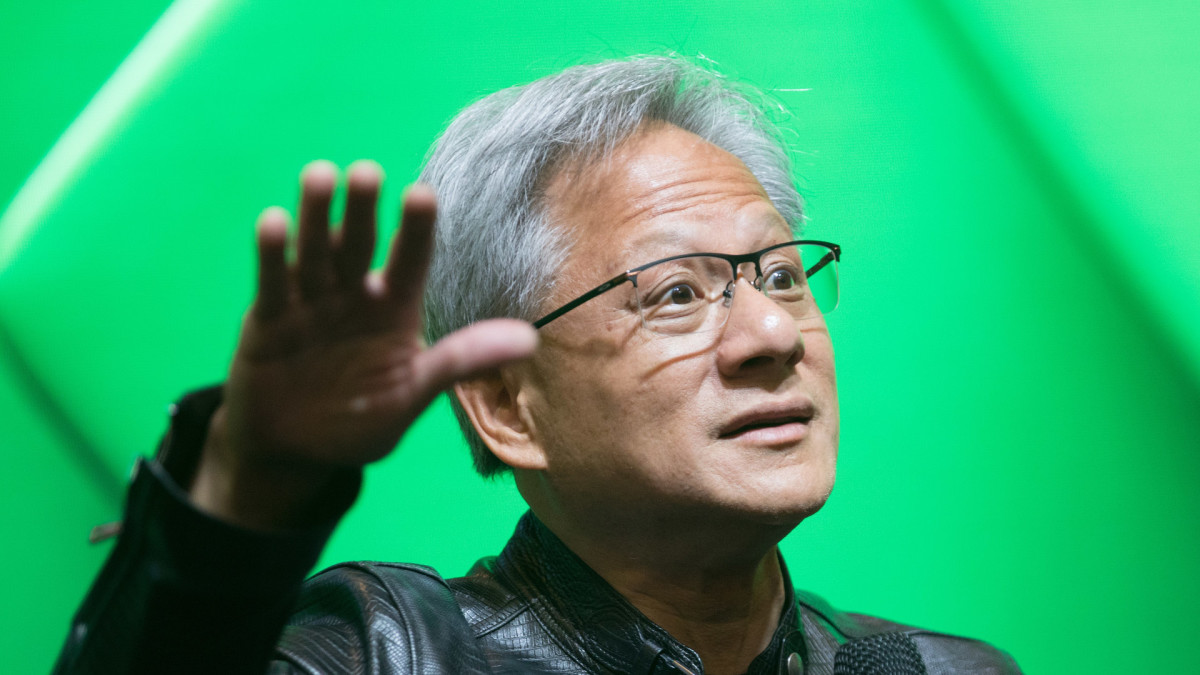

"Whatever the new administration decides, we'll, of course, support the administration," CEO Jensen Huang told investors on a conference call last month.

More AI Stocks:

- Analysts update Salesforce stock price targets ahead of earnings

- Druckenmiller predicted Nvidia's rally, now has new AI target

- The 5 biggest takeaways following Nvidia's earnings

"That's our highest mandate. And then after that, do the best we can and just as we always do," he added. "And so, we have to simultaneously and we will comply with any regulation that comes along fully and support our customers to the best of our abilities and to compete in the marketplace."

Nvidia shares were marked 2.7% lower in early Monday trading and changing hands at $138.59 each.

Related: Veteran fund manager delivers alarming S&P 500 forecast